The muddle-through trend is strong. Or should I say weak?

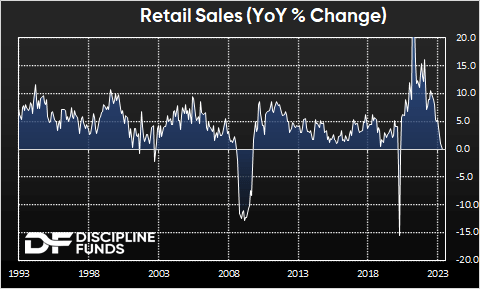

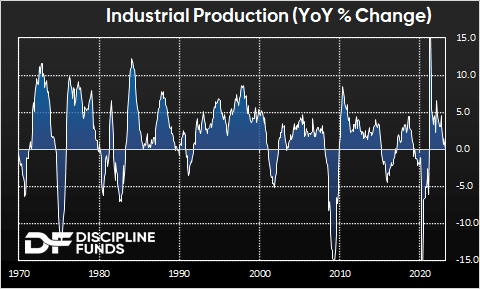

We got two big data points on May 16th on the economy and both pointed to sluggish trends in growth. Retail sales and industrial production have a strong correlation with weak economic growth and both came in unusually weak last month.

We’re not big fans of the “recession” vs. “no recession” debate because it’s such a binary and arbitrary determination (always defined in hindsight), but one thing we know is that these readings correlate strongly with softening economic growth and higher market risks. This is especially true when the yield curve is inverted and unemployment is low.1

Industrial production is an especially good leading indicator of growth with 9 of the last 11 negative readings preceding NBE-defined recessions. The 2015 false alarm came during the global economic recession when US growth did not meet the criteria for “recession” despite 1%ish growth.

From a market perspective this environment continues to have many of the telltale signs of elevated risks. There aren’t many panic signs as of yet, but the deceleration across many sectors is consistent with slowing growth.

If there’s a big risk out there, it’s that the Fed remains way too tight relative to where the economy currently is and is likely to go. This creates the risk that real estate and credit markets will remain under pressure which increases the risk of a broader credit event. So the longer the Fed remains tight, the higher the risk becomes.

I’ve been very vocal that inflation has likely been defeated. We won’t be able to confirm that for 12-24 months though. The risk is that by the time we realize inflation is no longer the risk we could realize that high real interest rates put downward pressure on the economy.

And of course, that’s partially the Fed’s goal. They want to make sure inflation is dead, dead, dead. But in doing so they risk being tight for longer than is necessary. We’re at that point in our view.

So far we’re just in a muddle-through – broadly where we expected the economy to be when the year began, but the Fed is putting a huge amount of downward pressure on the economy and so the asymmetric risks remain skewed to the downside (as opposed to the asymmetric risk being skewed towards a boom).

1 – One of the more counterintuitive concepts in economics is that a high unemployment rate is bad for the stock market. In other words, a very low unemployment rate reflects an economy where corporations have leveraged themselves up on labor (their largest expense). Corporations manage their risks primarily by hiring and firing workers. And when they’ve hired a lot of workers you can think of the corporate sector as being highly levered. And vice versa. Corporate America, as of today, is very highly levered and that creates asymmetric risks in the situation where economic growth softens and they shed risk by reducing their workforce (which results in lower profits and aggregate demand until we reach the new equilibrium point in the economy).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here