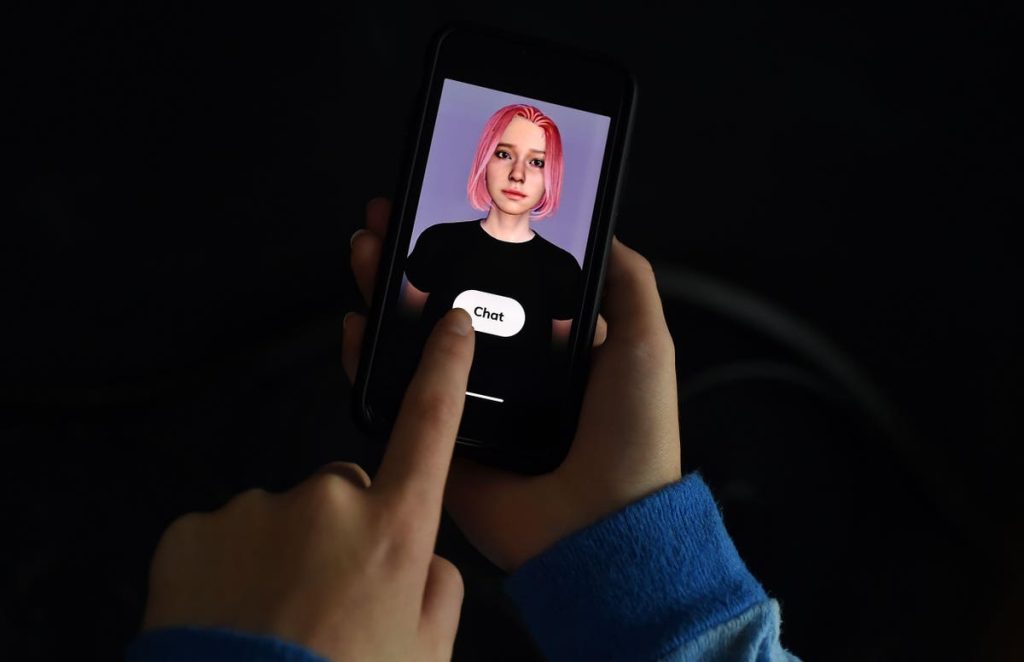

If you’ve tried to get customer service online in the past year or so, you may have gotten stuck in a “doom loop,” where an AI chatbot keeps repeating the same questions. It’s incredibly frustrating.

At that point, you’re yelling at the robot, pining for a customer service rep — even a surly one. This is getting to be a common issue.

According to the Consumer Financial Protection Bureau (CFPB), doom loops are becoming a growing problem, particularly with financial services companies. Here’s what the CFPB found in a recent survey:

- Financial institutions are increasingly using chatbots as a cost-effective alternative to human customer service. The CFPB review found that each of the top 10 largest commercial banks have deployed chatbots as a component of their customer service. Approximately 37% of the U.S. population is estimated to have interacted with a bank’s chatbot in 2022, a figure that is projected to grow.

- Chatbots may be useful for resolving basic inquiries, but their effectiveness wanes as problems become more complex. There are many kinds of negative outcomes for the customer, including wasted time, feeling stuck and frustrated, receiving inaccurate information, and paying more in junk fees. These issues are particularly pronounced when people are unable to obtain tailored support for their problems.

- Financial institutions risk violating legal obligations, eroding customer trust, and causing consumer harm when deploying chatbot technology. Like the processes they replace, chatbots must comply with all applicable federal consumer financial laws, and entities may be liable for violating those laws when they fail to do so. Chatbots can also raise certain privacy and security risks.

How do you get what you need when the machine can’t help you? There are a few routes:

1) Call customer service. That’s right. Pick up your phone and call their toll-free number. You may have to dig to find one, but it’s usually at the bottom on their homepage.

2) Go to a bank branch. Regional and megabanks still have them. I’ve resolved some big issues by talking to a banker in person. In fact, I have a banker in my local branch that I’ve established a working relationship with over the last few years. He can usually resolve my issue quickly. People power still works.

Read the full article here