Thesis Summary

Sea Limited’s (NYSE:SE) latest earnings report revealed modest revenue growth, accompanied by missed earnings per share expectations. As a result, the SE stock experienced a 17% drop right after the earnings announcement. While the future remains uncertain, the company reported more than 50% growth in a crucial sector and a significant decrease in costs & expenses.

I am still very bullish on this stock long term.

Q1 Overview

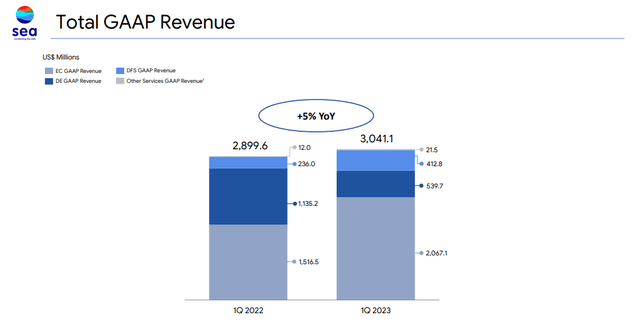

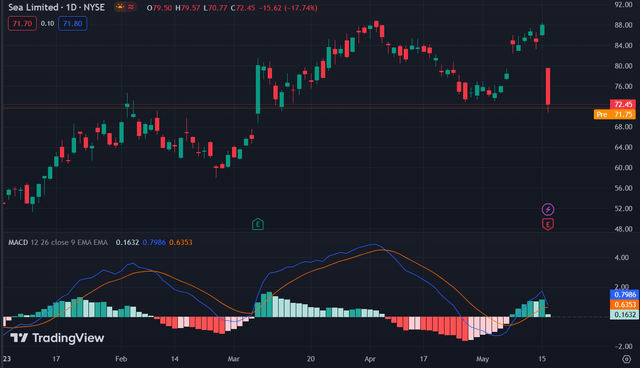

Sea’s latest earnings report posted on 16 May 2023 indicated just 5% growth YoY in terms of total GAAP revenue. While the company presented strong indicators of improved financial efficiency and development in leading sectors, investors reacted sceptically to the earnings beat. Therefore, the SE stock’s price has dropped by more than 14%, closing at $72.45 per share.

GAAP revenue (Investor slides)

The company’s underperformance in the digital entertainment sector, where bookings fell more than 50% compared to Q1 2022, may have influenced the drop in share value. Furthermore, the diluted earnings per share ended up at $0.15, while the average estimates by investors were standing around $0.39 for the last quarter.

SE Price action (Tradingview)

Sea Limited operates in three different business segments. To get a more informed overview, we will examine the reported numbers for each segment, followed by the combined numbers of the earnings report.

Earnings Reports for Q1 2023 By Business Segment

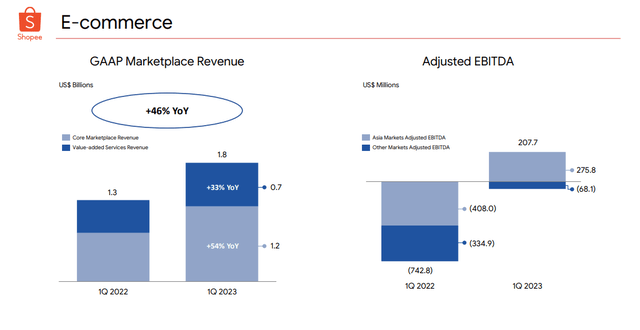

The first key sector in which Sea Limited reported positive results is the e-commerce sector. Shopee is an e-commerce platform owned by Sea that operates in Southeast Asia, Taiwan, and Brazil. The virtual marketplace’s revenue grew by 46% year-over-year, while the adjusted EBITDA surged by 127.97%. The company shows strong progress and competency to generate profit in a leading sector, which is expected to reach 7.9 trillion by 2030, according to Statista.

e-commerce growth (Investor slides)

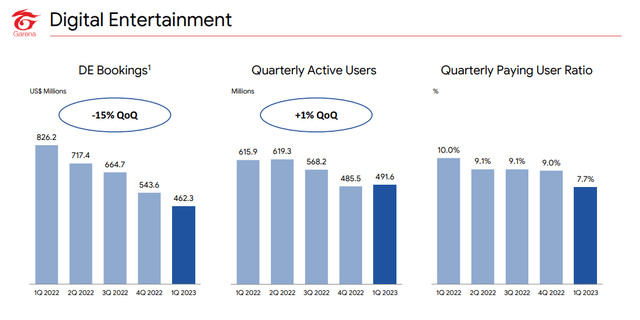

The Digital Entertainment sector was the weakest performer out of the three for Sea Limited. Sea’s global online games development platform Garena reached peaks of 826.2 million DE Bookings in a post-covid period of Q1 2022. Their last report, however, indicated a downfall of 15% QoQ and more than a 54% fall from last year’s Q1 report. Since the previous year’s statistics, active users have dropped to 491.6 million from 615.9 million, a plunge of 20.16%. The playing user ratio also tumbled by approximately 14% since the previous quarter.

