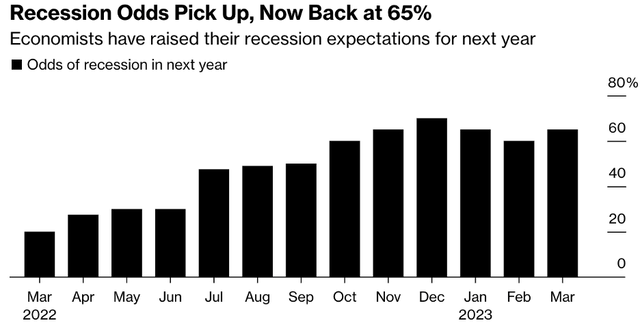

For almost a year, investors have been worried about a looming recession that never really arrived. As opposed to broad-based layoffs and disappointing numbers, we have seen “mini recessions” in certain sectors of the economy, including the tech sector. These mini-recessions sound much less alarming than the global financial crisis of 2008 or any other recessionary period the U.S. has gone through. With the global economy still facing massive challenges in the form of high inflation, supply-chain disruption, and geopolitical uncertainty, it would be naïve to rule out the probability of a recession just yet. According to economists surveyed by Bloomberg, there is a 65% probability of a U.S. recession within the next 12 months.

Exhibit 1: U.S. recession odds

Bloomberg

I am not a fan of predicting recessions – I would rather focus on identifying companies that are well-positioned to grow in the long term. That being said, I do not want to turn a blind eye to the risks the American economy is facing today as these risks can have an impact on the performance of my investment portfolio. Whether we see a recession in 2023 or not, one thing is for sure – economic challenges will persist.

This brings us to the retail sector. For more than a decade, e-commerce companies have grabbed market share from traditional retailers, but the strength of the e-commerce industry is yet to be tested by a recessionary environment. Back in 2020 when the U.S. economy plunged into recession, business conditions were skewed in favor of the e-commerce sector due to once-in-a-lifetime developments such as worldwide mobility restrictions. As we navigate the current economic challenges, e-commerce companies will not benefit from pandemic tailwinds and will have to compete with discount retailers who usually thrive amid challenging macroeconomic conditions.

Odds Will Tilt In Favor Of Discount Retailers In A Recession

History might not repeat itself, but as investors, there’s a lot to learn by looking in the rearview mirror. During recessions, the level of unemployment generally rises, and household savings start depleting. Although we might have entered this difficult phase with better household savings compared to the past thanks to the fiscal and monetary policy boost during the pandemic, consumers will turn cautious when the risk of unemployment increases – which naturally happens during a recession. We need to understand a few important data points to evaluate the prospects for e-commerce companies and discount retailers during a recession.

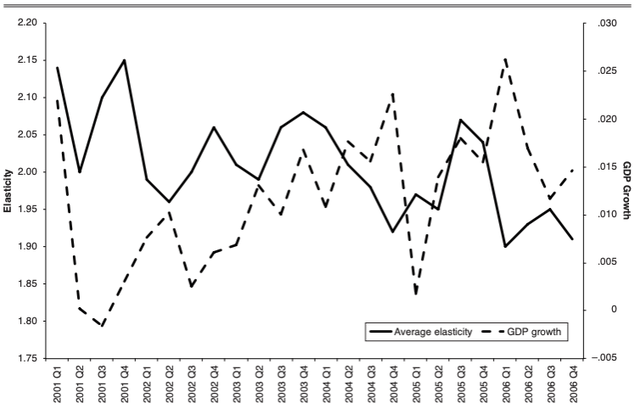

During recessions, the price elasticity of demand increases across almost all product categories. The increase in the price elasticity of demand can vary depending on the product category, but in general, consumer purchasing decisions tend to be impacted by the pricing to a higher degree during recessions. The below chart illustrates how the average price elasticity to demand was impacted by GDP growth between 2001 and 2006.

Exhibit 2: Average elasticity by quarter

Columbia University

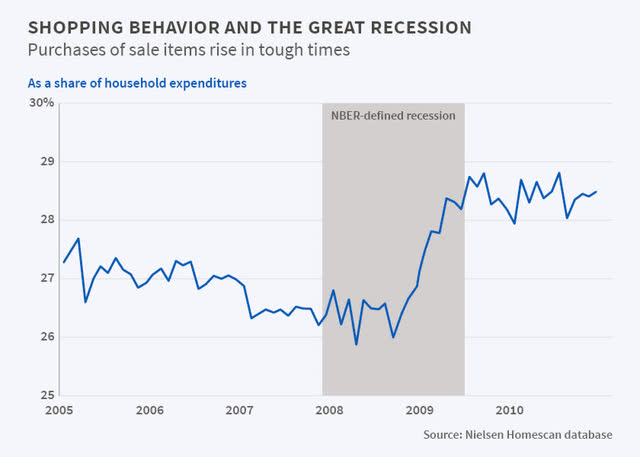

Going by the above data, if the U.S. enters a recession later this year, we can expect the price elasticity of demand to increase notably. This implies that consumers will start looking for bargains and discounted items to save even seemingly smaller amounts. What this also means is that consumers will prioritize savings over convenience during a recession. The shopping behavior of Americans during the financial crisis of 2008 confirms our findings. As illustrated below, purchases of sale items increased sharply during the 2008 recession and remained elevated for a few years.

