This article was first released to Systematic Income subscribers and free trials on May 10.

In this article, we catch up on the latest quarterly results of Oaktree Specialty Lending Corporation (NASDAQ:OCSL). The company continues to generate net income gains while retaining a high-quality portfolio. OCSL trades at a 12% yield and a 7% discount to book.

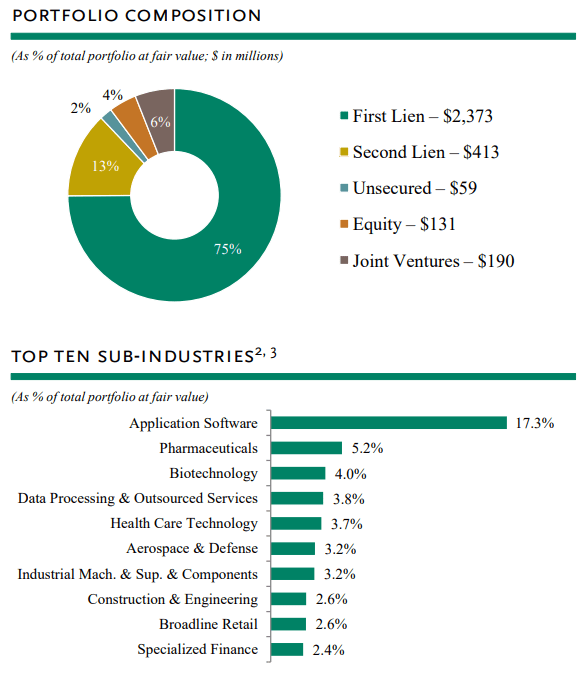

OCSL is primarily focused on secured loans with a low allocation to equity securities. Its sector overweights are software and healthcare – a fairly common combination in the BDC space.

Oaktree

OCSL focuses primarily on the upper middle-market segment and beyond, similar to other larger BDCs such as ARCC and ORCC. The median portfolio company EBITDA rose slightly over the quarter to $133m.

Quarter Update

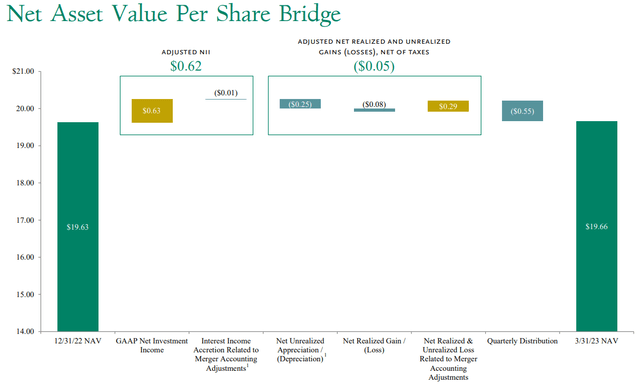

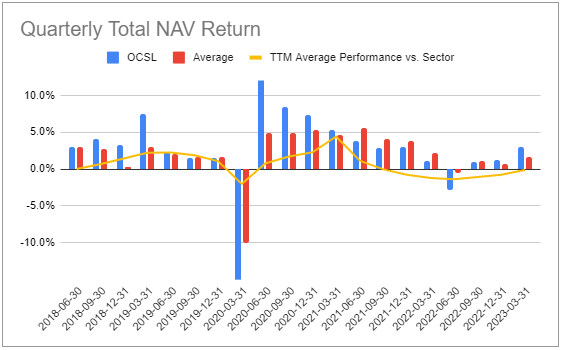

OCSL put together a strong quarter for a 3% total NAV return.

