Thesis

With rescheduling on the horizon, and most cannabis stocks currently trading in the gutter, now is the time to look for long-term winners. Unfortunately, most of the sector is unprofitable. SNDL Inc. (NASDAQ:SNDL) has been a significant player within the ecosystem and is worth keeping an eye on. The company has adopted a strategy where they purchase their distressed competitors. Unfortunately, this has left them with a large amount of poor quality revenue. After looking over their most recent quarterly report, they have improved their ROIC and ROE to the point that I am changing my rating for SNDL from a Strong Sell to a Sell.

Company Background

SNDL was founded in 2006 and was formerly known as Sundial Growers Inc. The company’s initial focus was on the production and sale of medical cannabis, but it has since expanded into the recreational cannabis market.

I went into much further detail on the history of the company in my last article on SNDL. The two most important highlights were that in 2018 Canada legalized recreational cannabis, and in early 2021, they raised a total of $1.18B through offerings.

Their most recent earnings call indicates that the company is continuing efforts to improve its operational efficiency during the second half of the year.

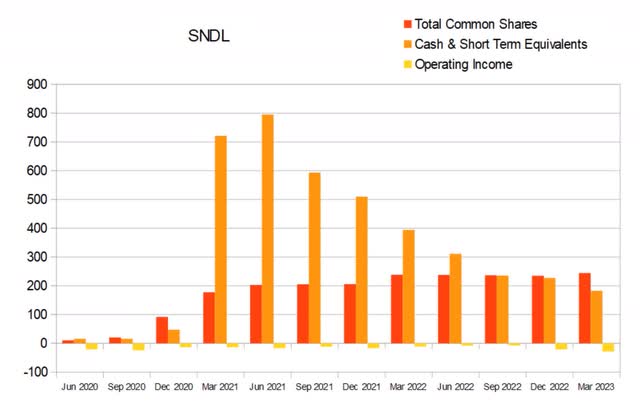

SNDL Forward Guidance (Q1 2023 Earnings Call Transcript)

Financials

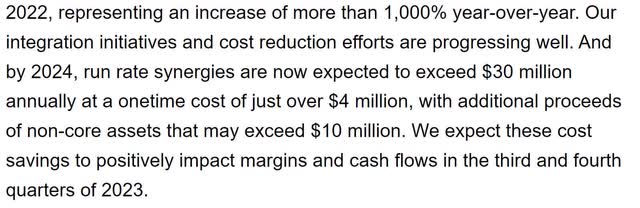

SNDL has been unable to produce organic revenue growth. Although total revenue went up dramatically in 2022, it was purchased revenue. This has grown their market share significantly. Unfortunately, it also burdens them with low quality revenue. These assets were on sale for pennies on the dollar for a reason.

Since their acquisitions in Q2 2022, revenue has declined 13.81% from $173.8M to $149.8M.

SNDL Quarterly Revenue (By Author)

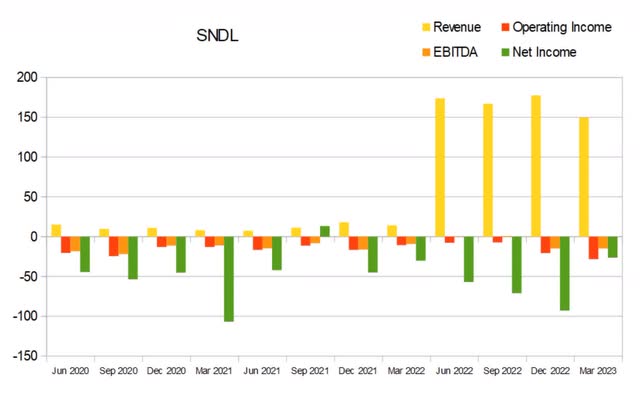

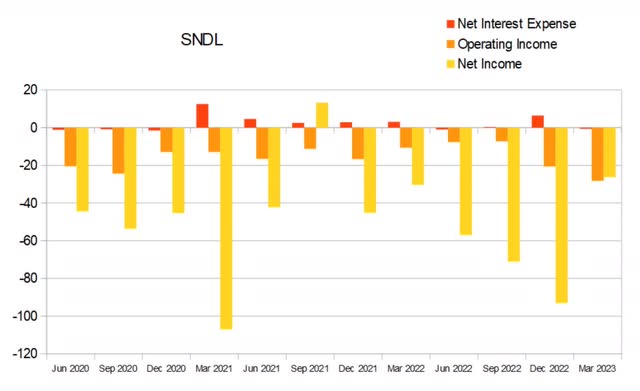

Margins are consistently horrible, but have been improving. Specifically, the last three quarters experienced a significant margin improvement over their previous quarters. As of the most recent quarter: gross margins were at 21.49%, operating margins were at -4.81%, and net margins were at -17.56%.

