Investors in Enphase Energy, Inc. (NASDAQ:ENPH) had suffered in 2023, as they watched in horror in late April when the leading energy technology company released its first quarter earnings.

It dropped nearly 26% in its initial post-earnings decline, posting its worst one-day selloff since June 2020. As a result, ENPH re-tested levels last seen in May 2022, wiping out nearly one year of gains and spooking late buyers who chased ENPH’s upside toward its highs in late 2022.

Without the appeal of a dividend, ENPH doesn’t have the luxury of income investors seeking yields to defend the stock. Moreover, management linked its tepid performance and surprisingly weak guidance in Q2 to the elevated interest rates.

As such, Enphase is facing multitudinous headwinds impacting its underlying performance and optimism, even though management assured investors that it believes the challenges are temporary. CEO Badri Kothandaraman stressed that “demand will unleash when interest rates return to normal.”

Keen investors should be aware that the company’s installers have been affected by the high-interest rates, hitting customers’ abilities to finance solar equipment purchases.

As a result, the company highlighted commentary in its risk disclosure in its recent 10-Q, highlighting “higher interest rates can discourage customers from making capital commitments, potentially leading to reduced purchases.”

Hence, investors need to be macro forecasters now, assessing the impact on Enphase’s ability to recover its growth trajectory, despite the possibility of a Fed rate pause in June.

Given the highly uncertain inflation dynamics, the critical question is when interest rates would return to “normal” levels that management envisages, as the Fed will likely remain in data-dependent mode.

However, ENPH’s expensive valuation suggests that investors must scrutinize management’s execution, even as growth was more robust ex-US.

I believe ENPH is at a critical juncture. Worsened by the transition from NEM 2.0 to NEM 3.0 adds another layer of unwelcome uncertainty to the company’s execution.

Management attempted to assure investors that it believes in the long-term benefits of the transition, accentuating that “NEM 3.0 is seen as a net positive for California and is expected to lead to strong demand for solar plus storage.”

However, Enphase also included risk disclosures relating to the transition in its filings, suggesting a negative impact. It added:

NEM 3.0 replaces retail rates with the Avoided Cost Calculator or ACC for export compensation. ACC values are generally lower than retail rates, potentially increasing payback periods for solar systems. NEM 3.0 may have an impact on export compensation and reduce demand for solar-only systems. – Enphase 10-Q

As a result, I think it’s increasingly clear why the company sees the criticality in its “solar plus” proposition, as it expects “strong demand for solar plus storage resuming after the next few months.”

Therefore, the company is betting that downstream customers are likely still adjusting to the near-term transition as installers run down their inventory backlog.

However, customers could see more value in Enphase’s comprehensive portfolio, helping to “accelerate the attach rate of batteries.” Despite that, “the higher cost of batteries” are expected to affect its profitability in the near term, hurting the company just as topline growth is expected to slow.

As such, I parsed that the market’s reaction to batter ENPH’s valuations to less aggressive levels reflects these significant headwinds, as they are not entirely within the company’s control.

As such, execution risks have risen markedly, behooving investors to take a more conservative approach to its valuation while betting on the company to emerge stronger subsequently.

ENPH’s valuation is still aggressive, as it last traded at a forward adjusted P/E of 29.3x, well above the 17.2x of its peers in the Invesco Solar ETF (TAN).

As a result, Enphase is still priced for high growth and must demonstrate its ability to recover quickly to justify its growth premium.

Interestingly, I realized that company insiders returned after the post-earnings selloff in April, scooping up shares through early May, likely seeing attractive value in its stock.

Accordingly, they bought about $10.6M worth of ENPH shares recently, marking the first significant buys over the past year. Management also highlighted in its earnings call that it would buy back shares if the opportunity is appropriate. Kothandaraman reminded investors that “the decision to repurchase stock is based on the share price being below a conservatively estimated intrinsic value.”

I believe management is making the right move in not rushing to defend its stock at every selloff unless the valuation dislocation is significant and attractive. It demonstrates management’s competence with capital allocation priorities and ability to make the correct decisions to benefit shareholders.

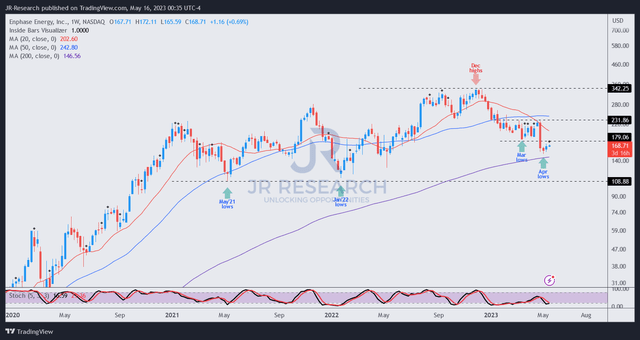

ENPH price chart (weekly) (TradingView)

I assessed that ENPH seems fairly valued at the current levels. However, the margin of safety is still not sufficient to attract me to consider it a core holding or buy aggressively to increase my exposure.

However, it’s still possible as a speculative opportunity, as I assessed market operators returned since its April selloff, helping to defend the current levels.

ENPH’s 200-week moving average or MA (purple line) should proffer more confidence to long-term buyers if the consolidation is constructive at the current levels, helping to stem further downside.

Rating: Speculative Buy (Revised from Hold). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here