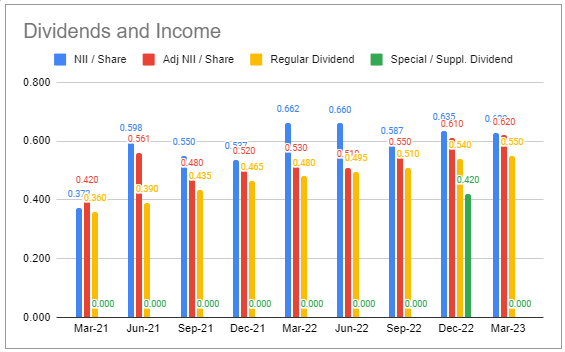

Adjusted net income (adjusted for merger accounting) ticked up by a penny to $0.62 while GAAP income was flat at $0.63. OCSL kept the dividend unchanged at $0.55, after 11 consecutive raises. Dividend coverage rose slightly to 113%.

Systematic Income BDC Tool

In the last quarter or so, many BDCs have tended to be cautious raising the dividend further given the widespread view that short-term rates may fall over the next year, causing net income to drop as well.

The NAV rose after falling for a number of quarters, however this rise was primarily due to merger accounting adjustments (+1.5% NAV impact) and the impact of retained income (+0.4% NAV impact). Without the merger accounting impact, the NAV would have been lower.

Investors familiar with OCSL know that the company tends to be more conservative with NAV marks (i.e. taking bigger write-downs and writeups, all else equal). This past quarter was no different as the company recorded unrealized losses once again.

Oaktree

In January, OCSL completed the merger with the Oaktree Strategic Income II, Inc., adding $572m of investments into the broader portfolio. Oaktree will waive $9m of the base management fee across two years, which comes out to around a tenth of the total base fee over this period.

Income Dynamics

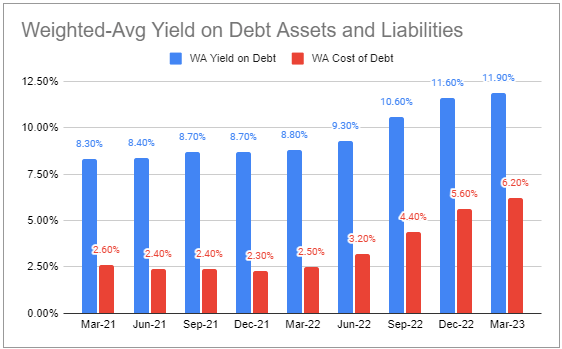

Portfolio yield rose to 11.9% due to higher short-term rates while interest expense rose for the same reason. The yield on new debt investments this quarter was in line with its 11.9% overall portfolio debt yield.

OCSL has an elevated level of floating-rate debt (through credit facilities and fixed-rate debt swapped to floating) which has pushed its interest expense 0.8% above the sector average despite a higher-quality rating profile. This also means that its yield gap (between assets and liabilities) of 5.7% is below the sector average of 6.6%.

Systematic Income BDC Tool

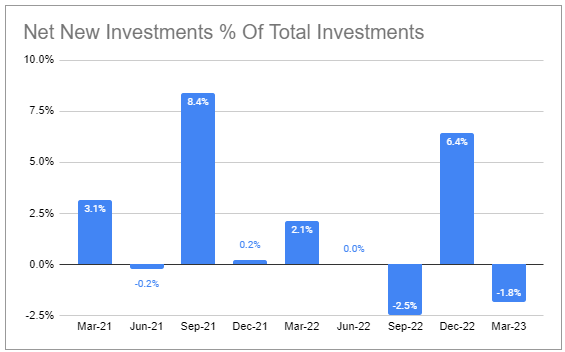

Net new investments fell after a big previous quarter.

Systematic Income BDC Tool

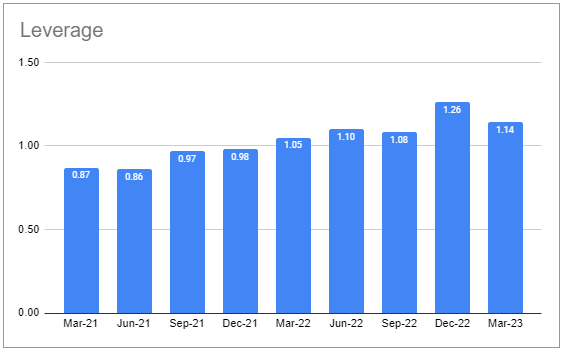

Leverage fell to 1.14x, primarily as a result of the merger. It’s currently around the midpoint of the 0.9x – 1.25x target range.

