All values are in CAD unless noted otherwise.

The Company

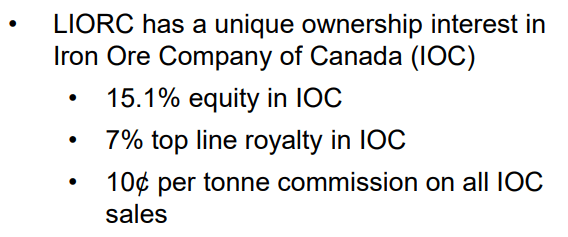

Labrador Iron Ore Royalty Corporation a.k.a. LIORC (OTCPK:LIFZF) (TSX:LIF:CA) owns equity interest in the Iron Ore Corporation of Canada. This equity interest brings it dividend income, but it also receives royalties and commissions from the same source.

Investor Presentation

Note: Labrador Iron Ore Royalty Corporation will be referred to as LIORC and Iron Ore Corporation of Canada will be referred to as IOC for the remainder of this piece.

The royalty and commissions come from LIORC’s ownership of mining leases and licenses that are leased by IOC. The latter is one of the largest producers and exporters of iron ore pellets and high-grade concentrate operating in the Newfoundland and Labrador province of Canada. IOC is operated by its majority shareholder, Rio Tinto Group (RIO), a name well known in the metals and mining circles.

Prior Coverage

The last time we wrote about LIORC, we rated it a hold as we were not sold. Iron ore’s fate is tied to steel demand, which we felt was not sustainable given that the bulk of it was coming from China’s housing bubble. This royalty play hitched its wagon to one commodity produced in one location, thereby removing the element of diversification. Add to that the low cost of producing iron ore left very little operating leverage advantage that is generally enjoyed by royalty companies. We still refrained from rating it a sell and outlined our reasons.

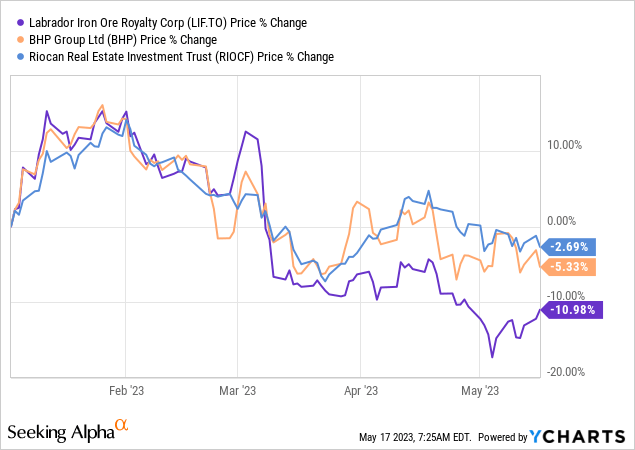

LIORC does benefit from a weaker Canadian dollar and that generally helps it when commodity prices are weak. At the current stock price, the higher margins and the benefit from the weaker currency are sufficient offsets such that we rate LIORC a Hold/Neutral. On the other hand we are short BHP and rate both BHP and RIO as Strong Sells.

Source: Labrador Iron: Royalty Play With 8% Yield, What’s Not To Like?

In the four months since our call, all three stocks are down but not in the order we envisioned. We take a look at the Q1 numbers for LIORC to see if the answer lies there.

Q1-2023

China eased its zero COVID-19 policy and iron ore prices jumped up in response.

Trading Economics

The sentiment also received some support as China tried to stabilize its property market.

China’s home sales rose for the first time in 20 months, signaling demand is recovering after policy makers expanded support for the struggling sector.

The value of new home sales by the 100 biggest real estate developers climbed 14.9% in February from a year earlier to 461.6 billion yuan ($67 billion), according to preliminary data from China Real Estate Information Corp.

That’s the first year-on-year increase since June 2021. The figures were helped by a favorable comparison with February 2022, which included the Lunar New Year holiday. It was celebrated in January this year.

