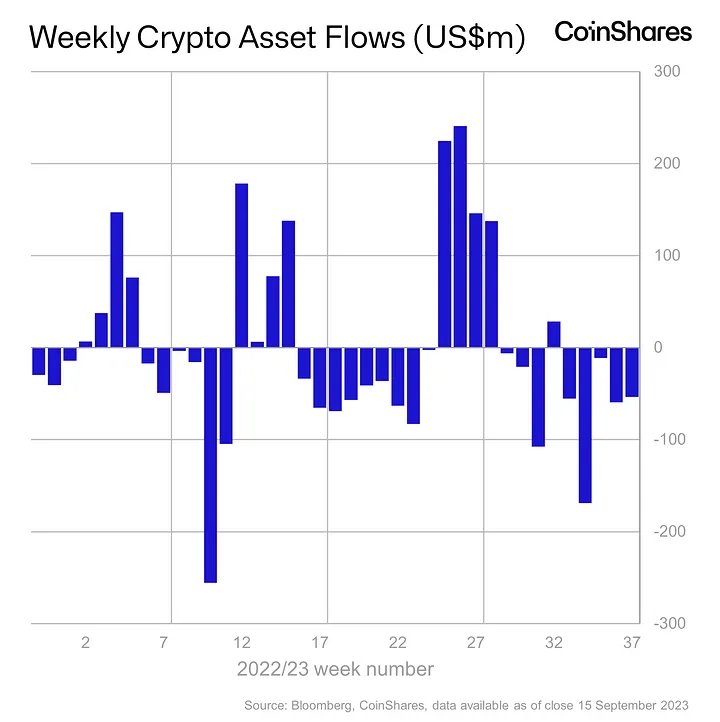

Cryptocurrency investment products recorded outflows for the sixth consecutive week with market leaders Bitcoin (BTC) and Ethereum (ETH) leading the pack.

A new CoinShares market report shows total outflows from digital asset products totaling $9 million with BTC accounting for $6 million in its third consecutive week of outflows while leading altcoin ETH in its sixth consecutive week of outflows posted $2.2 million.

As the crypto winter ravages the space, volumes were also significantly lower at $820 million for the week than the yearly average of $1.3 billion

Short-bitcoin saw total exits hitting $2.8 million far below its $15 million high this month with 78% of assets under management (AUM) withdrawn in the last 22 weeks.

Multi-asset products are also in slight losses this past week with total outflows for the year tapping $32 million.

Meanwhile, amidst losses from BTC and ETH, altcoins like Ripple (XRP) and Solana (SOL) recorded inflows of $0.66 million and $0.31 million following investor confidence in the other altcoins.

Bull’s eye growth amid chaos

At press time, the price of Bitcoin trades at $26,337, way below this year’s $31,000 high after the BlackRock ETF application followed by several firms making similar moves showing a renewed institutional investment.

Despite this, bulls are keen on a change in the status quo and this can be seen in the week-on-week reports so far.

In the previous report, weekly outflows in investment products totaled $54 million with a staggering eight weeks sum of $455 million. BTC also led the pack with $45 million in exits, 85% of the total volume.

Ethereum on the other hand recorded limited outflows of $4.8 million with the United States posting the highest number of exits.

Ethereum on the other hand recorded limited outflows of $4.8 million with the United States posting the highest number of exits.

Europe takes the torch

It has been widely noted that the UK market has been in a bit of chaos following unclear rules and multiple court cases. This reality is encapsulated in the report.

Per the data, Europe recorded inflows of $16 million in digital asset products while United States investors withdrew $14 million from the market pointing to a divergence in recent investment narratives in both regions.

In total monthly investments, outflows in the US remain higher at $67.5 million while Europe recorded $24 million with Germany, Sweden, France, and Switzerland most notable.

The major driver of this trend remains clear regulations in Europe following the signing of the Market in Crypto Assets (MiCA) regulation.

Recently industry executives have criticized the bottleneck and enforcement by court approach of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission.

Pro-market policy watchers have also reiterated a potential migration of web3 talent away from the US to industry-friendly jurisdictions.

This month, Coinbase announced a global expansion plan listing regions like the UK, Europe, Brazil, and Hong Kong as “near-term priorities” while criticizing regulators in the United States.

Read the full article here