Exhibit 3: Purchases of sale items as a percentage of household expenditure

National Bureau of Economic Research

Now that we have established the fact that Americans will most likely be on the lookout for bargains and discounted items if the U.S. enters a recession in the foreseeable future, the next step is to assess whether e-commerce companies can compete with discount retail stores.

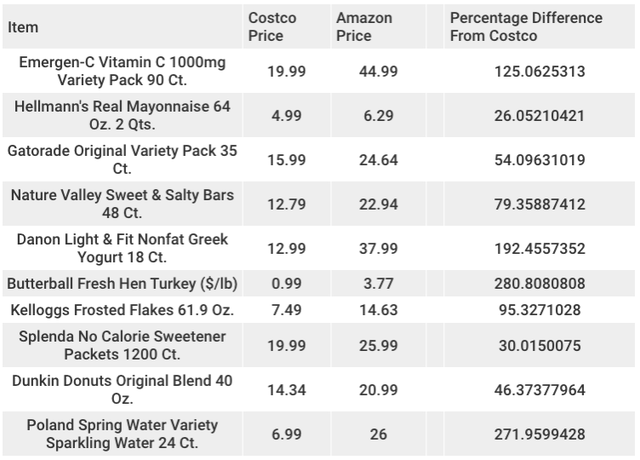

For ease of comparison, I will use Costco Wholesale Corporation (COST) as a proxy for an average discount store in the U.S. while Amazon.com, Inc. (AMZN) will be used as a proxy for the e-commerce sector. LendEDU recently (April 2023) conducted a price comparison between Amazon and Costco to determine which is cheaper. According to their findings using 38 different products, Costco was 12.1% cheaper than Amazon from a total price perspective. During a recession, the demand for essential items such as groceries can be expected to remain steady in comparison to electronics and non-essential items. According to LendEDU, food items on Amazon were substantially more expensive than Costco in April.

Exhibit 4: Food & beverage prices on Amazon and Costco

LendEDU

Building on our earlier discussion of price elasticity trends during recessions, we can conclude that discount retailers stand to benefit during a recession – or at least weather economic downturns better than e-commerce marketplaces.

A granular view of e-commerce sales presents more data to be bullish on discount retailers during recessions. According to data compiled by eMarketer, as of May 1, 2022, consumer electronics sales dominated Amazon’s retail sales followed by apparel and accessories.

Exhibit 5: Amazon U.S. e-commerce sales by product category

eMarketer

With essential items such as food and beverages accounting for less than 4% of total sales, Amazon sales are dominated by non-essential items that can take a massive hit during a recession. This is true for many other e-commerce platforms as well.

Discount Retailers Score A Valuation Win

With economic challenges persisting, investors need to pay close attention to the valuation levels of companies. With interest rates continuing to remain elevated, future cash flows will be discounted at higher rates compared to the last five years. This will essentially lower the present value of these expected cash flows, thereby making high-growth companies expensively valued in the market as the bulk of their lifetime cash flows are expected to be generated in the future. Amazon, the leading e-commerce platform in the world, has already turned itself into a cash-flow machine, which makes it the most comparable e-commerce platform to discount retailers. A direct comparison between Amazon and discount retailers does not make a lot of sense given that Amazon has branched into many other business categories, but there’s no harm in doing a comparison to get an understanding of the relative valuation level.

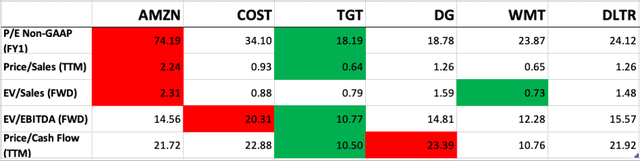

Exhibit 6: Valuation comparison of Amazon and retailers

Seeking Alpha

I have added an emphasis by highlighting the most expensive companies from a valuation metric in red and the cheapest companies in green for ease of reference. On average, discount retailers (I included Walmart in this category as the company runs promotions during recessions) are more attractively valued than Amazon today, and these retailers are substantially more profitable than many e-commerce platforms.

Takeaway

Recession fears are continuing to make an impact on stock prices and investment decisions. The e-commerce sector seems well-positioned to grow in the long term aided by several macroeconomic tailwinds including the growing Internet penetration in developing regions of the world and the increasing importance placed on convenience. However, during a recession, discount retailers are likely to outperform high-flying e-commerce companies. Investors who are hunting for recession-proof stocks might want to consider top American discount retailers today.

Read the full article here