Fed Raises Interest Rates to 22-Year High, Leaves Door Open for More

The Federal Reserve resumed raising interest rates and Chair Jerome Powell left open the possibility of further hikes, which he emphasized will depend on incoming data that has recently signaled a resilient US economy. After pausing rate increases in June, policymakers lifted borrowing costs again at their policy meeting on Wednesday for the 11th time since March 2022 to curb inflation. The quarter percentage-point hike, a unanimous decision, boosted the target range for the Fed’s benchmark federal funds rate to 5.25% to 5.5%, the highest level in 22 years. [Bloomberg]

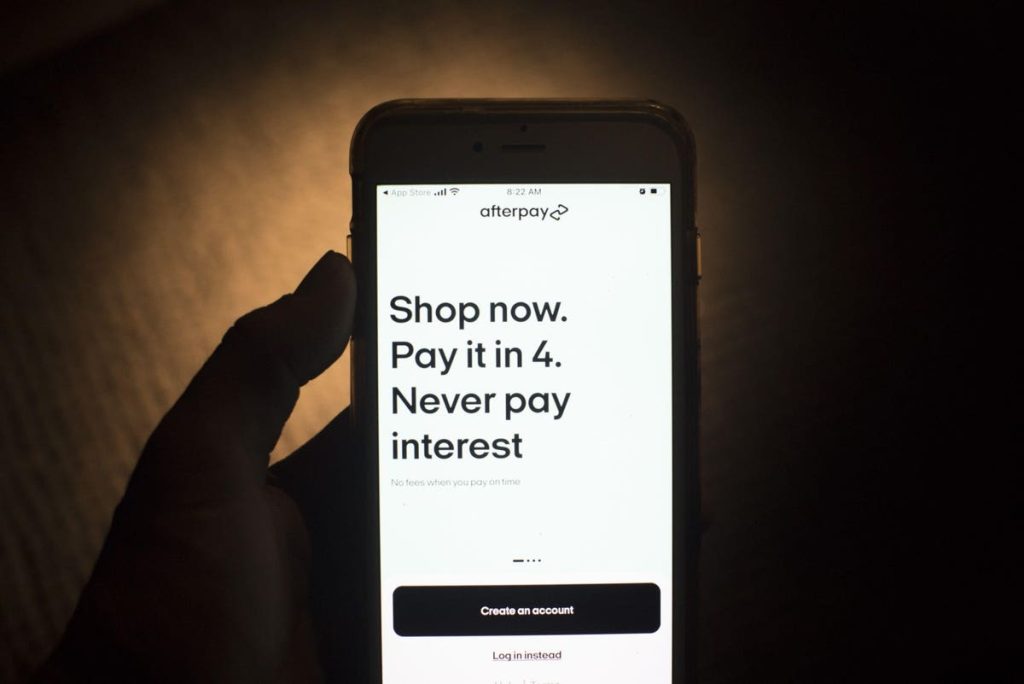

One-Third of U.S. Adults Use Buy Now, Pay Later Programs, More Than Half Report Credit Card Debt

Recent reports call into question whether buy now, pay later services are a riskier option than credit card financing. For example, some buy now, pay later programs have high late fees and long-term loan options with high-interest rates, making BNPLs, in some cases, more expensive than credit card financing. As of July 2023, a third of U.S. adults report using BNPL services, up three percentage points from July 2022. BNPL intent has remained relatively stable over the past year, standing at 12% today. This means that 45% of U.S. adults are either current or potential buy now, pay later users. Despite increased adoption, the ease of buying can add up fast. CivicScience data show that BNPL users are more likely to say they’ve accumulated credit card debt. As of July, 54% of buy now, pay later users report they have credit card debt, compared to 35% of intenders and 38% of non-users. [Civic Science]

Mastercard Demands U.S. Cannabis Shops Stop Accepting Debit Cards

Mastercard has said financial payment companies must stop allowing US customers to buy legal marijuana in shops with its debit cards. Because marijuana remains illegal at a federal level in the US, customers in the 38 states where it is allowed are usually forced to pay in cash. Mastercard said the move comes after it found some shops accepted debit payments despite the federal ban. Marijuana advocates have called for new laws to ease sales of legal cannabis. [BBC]

Legislation Could Wipe Out Credit Card Rewards. Big Spenders Stand to Lose the Most

Legislation currently making its way through the halls of Capitol Hill has the potential to wipe out the credit card rewards ecosystem, with the biggest spenders standing to lose the most. Despite receiving little attention from media and consumers, the Credit Card Competition Act, proposed by Illinois Sen. Dick Durbin, a Democrat, would end the system by which credit card transactions are processed. Critics of the current process, mostly retailers, say it privileges the banks that issue cards, allowing them to collect a fee that may be as high as 2%-3% of each transaction. Durbin’s legislation would open the infrastructure, also known as the “interchange,” to more payment processors. Right now Visa

