Thesis Summary

PayPal (NASDAQ:PYPL) has come down since reporting Q1 earnings, and I feel this is unjustified.

The market is punishing the company for lower margins, but what I see is a company trying to stay relevant and acting from a position of strength.

PayPal offers a compelling valuation based on forward PEG, and the technical outlook is showing evidence that a bottom could be in.

Recent Earnings

PayPal recently reported Q1 2023 results, and despite an earnings beat, investors were not happy, with the stock plummeting over 10% following the news.

While some of the guidance might have been disappointing, there was a lot to like about the actual results for the quarter:

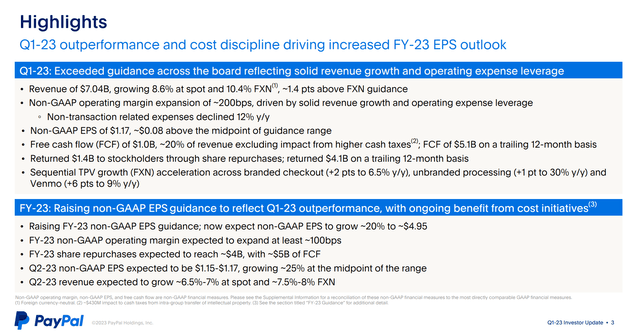

Financial highlights (Investor Presentation)

Operating margin was up 200 bps due to good revenue growth and cost-cutting initiatives. Revenues grew by 10% on an FX-neutral basis, and the company carried out $1.4 billion in stock buybacks.

However, if we look at the whole guidance for 2023, the company expects the operating margin to expand by 100 bps, which implies that margins will contract in the coming quarters.

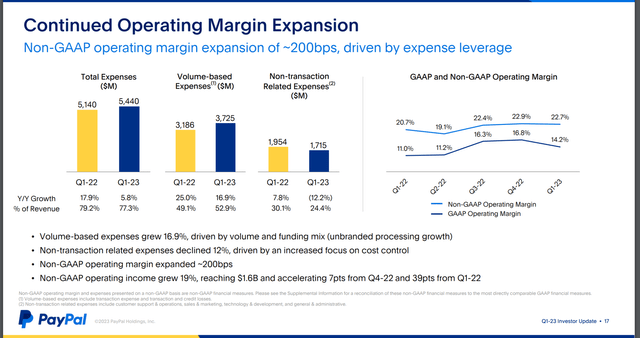

Operating Margin (Investor Presentation)

As we can see in this slide above, the company cut down non-operating expenses by 12% YoY, which contributed towards obtaining a 22.7% operating margin. This is in line, yet slightly below last quarter’s margin. It must be said though, that GAAP operating margin decreased sequentially due to the impact of SBC and related payroll taxes.

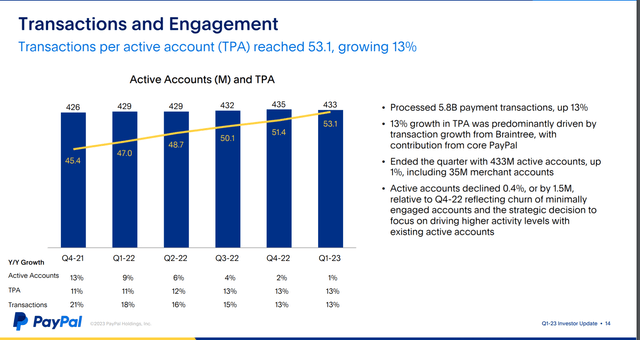

Transactions and engagement (Investor Presentation)

One of the strong points of the quarter was also the increase in transactions per active account, which continued to increase at a rate of 13%, mostly driven by Braintree.

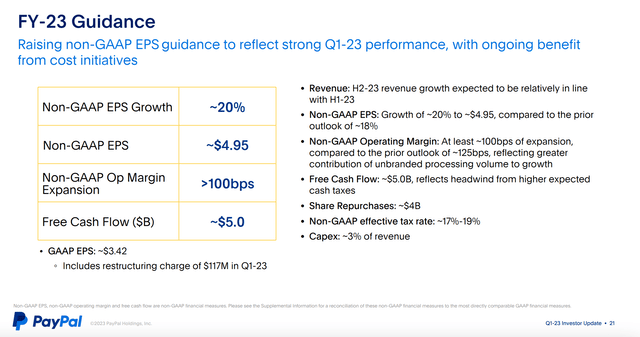

Guidance (Investor Presentation)

Ultimately, the company expects a solid non-GAAP EPS growth of 20%, coming in at $4.95, and a total free cash flow of $5 billion. For reference, cash flow in 2022, was $5.112B and non-GAAP EPS of $4.13 in 2022.

I’d call the results a mixed bag. Revenues are projected to grow 7-8%, with non-GAAP EPS growing 20%. The company is making the right moves in terms of improving margins, but it seems that it will struggle to improve margins moving forward.

The biggest issue that dissuaded investors was the shrinking transaction margins.

Insights from the Tech, Media and Communications Conference

Yesterday, May 22nd, PayPal CEO Dan Schulman attended the JP Morgan Global Technology, Media and Communications Conference.

In his talk, he cleared up a lot of issues surrounding the recent results and the current outlook.

When asked about margins, this is what the “sticking point” of margins, Schulman had this to say:

The one place that people pressed on was our transaction margins. They grew by about 1% in the quarter. Look, over a five-year period from 2017 through 2022, we have grown our transaction margin dollars by an average of about 13%. We are kind of in a place right now where there are a couple of things that are putting pressure on that.

