Baidu shares were rising early on Tuesday after the Chinese internet company topped earnings and revenue expectations.

Baidu is focusing on artificial-intelligence investment but an advertising rebound was key to its first-quarter growth.

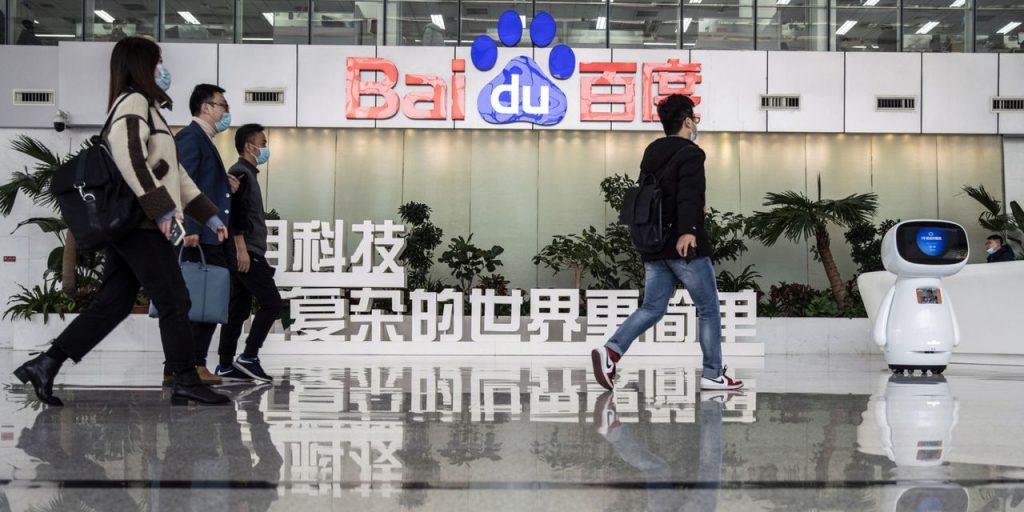

Baidu

(ticker: BIDU) reported adjusted earnings of $2.34 per American depositary share, rising 43% from the same quarter a year earlier. Quarterly revenue came to $4.54 billion, up 10%.

Baidu had been expected to report earnings of $1.76 on revenue of $4.32 billion, according to a FactSet poll of analysts’ estimates.

Baidu was boosted by a return to annual growth in online marketing revenue, with its search business having been hit in recent quarters by Covid lockdowns in China.

Online marketing revenue rose 6% to $2.42 billion while non-online marketing revenue—including cloud and its AI businesses—climbed 11% to $928 million. Analysts at

J.P. Morgan

had forecast 2% advertising growth and 8% cloud growth ahead of the report.

Baidu’s American depositary receipts were up 2.4% in premarket trading on Tuesday to $130.70.

The ADRs are up 12% this year so far through to Monday’s close, partly driven by excitement around the launch of its ERNIE Bot generative AI product. Baidu is competing with local rivals

Alibaba

(BABA) and

Tencent

(TCEHY) to become China’s leading AI company.

“Generative AI represents a new paradigm shift…and Baidu is poised to take advantage of this massive market opportunity. Baidu will continue to invest unwaveringly in this area in the coming quarters,” CEO Robin Li said in the company’s earnings statement.

Analysts at Mizuho said in a recent research note that while Baidu should benefit in the long term from its generative AI efforts, investment in advanced semiconductors would likely hit its margins in the nearer term. Baidu uses its own Kunlun AI chips, which it has said will offset the effects of U.S. curbs on exports of advanced semiconductor technology to China.

Write to Adam Clark at [email protected]

Read the full article here