V

Mastercard Debuts Receivables Manager as Virtual Card Use Increases

Mastercard has launched a tool designed to streamline virtual card payments. The company said Receivables Manager comes at a time when businesses are turning to virtual cards to replace paper-based payments. Receivables Manager, developed in partnership with payments company Billtrust, was created to make virtual card transaction processing more efficient, secure and cost-effective, freeing suppliers from having to manually capture and enter virtual card details to reconcile digital payments received. [PYMNTS]

Visa and Mastercard Can Now Be Used on China’s Biggest Payment Apps

Visiting China just got a whole lot easier for international travelers. Visitors are able to link their Visa and Mastercard accounts to China’s most popular mobile payment platforms, allowing them to book taxis, ride the subway and pay for goods and services at millions of outlets across the near-cashless country. The move marks a revival of efforts by Alipay and WeChat Pay to accept foreign credit cards after they provided some limited access in late 2019. The companies said previously that they were acting under the guidance of Chinese regulators, as Beijing seeks to attract foreign investment and international travelers to boost its flagging economy. [CNN]

More Than a Quarter of U.S. Consumers Use More Than One Mobile Wallet

The majority of mobile wallet users stick with the same carrier. However, as noted in proprietary research prepared for the PYMNTS collaboration with ACI Worldwide, more than 40% switched carriers within the 12 months previous to being surveyed. Within that sizable minority, 26% started using a new mobile wallet during that time while still using the previous one. Across generations, digital-native Gen Z has the most consumers straddling multiple mobile wallets, with 42% of the demographic doing so. This practice goes down by preceding generation, tapering to an 8% low among baby boomers and seniors. [PYMNTS]

California Expanding Pilot Program to Fight Meth Addiction with Gift Cards, Incentives

California has come up with a new way to fight methamphetamine addiction: incentivizing users to stay sober with gift cards. The Golden State will debut its expanded pilot program to 24 counties, targeting big city hubs grappling with drug-addicted homelessness as seen in San Francisco, Los Angeles and Sacramento. “Individuals will be able to earn motivational incentives in the form of low-denomination gift cards, with a retail value determined per treatment episode,” according to the state’s Department of Health Care Services website. [Fox News]

48% of Credit Card Users Aren’t Aware of This Major Consequence to Paying a Bill Late

You’ll generally be charged $25 for your first late payment fee and $35 for subsequent ones, according to the CFPB. Being late with a bill could cause your credit score to plunge, making it harder to qualify to borrow money when you need to. Not only that, but the lower your credit score, the higher an interest rate you’re likely to get stuck with when you are approved to borrow money. And a higher interest rate could cost you well more than $25 or $35 late fee. There are several different factors that go into calculating your credit score, but of all of them, your payment history carries the most weight. In fact, it accounts for 35% of your total FICO score. [The Motley Fool]

47% of U.S. Adults Have at Least One Unused Gift Card

If you’ve found a gift card (or three) you had forgotten about in the back of your wallet, or were surprised by the store credit you found sitting in an app, you’re in good company. Nearly half (47%) of U.S. adults have at least one unused gift card, gift voucher or store credit, according to a new Bankrate study. Those gift cards aren’t small change: The average value is $187 per person, a total value of $23 billion nationwide. Due to inflation and recession concerns, 39% of U.S. adults say they’re putting in more of an effort to use their gift cards since last year. [Bankrate]

Jeeves Expands Its Offer with Cross-Border Payments and Local Prepaid Cards

Jeeves, a financial operating system built for global companies, has expanded its product offering to include prepaid cards and cross-border payments. Jeeves launched publicly 22 months ago with corporate credit cards as its initial product and has seen surging demand for its cross-border payments product, especially throughout Latin America. Jeeves will allow customers to move funds in and out of Brazil, Colombia, and Mexico within 24 hours, a marked improvement on the legacy process, which could take up to 7 days. Customers can now pay vendors and suppliers across 150+ countries in local currencies, supported by multi-language invoice scanning technology to make the experience seamless. [Contxto]

Another GOP Presidential Candidate Is Offering Donors $20 Gift Cards

The Republican presidential primary sweepstakes continue. In the dash to amass enough donors to make it onto the August debate stage, another GOP presidential candidate, Miami Mayor Francis Suarez, is offering gift cards in exchange for donations. Anyone who donates $1 to Suarez’s campaign will receive a $20 gift card, his campaign announced on Twitter on Tuesday. It’s not a new tactic among the GOP long shots. North Dakota Gov. Doug Burgum offered 50,000 donors the same deal in June. It seems to have worked for Burgum, who officially hit the RNC’s requirements for the debate stage Monday after racking up the 40,000 necessary donors last week. [Politico]

Read the full article here