Digital Entertainment (Investor slides)

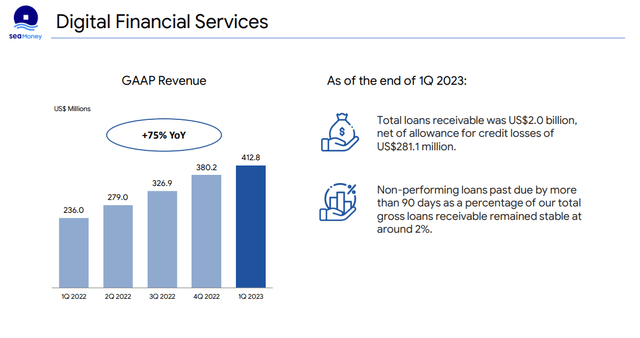

SeaMoney is Sea’s digital financial services arm. Interestingly, the revenue in this secondary sector for Sea Limited is getting close to their digital entertainment services, with a difference of just $49.5 million. When examining the numbers QoQ, we can see that growth is slowing down a little bit; however, GAAP revenue YoY is still up by 75%.

Financial services (Investor slides)

Growth Outlook

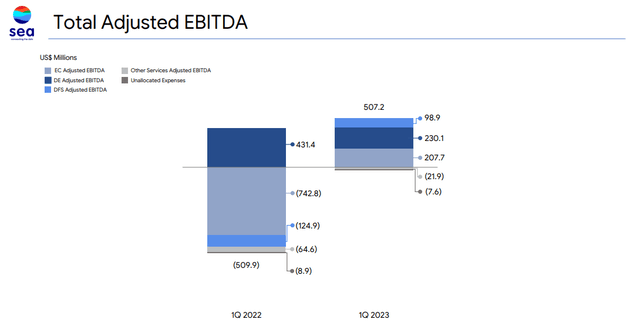

Despite not meeting EPS expectations and a disappointing performance in the digital entertainment sector, Sea still reported 5% GAAP revenue growth year-over-year. Moreover, total adjusted EBITDA turned from negative $509.9 million to positive $507.2 million, rising by almost 200% in a single year. Gross profit was also improved by 21% compared to Q1 2022. Although net income ended up at a loss due to the negative impact of $117.9 million related to the decreased value of assets acquired in a previous acquisition, it still stands at a positive $87.3 million.

EBITDA (Investor slides)

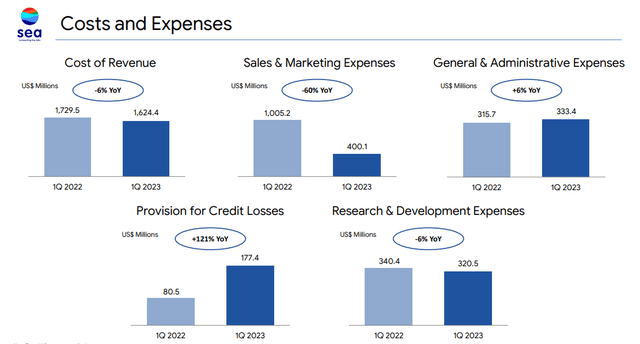

Adding to the overall positive outlook in terms of finances in the earnings report, Sea Limited also reported impressive costs and expenses management. Sales & Marketing expenses were down by a whopping 60% YoY, while the Cost of Revenue and Research & Development Expenses declined by 6% each. On the contrary, General & Administrative Expenses rose by just 6%. Provision for Credit Losses soared by 121% due to the company’s efforts to expand to a broader user demographic and improve its loan book.

Costs and Expenses (Investor slides)

Overall, Sea proved it could become profitable and organise its finances; however, the market wants to see more improvement in the digital entertainment sector. If Garena continues to deteriorate, investors may, in fact, miss on bullish expectations.

Technical Analysis of SE’s Performance

At the time of writing this report, SE stock’s price stands at $72.45, with a market cap of 41.06 billion. Despite yesterday’s downturn of around 14%, we should note that Sea Ltd. stock is up 36.75% year to date.

SE TA (Tradingview)

Looking at SE’s trading chart, we can see that the blue MACD line is about to cross over the orange signal line. This trend is often an indicator that a bearish trend may follow in the near future.

Risks and Challenges

The company outlined crucial risks and uncertainties that may affect its performance in its forward-looking statement. Some factors may include Sea’s future goals and strategies, financial condition and results, market growth, competition, government policies and regulations, and general economic conditions.

The company remains optimistic for the future and is pleased with the achievements and improvements in the current quarter.

We are also pleased with the progress we have made so far to strengthen the fundamentals of our business. As we continue to fine-tune our operations and navigate near-term macro uncertainties, we remain highly confident in the long-term opportunities in our markets and our ability to capture those profitably,

Source: Forrest Li Interview, Business Wire

Final Thoughts

Although Sea Limited experienced a 14% drop in share value, it still gained substantial revenue. Due to the increasing demand for e-commerce services, and the company’s positive-looking forward statement, investors should consider monitoring Sea Limited’s efforts as we advance. Although predictions for the near future remain bearish, remaining patient after the buzz following the earnings report wears out should give more valuable insights into future performance. With more than a 36% surge from the beginning of the year, the Sea stock forms itself as a value stock with long-term growth potential.

Read the full article here