Systematic Income BDC Tool

Overall, the company’s relative low net income beta to short-term rates, the stabilization in rates, negative net new investments and the drop in leverage suggest that we shouldn’t expect large net income gains in the coming quarters.

Portfolio Quality

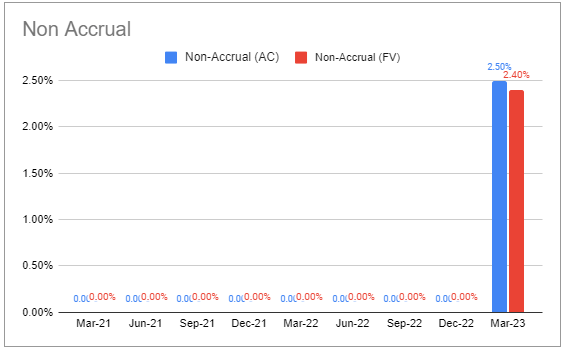

Non-accruals rose to 2.4% on a fair-value basis from zero as a result of two investments. Management has guided that they expect a near term resolution to these positions and consider themselves well-covered at current marks of 88% and 98% on the two positions.

Systematic Income BDC Tool

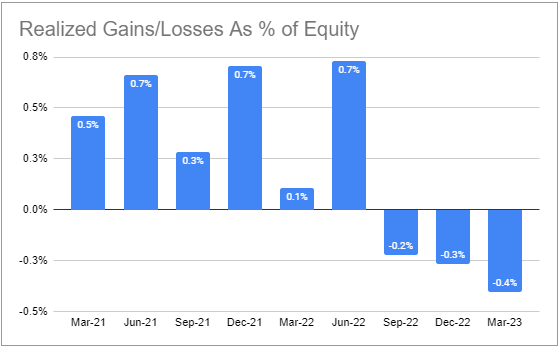

It was another quarter of realized losses though the total losses are below what the company has accumulated since 2021.

Systematic Income BDC Tool

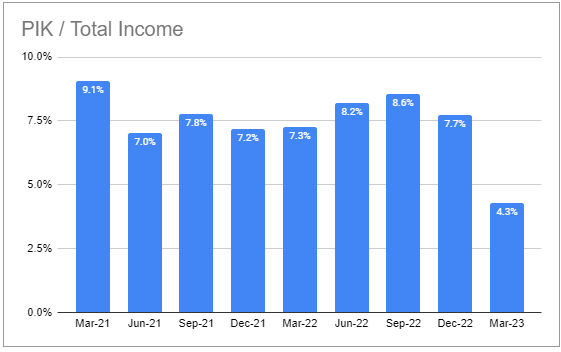

The level of PIK income fell.

Systematic Income BDC Tool

Return And Valuation Profile

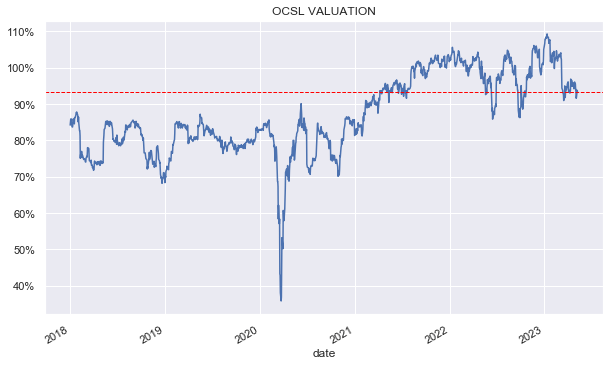

OCSL has moved off its high valuation at the start of the year towards a more moderate one. We don’t expect the stock to sustainably move back towards the low valuation it traded at 3-5 years ago. At that point, Oaktree was still working out of the lower-quality legacy portfolio it inherited from Fifth Street which presented a number of risks. Moreover, the company’s strong underwriting process was not yet evident.