China has shifted policy to help the industry — first by easing financing for developers and then by taking steps to revive homebuyer demand. Some local governments moved away from rules restricting land sales, while the securities watchdog introduced a pilot program for real estate private equity investment funds.

Source: Bloomberg

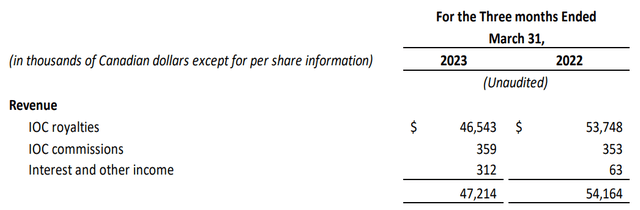

The price did not sustain, and provided only a modicum of relief to LIORC’s Q1 numbers. Royalty, its primary revenue driver, was down 13% year over year driven by lower average pellet and concentrate prices on product sold by IOC.

Q1 Financial Report

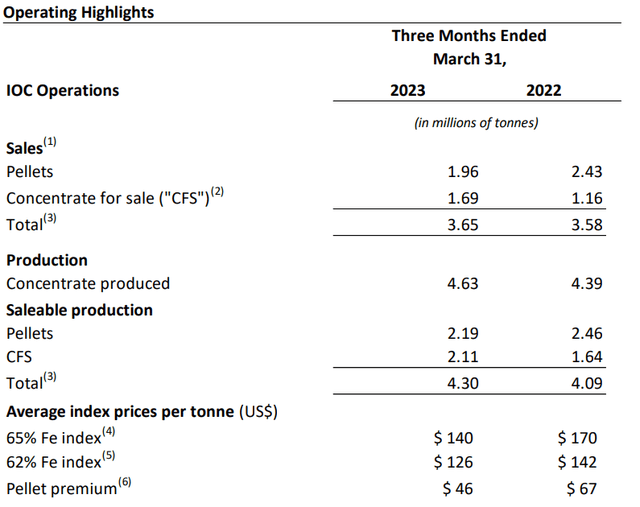

IOC also found fewer takers for its pellets with recessionary concerns and lower steel margins causing European steel producers to opt for less expensive iron ore from competitors. The impact of this can be seen in the comparative change in pellets versus concentrate product mix below.

Q1 Financial Report

Overall, the revenue drop decreased net income by 31% for IOC.

Outlook & Verdict

The prices obtained by IOC in Q1-2023 are also higher than what can be currently obtained. So a further decline in cash flows is built in for Q2-2023. We already saw that earlier pressures created a 28% dividend cut. The first thing here is therefore to forget about the old distribution rate for now. The guidance also reflects a bump up in tonnes produced, but this is offset by a 17% higher capex. So if the current pricing holds, we would look for about 45 cents in distribution per quarter on average for the rest of the year.

Of course, our outlook here on iron ore remains decidedly bearish. China’s property bubble is still in the very early stages of a meltdown. All those that wagered that the government would be able to sustain an indefinite bubble were proved incorrect in 2022. The only question remains is the glide path down. In an array of bad and awful choices, we think policymakers will choose the least problematic one. That lease problematic one is to stop targeting high GDP via construction of a lot more homes. They will of course work to stabilize the market and bail out the banks and potentially some construction firms. None of those bailout measures will create a demand for iron ore. Even on the US side, we are likely to use substantially less in the next 12 months if our leading indicators are worth anything. We see iron ore prices dropping possibly as low as $60/tonne in the next 12-15 months. This would lead to a 20 cents of dividend per quarter, all else being equal. We did see a 25 cents a quarter dividend in 2020. At that point iron ore had still held near $80/tonne. So our downside outlook for the dividend here may be conservative.

We will pass on purchasing the shares now and continue to rate this as a hold. We are short BHP and think that likely shows more downside as its free cash flow is more sensitive to iron ore prices than IOC.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here