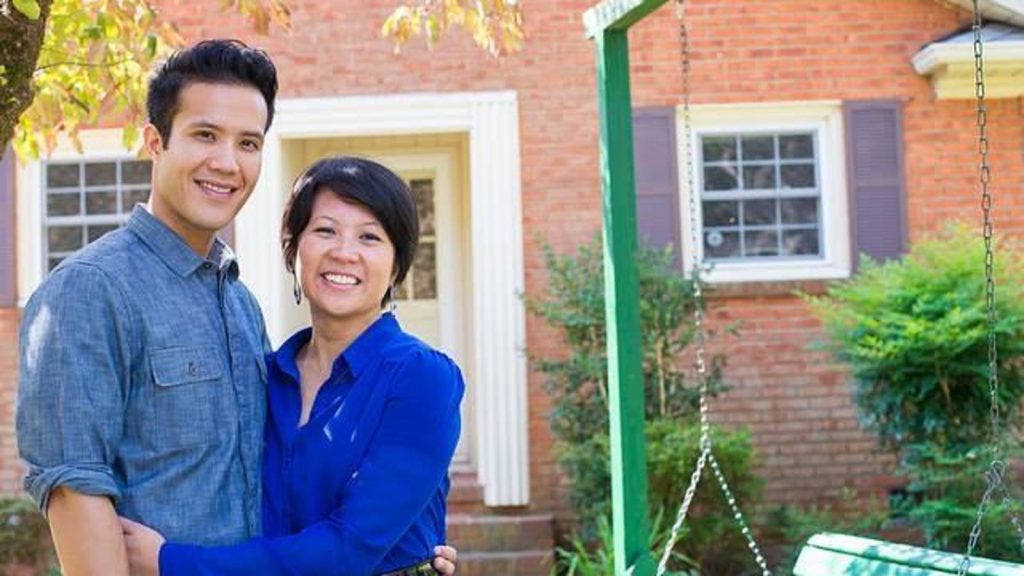

My husband AJ and I became debt-free including our mortgage in our 30s. We paid off $300,000 after we started pursuing the FIRE movement in 2019.

Then we did something none of our friends or family expected — we sold that 2,200- square-foot home and downsized to a 2-bedroom apartment half the size.

For a long time, we thought our American dream was to be homeowners, but here are a few reasons to consider renting if you want to retire well before the traditional age.

You Don’t Need As Big Of An Emergency Fund For Home Repairs

Many financial experts have a rule of thumb: Set aside three to six months’ worth of expenses in an emergency fund. So, if your monthly expenses are $4,000, you need to save $12,000 to $24,000.

Early on as homeowners, we experienced firsthand how our emergency fund was necessary for unexpected home maintenance and repairs. This included replacing our washing machine, a leak in our roof, and the removal of a large tree in our yard for safety.

We always erred on the more conservative end of the range and kept six months or more of savings set aside. This helped us feel secure should another unexpected expense arise.

Since we’ve moved into a rental, we now feel more comfortable keeping only three months of savings versus six months. Our rent is predictable and any appliances or systems that break in our apartment will be our landlord’s responsibility.

Renting has also saved us from many of the do-it-yourself projects we tried to prevent future issues in the home we used to own.

Take The Extra Cash And Invest Into Passive Income

By September 2022, 54% of active Airbnb listings were added to the platform since 2020, according to AirDNA, a research and analytics company focused short-term rentals. My husband and I were eager to join that trend in 2021. We decided to buy a smaller condo to live in and rent out our larger home as passive income.

It was exciting because we made nearly $5,000 of revenue in the first few months. Our first guests rented our home for several weeks while repairs were being completed at their home, and they rarely needed assistance. But from then on, maintaining the home to continue renting it out to short-term guests became more inconvenient, especially since we no longer lived in the same area.

After a particularly challenging Airbnb guest, we started to wonder if renting out our home was as passive as we would like. We started to entertain the idea of selling our home to take that equity from it and invest it elsewhere.

Because our home was already paid off, we were able to get the full amount of the net sale proceeds. We only needed a portion of it to pay off our smaller condo, and were able to put the rest of the money into investments.

We chose income-producing investments including a real estate investment trust, dividend ETFs and government money market funds that now earn us around $2,000 per month consistently, without having to deal with tenants or property management.

We’re also saving a lot more on taxes. We don’t need to pay thousands of dollars per year on property taxes, and with some investments like treasury bills, our passive income isn’t taxed as highly as our rental income was.

Letting Go Of The Forever Home Mentality Can Open You Up To Retiring Overseas

Once we sold the home we thought we would live in for the rest of our lives, we entertained not only living in another neighborhood, but in other parts of the world. We both love to travel, and thought we would have to wait until traditional retirement age to explore international living.

But following the FIRE movement led to us to look for other countries where healthcare is less expensive, safety would be prioritized and access to other cultures would be easier.

It’s unclear exactly how many Americans are retired overseas, but according to the Social Security Administration, almost 450,000 people received their retirement benefits outside the U.S. at the end of 2021.

While many of our friends and family cannot fathom living abroad, we started to make more friends on social media who live abroad to get their points of view. This year, we are traveling to Portugal, France and South Korea, and feel more confident in our ability to adapt than if we were in a later stage in life.

In downsizing our home and going back to renting, we also realized that we could maintain happy and purposeful lives with a lot less furniture, clothing and material goods that filled up our big house before. Thanks to this shift, our retirement is looking very different from what we imagined, and much closer in our future.

Read the full article here