Systematic Income

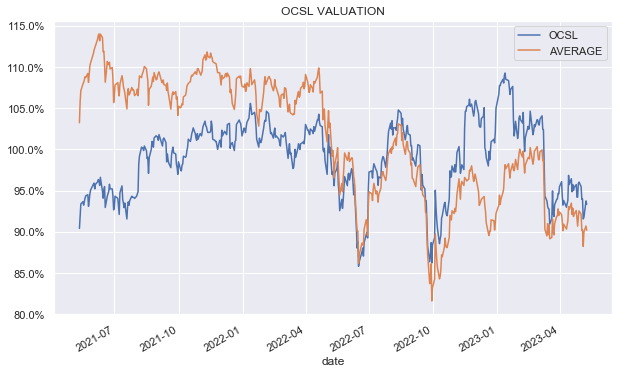

We can gauge its valuation more accurately by plotting it against the average sector valuation (orange line). We can see that OCSL used to trade at a significant discount to the broader sector, then closed the gap around 2022.

Systematic Income

Our first allocation to the stock was in November 2021 when it traded at a valuation 5% below the sector average. We would be surprised to find it at a similar discount to the sector in the future.

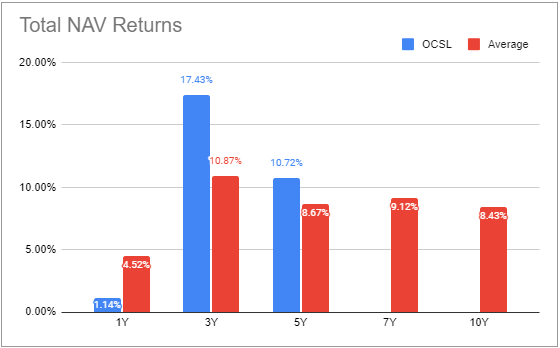

The company’s longer-term valuation has beaten the sector average. Over the shorter-term it has underperformed somewhat.

Systematic Income BDC Tool

The key reason for its recent underperformance, in our view, is its portfolio marking process which tends to be somewhat heavy-handed. In part this is due to it holding publicly traded loans which are more volatile than private loans. We can see this dynamic below where the company underperformed during the COVID shock, then outperformed coming out of the shock.

Systematic Income BDC Tool

It, once again, underperformed starting in 2022, and we expect it to outperform when we come out of the current market malaise. In effect, the company is carrying a larger loan-loss reserve than the broader sector which overstates its valuation. In our view, its apples-to-apples valuation is closer to the sector average of 90% than its official 93% figure.

Stance And Takeaways

OCSL delivered a decent quarter with a positive total NAV return and a gain in net income.

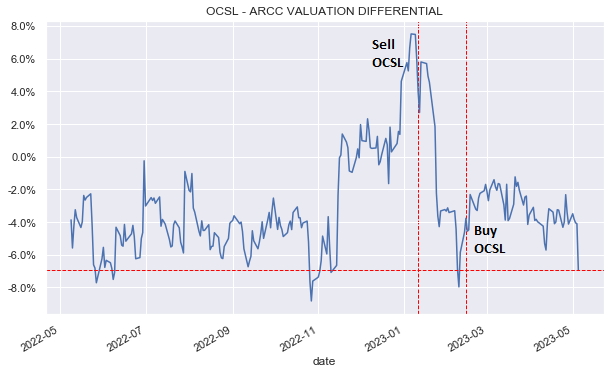

We downsized our allocation to OCSL in January when its valuation blew out to a surprisingly high level by rotating to ARCC. Once the OCSL valuation corrected in February, we moved back to OCSL. Although the timing wasn’t perfect, there was about 7% of alpha after just a month.

Systematic Income

The stock is currently attractively valued and we would look to add to our position on further valuation drops relative to the sector.

Read the full article here