A few months ago, I wrote a cautious article on the SPDR S&P Retail ETF (NYSEARCA:XRT), arguing for caution as a weak December retail sales report suggest consumer spending may be faltering.

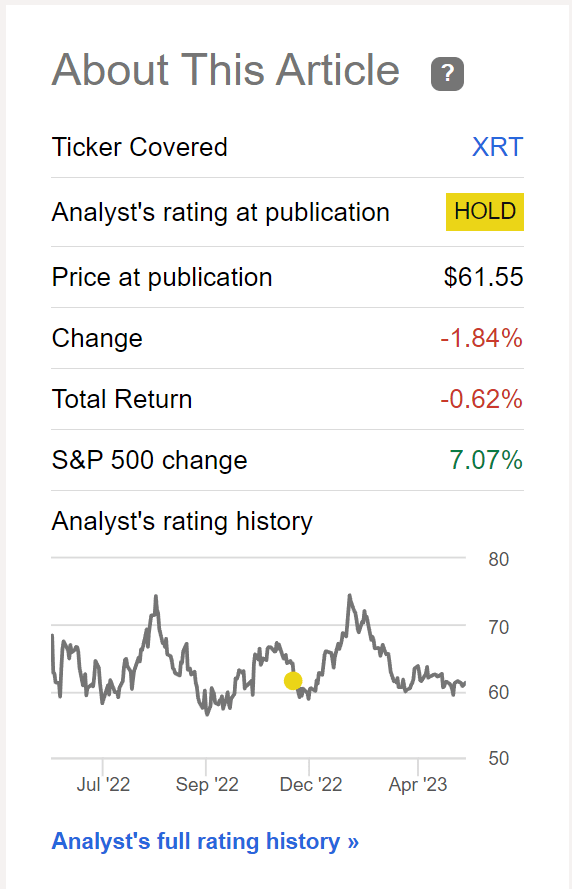

Since my article, the XRT ETF has essentially tread water vs. a 7% gain for the S&P 500, suggesting my caution was warranted (Figure 1).

Figure 1 – XRT has tread water since December (Seeking Alpha)

Retail Sales Continue To Lose Momentum

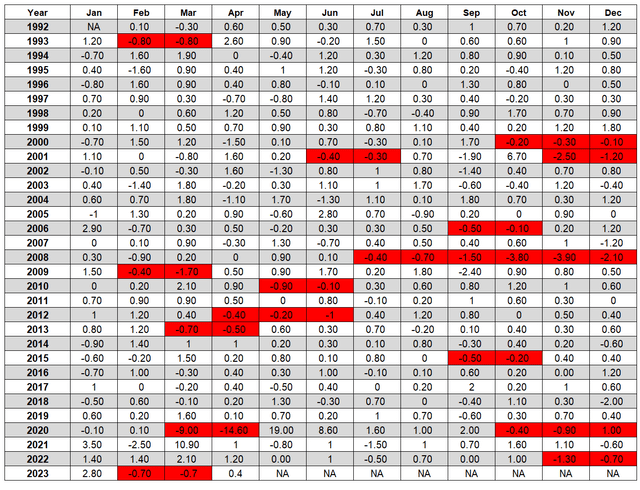

Moreover, inclusive of a recently reported April retail sales report, U.S. retail sales have been negative on a seasonally adjusted basis in four of the past 6 months, suggesting consumer spending is losing momentum (Figure 2).

Figure 2 – U.S. retail sales have been negative in 4 of the past 6 months (Author created with data from the U.S. Census Bureau)

The 0.4% MoM reading missed consensus estimates, which had been looking for a 0.7% rebound following March’s decline. In fact, not only did April’s advanced retail sales miss estimates, March’s decline was also revised lower to -0.7% from the previously reported -0.6%.

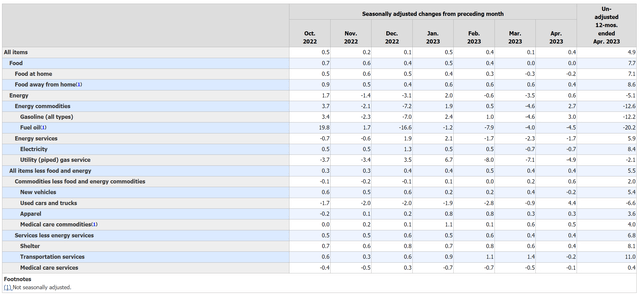

Coupled with CPI inflation, which has been running at a 4-5% YoY rate in the past few months, retail sales are actually quite weak, as sales figures are not inflation adjusted (Figure 3).

