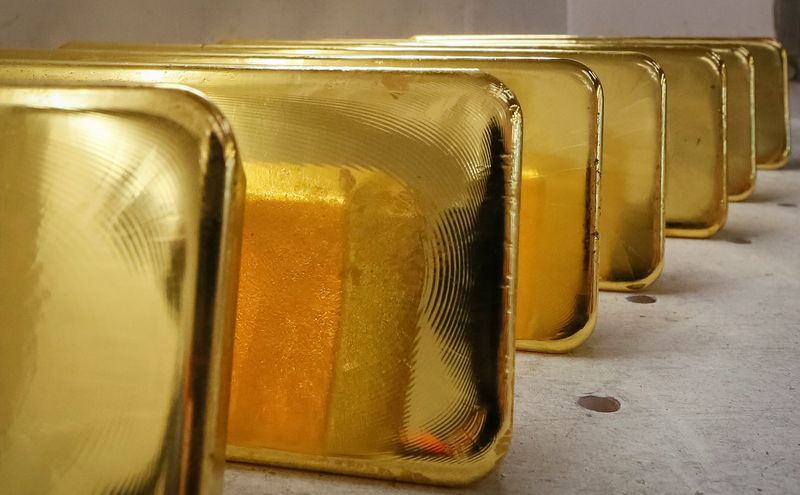

Gold prices experienced a minor decline on Wednesday as investors adopted a cautious stance in anticipation of the Federal Reserve’s imminent interest rate decision. The precious metal’s price was further pressured by an increase in U.S. Treasury yields and a robust U.S. Dollar, with dipping by 0.1% to $1,930.22 per ounce, and December also declining by 0.1%, reaching $1,950.95 per ounce at 00:28 ET (04:28 GMT).

The Federal Reserve, concluding its two-day meeting on Wednesday, is widely expected to maintain current interest rates. However, the recent uptick in inflation, primarily driven by rising oil prices, has led to speculation about a more hawkish approach from the central bank. Even if no further rate hikes are indicated, the Federal Reserve is projected to keep interest rates at levels unseen in over two decades until at least mid-2024. This outlook has implications for gold and other non-yielding assets which tend to underperform in periods of higher interest rates.

The strength of the U.S. dollar and uncertainties surrounding China’s economic recovery have also influenced copper prices, with dropping 0.3% to $3.7428 per pound on Wednesday. The People’s Bank of China kept its record-low key loan prime rates unchanged, as expected, and is anticipated to continue its liquidity measures to support the economy.

In other precious metals markets, spot silver decreased by 0.8% to $23.05 per ounce, while platinum dropped by 0.4% to $935.25 per ounce. Palladium saw a marginal increase of 0.1%, reaching $1,261.15 per ounce.

This week will also see the UK and Japan announce their respective interest rate decisions, adding additional factors for investors to consider in the global economic landscape.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here