A new Glassnode report says that Bitcoin (BTC) Ordinals are not displacing monetary transfers despite concerns of network clogging.

In a Sept 25 release, on-chain analytics firm Glassnode explained the role of BTC inscriptions on the network, their impact in competition with other transactions, and how they shape the mining industry.

According to the report, there is minimal evidence that Ordinals are displacing high-value transactions as many community members believe.

This is based on the fact that inscriptions consume less space, cost less and users are willing to wait longer periods for confirmation.

“Since Bitcoin transaction fees are paid on a per-data basis (fee per byte), inscriptions tend to be relatively sensitive to the size of the absolute fee. As such, inscription users have tended to set relatively low fee rates, expressing a willingness to wait longer periods for confirmation.

Inscriptions makeup 20% of block fees and usually consume the cheapest available block space and are described as “pocket fillers” to fill blocks faster while being periodically displaced by more pressing transfers.

This can also be seen in the mean and median transfer volumes of which the mean represents monetary transfer movements while the median could represent inscriptions over a long time.

A miner’s dilemma

The general notion is that inscriptions have given miners a new income stream with more filled blocks.

Observers have noted in the past that while miners suffer from a bearish outlook forcing many to pivot into Artificial Intelligence, selling Bitcoin reserves, etc.

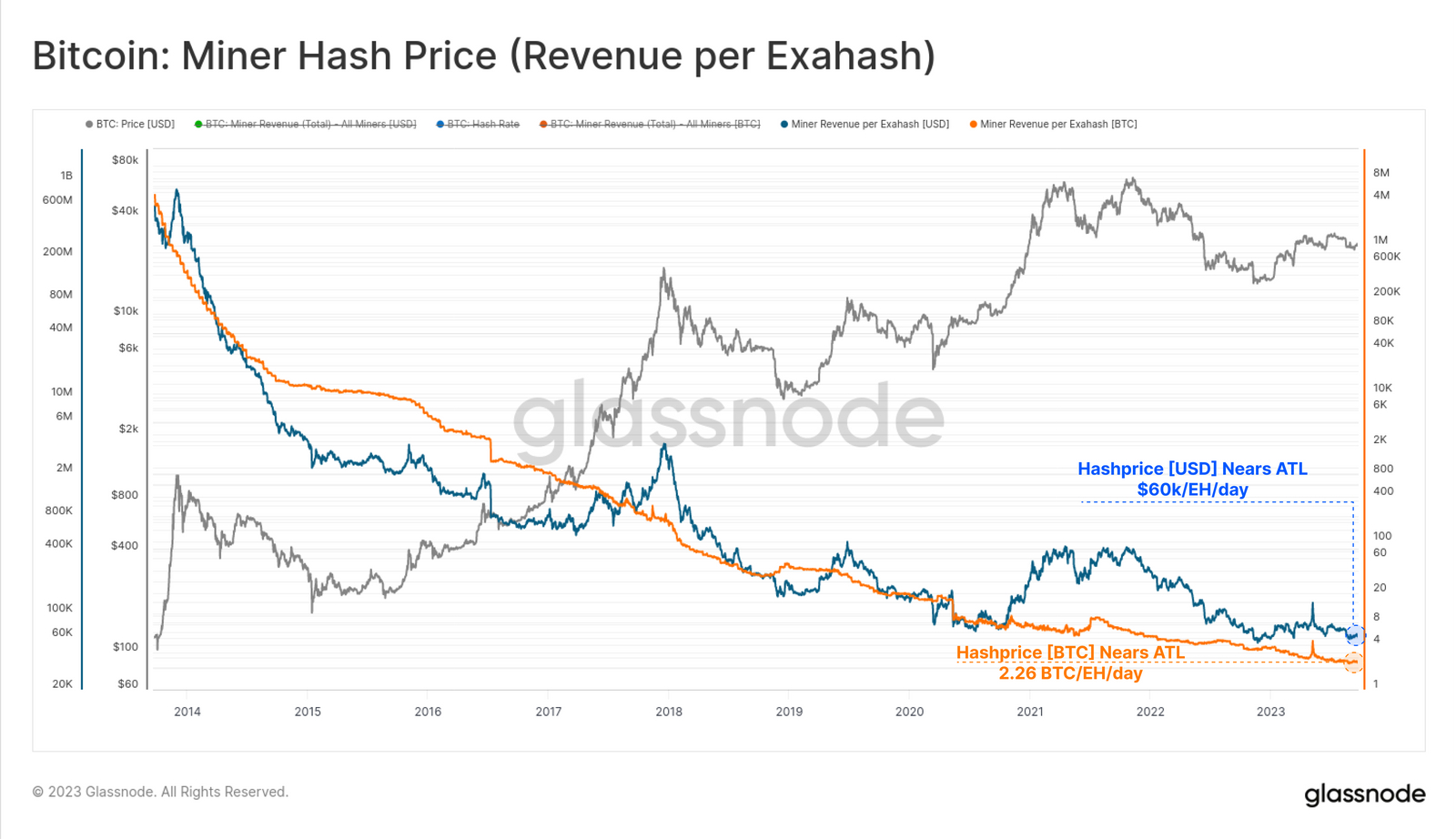

While block space demand has improved miners’ fees since February, the amount of hash rate has also increased by 50% since the roll-out of Ordinals.