Figure 3 – Retail sales have been flat to down despite positive CPI inflation (BLS)

Home Depot Latest Canary In The Coal Mine

Coinciding with the weak retail sales report, The Home Depot (HD) also reported mixed Q1/23 results on May 16th, adding further weight to the weak consumer narrative.

Home Depot reported comparable store sales falling 4.6% YoY in Q1, far worse than analyst expectations for a 2.1% decline. While lumber deflation was a key driver to lower sales for HD, the company also saw “more broad-based pressure across the business,” compared to the fourth quarter just a few months ago.

Worryingly, Home Depot also reduced its full year guidance with sales and comparable sales expected to decline 2-5%, and EPS expected to decline 7-13% vs. versus prior guidance of a mid-single-digit decline.

Big Week For Retail

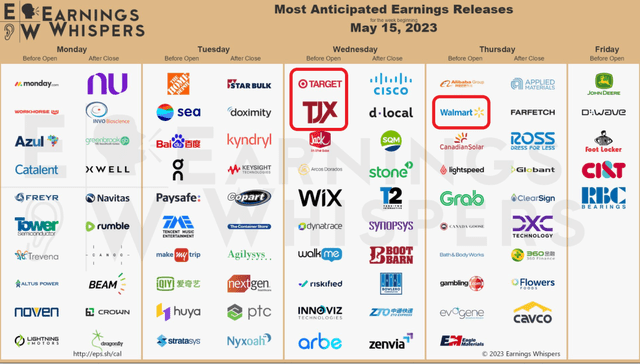

Looking forward, there are three more retailers reporting earnings that investors should monitor this week to gauge the health of the consumer: Target (TGT) and TJX (TJX) on Wednesday and Walmart (WMT) on Thursday (Figure 3). Collectively, these three retailers generate over $500 billion in annual sales in the U.S., so they should provide good readthrough to the rest of the retailing sector.

Figure 4 – Big week of earnings for retail (earningswhispers.com)

Buy Now Pay Later Even For Groceries?

In another sign that the U.S. consumer is stretched to the breaking point by persistently high inflation, there have been recent news reports of financially stressed consumers resorting to ‘buy now pay later’ (“BNPL”) services like Afterpay and Klarna to afford everyday necessities like groceries.

According to the Bloomberg article, almost half of Americans have used BNPL at some point in time and 1/5th of BNPL users have used it to buy groceries. Financially stretched consumers resorting to BNPL for groceries is no surprise, as the USDA estimates a family of four must now spend close to $1,000 on groceries per month (under a ‘thrifty’ plan) to afford a nutritious diet, up 45% from approximately $675 two years ago.

Resumption Of Student Loan Payments May Hurt Consumer Spending

To put another burden on consumers living paycheque to paycheque, student loan payments that have been paused for over 3 years are set to resume before the end of August, according to the Education Secretary Miguel Cardona.

According to a Bank of America survey, more than 43 million Americans will have to budget an extra $200-400 per month to repay student loans, once the payments restart later this year.

Technical Picture Remain Weak

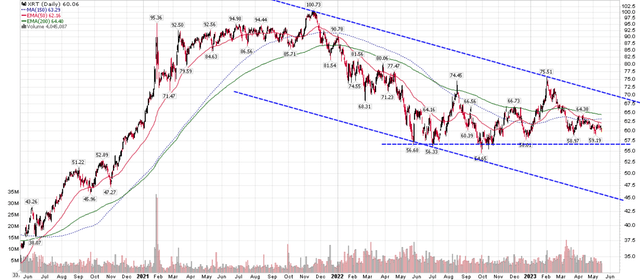

Technically, the XRT ETF has essentially done nothing in the past 6 months, with price still consolidating above the breakdown level near $57 (Figure 5).

Figure 5 – XRT still consolidating near breakdown levels (Author created with pricechart from stockcharts.com)

If the $57 support is broken, I can see downside towards the lower-end of the down-channel at $45.

Risk To My Call

The risk to my call is continues to be the resilience of the U.S. consumer. Despite inflation hurting affordability, consumers have continued to open their wallets, even if it is funded with credit cards (credit card balances reached new all-time highs of $930 billion recently).

As long as consumers continue to have jobs (3.4% unemployment rate), the consumer may be able to kick the can down the road and continue to spend.

Conclusion

The XRT ETF gives investors broad exposure to the U.S. retail sector. Recent retail sales reports continues to show weakening consumer spending. This is confirmed by bellwether Home Depot’s Q1 earnings and 2023 guidance.

Increasingly, lower income consumers are stretched to the breaking point, with many resorting to BNPL to afford necessities like groceries. With student loan repayments set to restart in the Fall, the outlook does not look bright for retailers. I would avoid the XRT ETF.

Read the full article here