Investing.com — Global oil benchmark Brent weakened Wednesday on renewed worries of a global economic slowdown, overshadowing the news earlier this week of more supply cuts from a series of top producers.

By 08:45 ET (12:45 GMT), the contract dropped 0.3% to $76.02, while futures traded 1.9% higher at $71.12 a barrel, having traded through a U.S. holiday to mark Independence Day without a settlement.

Services activity data point to slowing global growth

Data from a private survey, released earlier Wednesday, showed expanded at the slowest pace in five months in June, the latest evidence of a faltering post-pandemic recovery in the world’s largest crude importer.

Additionally, slipped into contractionary territory last month in a broad-based downturn, suggesting this economy will struggle to register significant growth after falling into recession in the first quarter of the year.

Central banks still likely to hike rates

Yet, despite this economic weakness, the is widely expected to continue its rate-hiking cycle when it next meets later this month.

The ’s next policy decision is more open to debate after it paused its year-long tightening cycle in June.

That said, the central bank policymakers signaled the likelihood of two more hikes this year, and this brings the release of the of the June meeting firmly into focus as traders look for further clues on the U.S. central bank’s outlook.

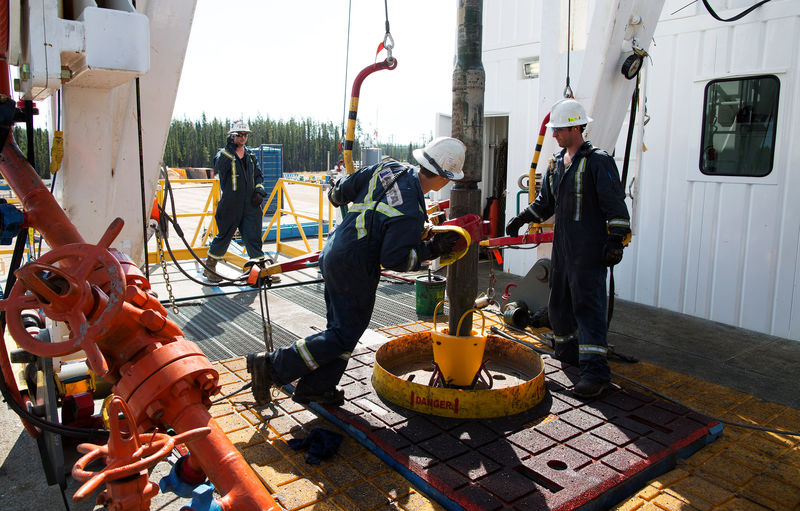

Exporters to do ‘whatever necessary’ to support prices

The week had started on a more positive note as top producers Saudi Arabia and Russia, as well as Algeria, had agreed to cut supplies further into August in an attempt to boost oil prices.

Saudi Energy Minister Prince Abdulaziz bin Salman told a conference on Wednesday that the cooperation between Russia and Saudi Arabia is still going strong as part of the OPEC+ alliance, which will do “whatever necessary” to support the market.

“Part of what we have done (on Monday) with the help of our colleagues from Russia was also to mitigate the cynical side of the spectators on what is going on between Saudi and Russia on that specific matter,” Prince Abdulaziz said.

U.S. crude inventories due

Chief executives from major global oil firms meet with energy ministers from the OPEC states on Wednesday and Thursday, potentially offering more cues to oil markets.

Traders will also be keeping an eye on weekly U.S. crude and product inventory data from the , due a day later than usual after Tuesday’s public holiday.

Read the full article here