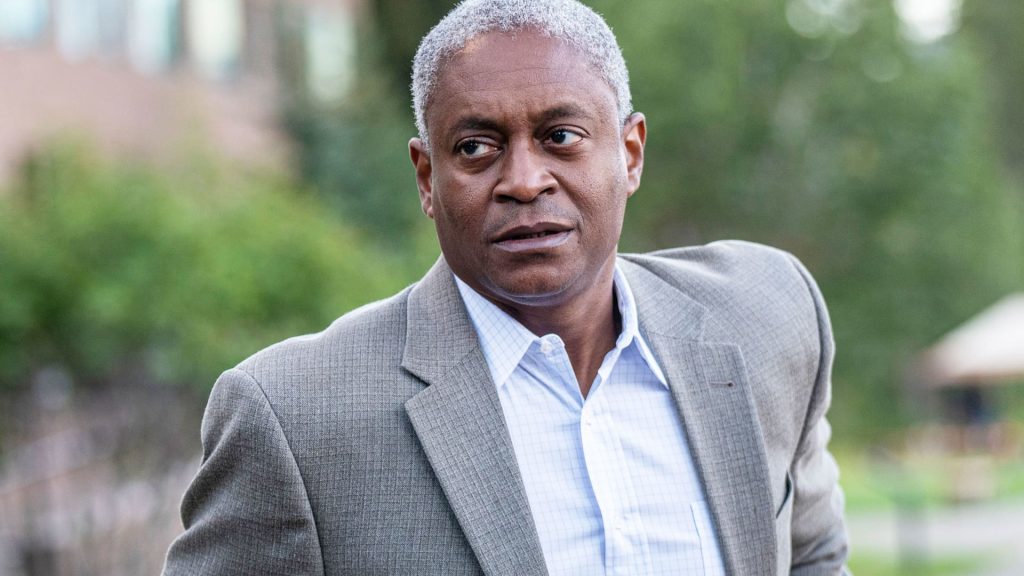

Atlanta Federal Reserve President Raphael Bostic said Monday that he doesn’t foresee rate cuts at least through 2023, even if there’s a recession.

“For me, inflation is job No. 1. We’ve got to get back to our target,” he told CNBC’s Steve Liesman during a “Squawk Box” interview. “If there’s going to be some cost to that, we’ve got to be willing to do that.”

His comments came as the Fed has raised rates 10 times since March 2022 in an effort to bring down inflation that a year ago was running at its highest levels since the early 1980s.

Even though inflation is still running well ahead of the central bank’s 2% year-over-year target, market pricing is indicating that the Fed is done hiking and in fact will be cutting rates multiple times before the end of the year. That is based largely on expectations that the economy is headed for a sharp slowdown and a likely shallow recession, which has been predicted by the Fed’s own economists.

But Bostic said he doesn’t see cuts coming anytime soon and in fact expects an increase would be more likely at this point.

The consumer price index, released last week, showed headline inflation running at a 4.9% annual rate while core — which excludes food and energy and usually receives greater emphasis from Fed officials — was at 5.5%.

“What we’ve seen is that inflation has been persistently high, consumers have been really resilient in terms of their spending, and labor markets remain extremely tight. All of those suggests that there’s still going to be upward pressure on prices,” he said. “If there’s going to be a bias to action, for me it would be a bias to increase a little further as opposed to cut.”

Bostic spoke at the Atlanta Fed’s Financial Markets Conference.

Chicago Fed President Austan Goolsbee also spoke to CNBC, saying he is taking a more cautious approach to policymaking amid at a time of elevated uncertainty.

“When you have these big times of uncertainty, let’s be prudent and patient and watch a lot more data than we normally do,” Goolsbee said. “We’ve still got a few weeks before for the next meeting, but [we’re] watching the credit stresses, watching the craziness of the debt ceiling, and watching what’s happening in the labor market, and the prices.”

On inflation, Bostic said he remains optimistic, while Goolsbee said, “Inflation is improving, but it’s not improving that rapidly.”

Bostic noted that in the CPI report, which covers the prices consumers pay for a voluminous mixture of goods and services, fewer than half the items were above 5% on an annual basis.

That at least provides some indication that things are moving in the right direction.

“There’s still a lot of confidence that our policies are going to be able to get inflation back down to our 2% target,” Bostic said. “And to be fully clear, we’re going to do all that we need to make sure that that happens.”

Read the full article here