“This has driven the hash price, being the BTC or USD reward earned per Exahash, towards new all-time-lows. Miners will now earn just 2.26 BTC (~$60k) per Exahash active on the network,” the report reads.

In a nutshell, the increased fees miners earned have come at a price and they now stand at the cusps of unprofitable with the halving event projected in the next 206 days.

Ordinals and the mempool

Bitcoin Ordinals are a method of inscribing digital content in the Bitcoin network. Often described as Bitcoin non-fungible tokens. (NFTs), they are virtual assets inscribed on the lowest denomination of Bitcoin, satoshis.

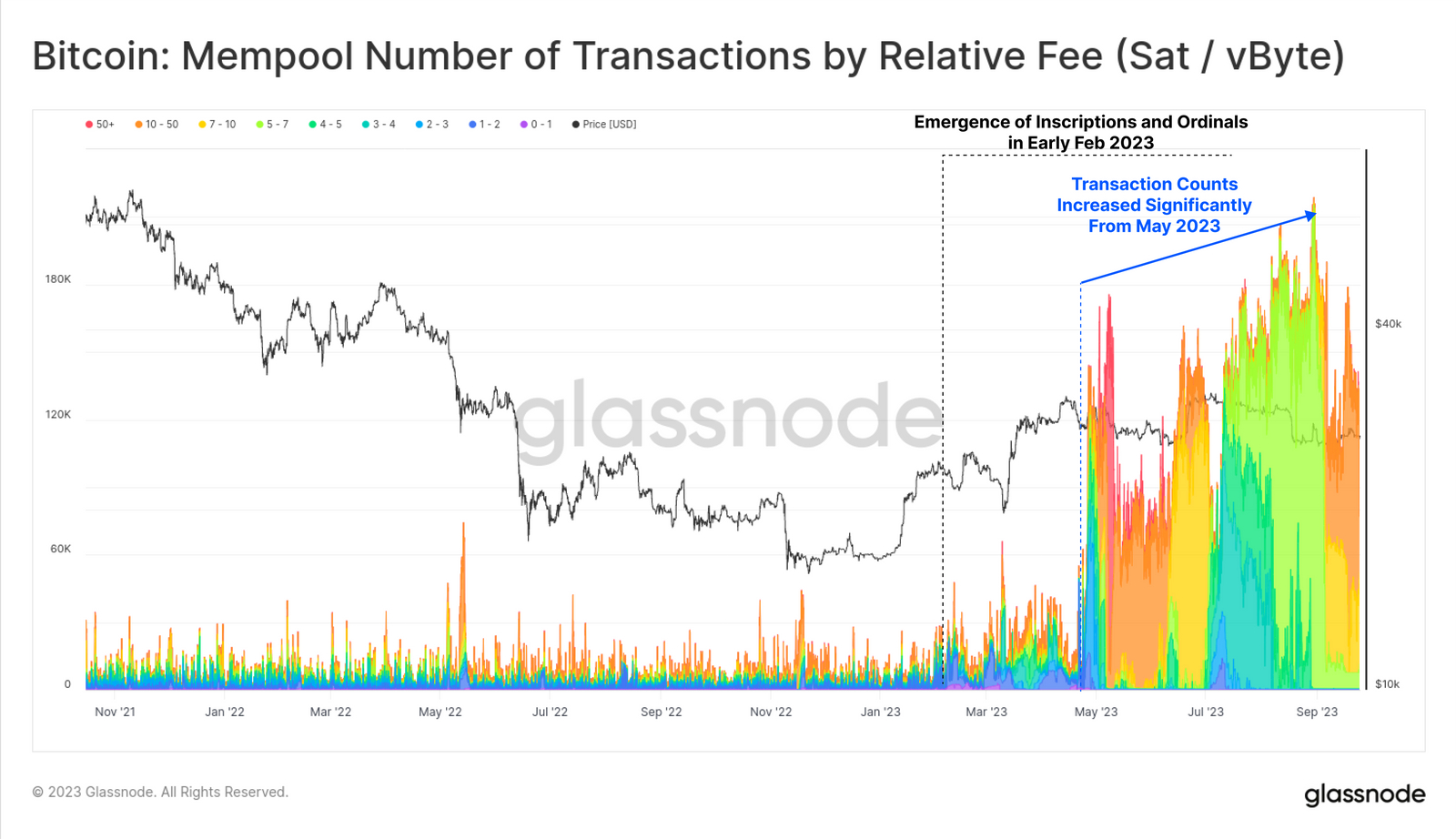

Per the report, Ordinals have reshaped on-chain transactions and the mempool, a temporary cloud for unconfirmed BTC transactions.

Whilst the report concedes that Ordinals and inscriptions have clogged the mempool, it opined that the discrepancy in pending transactions between February and May shows a lower data footprint.

“This indicates that a majority of these unconfirmed transactions have a very small data footprint (more transactions fit within the 300MB capacity of the Glassnode mempool),” it added.

Read the full article here