Alexandria Real Estate Equities (NYSE:ARE) is an office REIT focused primarily on life science tenants. The consensus here on Seeking Alpha seems to be that because the company is not directly threatened by the work from home movement it is the best positioned office REIT. That’s why of the analysts are covering the stock, only one is at a HOLD rating with everyone else at BUY or STRONG BUY. The goal of this article is to look at the facts objectively and argue that although the REIT is fundamentally sound and amongst the best it might be trading at too high a premium for the current market conditions.

Overview of ARE

Most readers are already fairly familiar with the company so I won’t go into too much detail. What’s worth mentioning is that there are a couple of things which put ARE into a category of its own, especially when compared with other traditional office REITs such as Boston Properties (BXP) or Piedmont Office Realty Trust (PDM).

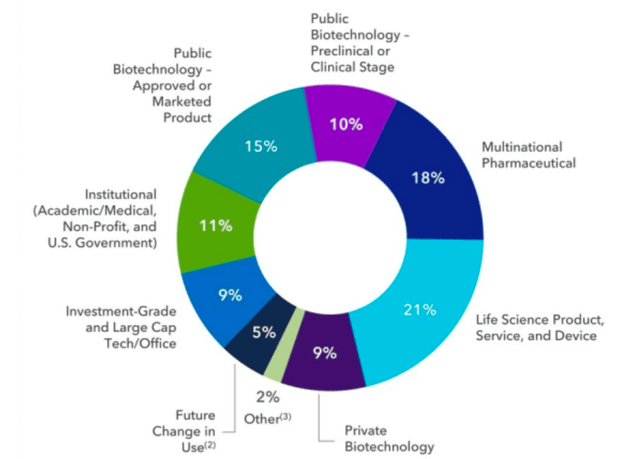

1. First of all, it’s their tenants. ARE leases exclusively to life science oriented companies. Some of these are big pharma firms, some bio-tech startups, and some academic and government institutions. The bulls argument that labs cannot be taken home the same way a laptop can is valid. That’s why almost all office REITs have been highlighting their life sciences exposure on earnings calls. The trouble is that obviously not all the space is lab space. ARE doesn’t tell us, but I suspect that a large portion of space that their top tenants such as Moderna (MRNA) or Novartis (NVS) lease is actually traditional office work space. If so, then this part would obviously be susceptible to WFH and we could easily expect that when companies renew their leases, they will do so for a smaller square footage. While this is largely speculation at this point, it is a worry that I have.

ARE

2. Next, its ARE’s growth prospects. The company has been able to post great returns and according to management’s guidance this is expected to continue going forward. Their growth is primarily driven by their sizeable development pipeline, which delivered 450,000 sft of new space during the first quarter alone. Beyond the first quarter, the company expects to deliver 6.7 Million sft of space over the next three years, adding over $600 Million to their NOI. I have to say that’s impressive and the thing is that this pipeline is already 73% pre-leased which shows that there is significant demand for the product. On this front, I have to give it to ARE, because their growth seems very visible and highly locked in unless their overall occupancy plummets due to the reasons mentioned above. Currently, occupancy stands at 93.6% and the thing about a growing pipeline is that it will likely put more pressure on leasing especially when you consider that the company already has almost 9 Million sft (20% of total) of lease expiries until 2025. What’s also worth mentioning is that the average cash initial stabilized yield on the properties delivered in Q1 stood at 6.6%.

3. Finally ARE is in a league of its own because of its balance sheet. With a BBB+ rating, 96% of their fixed rate, and no debt maturities before April 2025, there isn’t much that could jeopardize the company’s plans. Add to this the fact that they have over $5 Billion available in liquidity to fund their growth. And really their overall debt level is reasonable at around 5.3x EBITDA which means that the company is in no way overleveraged.

So as you can see, ARE is a pretty special company and there is a lot to like. The only concern on a fundamental level is the proportion of space that is not lab space, but traditional office space and the implications this might have on the overall occupancy level especially combined with high lease expirations and a sizeable pipeline of new developments. In either case, my skepticism towards the stock isn’t coming from fundamentals but rather the valuation.

In Q1 the company posted annualized NOI of $1.8 Billion. With that, we can calculate that it trades at an implied cap rate of 5.6%. To me that feels way too low. With 10-year treasuries at 3.5%, it implies a spread of only 210 bps, which is similar to the kind of spreads that the market is applying to prime residential real estate or some of the safest net lease space. Although ARE is fundamentally healthy, I still think their business model is under more pressure than residential space which tells me that cap rates might have further to increase. This would be confirmed by the lack of transactions that management has been able to show and their lack of commentary on the earnings call regarding the pricing of ongoing deals. This is why I rate ARE as a HOLD here and don’t plan on buying until the below a 6-6.5% cap rate.

Read the full article here