Source: Interview

To sum up, he points out that e-Commerce was slower than expected and international payments came under pressure, with China being a clear laggard.

However, the biggest drawdown for transaction margins was the “unbranded” payment platforms. These refer to payment systems like Braintree and PayPal Complete Payments.

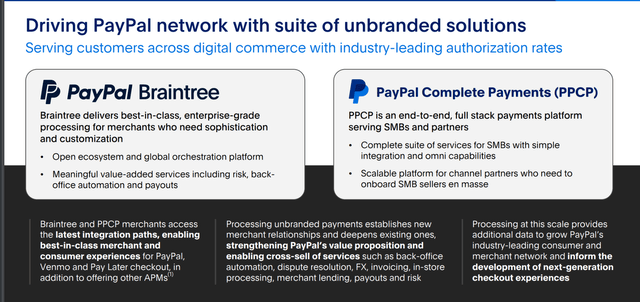

Unbranded (Investor Presentation)

Braintree and PPCP are some of PayPal’s efforts to target small and medium-sized businesses. Understandably, the market is more competitive here, and margins are smaller, but at least the company is succeeding to generate some growth.

The PayPal CEO also talked about AI:

One thing that has not come down is the cost of software. But I think we are in a Guddenburg [ph] moment right now with software, where you are going to be able to use forms of AI to do all of your quality control through that, which is a massive cost element for it. New software is going to be done in an automated fashion.

And then you look at front office, back office, legal marketing. This is not about cutting in a muscle. This is about doing things more efficiently, better at much lower cost and that is going to continue for quite some time.

Source: Interview

Dan Schulman seems positive about the outlook for AI and its ability to drive down costs.

Here’s What I see

Looking at the recent earnings results, I feel like the market is being blindsided by one technical point while missing the much larger, more encouraging picture.

Sure, transaction margins are coming down, but this is to be expected. PayPal has been accused by investors of being a dinosaur, but when it comes out with innovative products like Braintree or PPCP, it gets sold because margins are coming down.

You can’t have it both ways. This is a cutthroat market, and to stay relevant, you have to offer competitive pricing.

If a startup launched a payment processing software that became popular but lost money, investors would probably jump at the opportunity to invest. Somehow though, when PayPal tries to stay relevant by offering a better service, it gets punished, even though this is an established company with healthy revenues and profitability.

PayPal actually offers the best of both worlds.

It is a profitable company generating $5 billion in FCF every year, and it is at the forefront of one of the most interesting industries moving forward. Payment processing systems are still very new to a lot of economies, and there’s a lot of money to be made and untapped opportunities.

For example, PayPal recently entered a partnership with Visa (V) to expand P2P services. PayPal also had an interesting project going on in the realm of stablecoins, though this has been paused for the time being.

Ultimately, my question is this; Why invest in an unproven/unprofitable business when you can invest in a profitable business with a dominant market share? Won’t it be much easier for PayPal to adapt than for others to disrupt, and isn’t this exactly what we are seeing?

Granted, with increased competition, the outlook isn’t as good, but the valuation at this point more than justifies a buy.

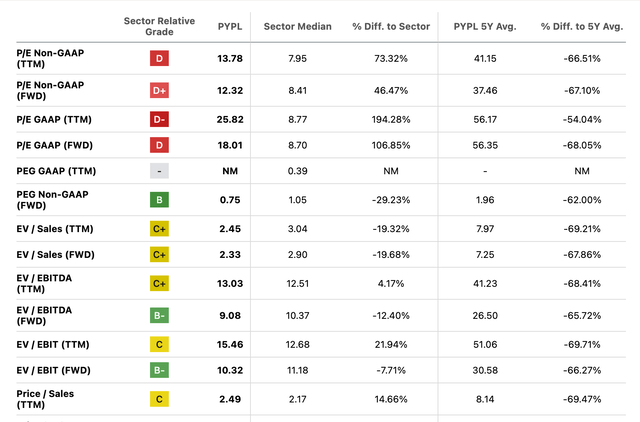

PayPal valuation metrics (SA)

PayPal offers the best of both worlds, meaning a good balance of growth and profitability, and this is evident when we look at the company’s forward PEG, which trades at 0.75. This ratio should be close to 1 to imply fair value, meaning PayPal should be worth at least 30% more.

Technical Analysis

From a technical standpoint, this also seems like a good time to buy.

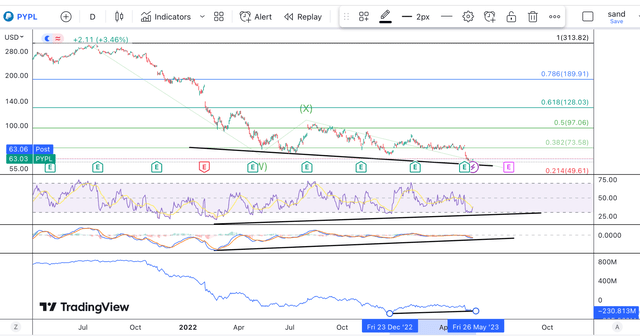

PYPL TA (Tradingview)

Looking at the PYPL chart, we can see clear divergences forming the daily chart. Both the RSI and MACD bottomed at the start of the year, while the share price has continued to slide down. This is a clear divergence in price and momentum.

More immediately, we can see that the On-Balance Volume has begun to trend up while the price continued to grind lower; yet another divergence.

Takeaway

PayPal may not be the most exciting company in the world, and that’s exactly why I like it. It offers, in my opinion, the perfect balance of value and innovation and growth/profitability. The market may not see this, but I do.

Read the full article here