SNDL Quarterly Margins (By Author)

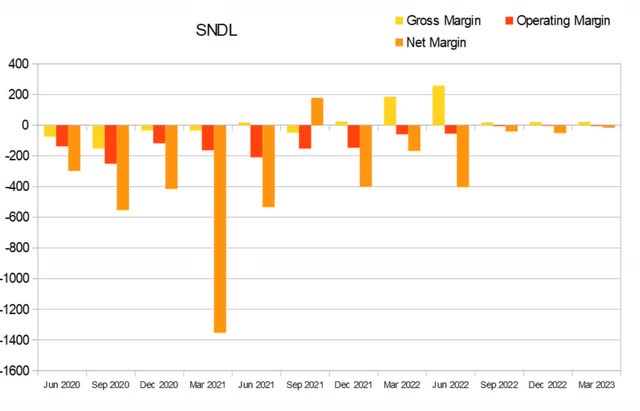

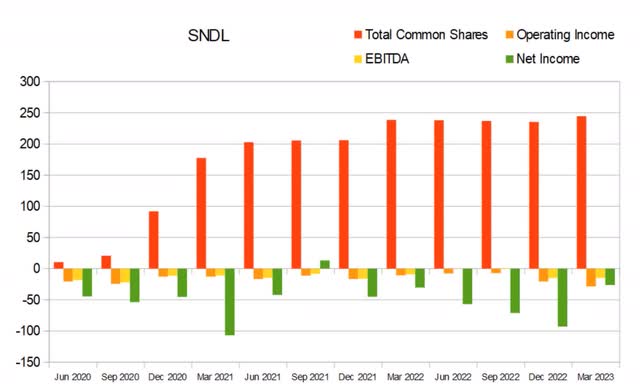

SNDL managed to raise a huge pile of cash in 2021, but has been unable to translate that into operating income. Instead, operating losses have increased by 119.38% from -$12.9M in Q1 2021 to -$28.3M in Q1 2023.

SNDL Quarterly Share Count vs. Cash vs. Operating Income (By Author)

Investors experienced additional dilution this most recent quarter. Total common shares outstanding rose an additional 9.1M shares from 235.2M to 244.3M. A portion of this 3.87% increase can be attributed to the $2.209M in share-based compensation. The company did buy back shares in 2022, but relative to both the total share count and the pace of dilution, it was insignificant.

SNDL Quarterly Share Count vs. Incomes (By Author)

The most attractive part of their financials is their debt situation. SNDL has very low debt; when paired against their long-term investments, the company often collects more interest from their investments than they pay to cover their debt.

SNDL Quarterly Net Interest Expense (By Author)

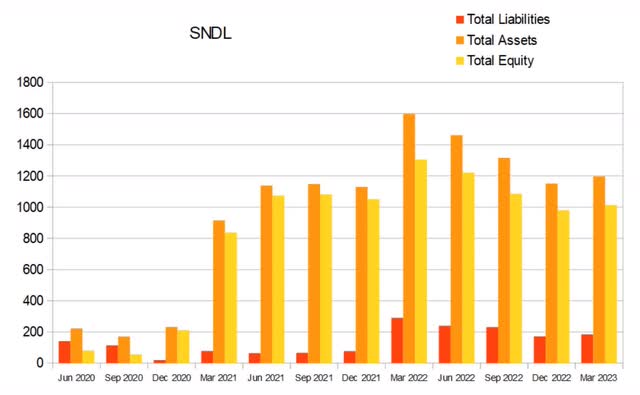

After spending the previous four quarters dropping, total equity rose this most recent quarter.

SNDL Quarterly Total Equity (By Author)

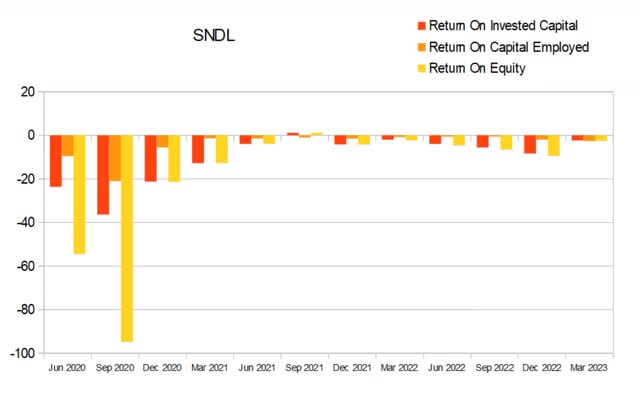

The company has never posted a positive ROCE. They briefly managed to achieve positive ROIC and ROE in Q3 2021. Typically, before I buy a company, I want to see all three of these values consistently above 10% annually or above 2.4% on a quarterly basis. This most recent quarter ROIC was at -2.3%, ROCE was at -2.65%, and ROE was at -2.59%. If these values were positive, they would be impressive enough to make me consider buying.

SNDL Quarterly Returns (By Author)

Valuation

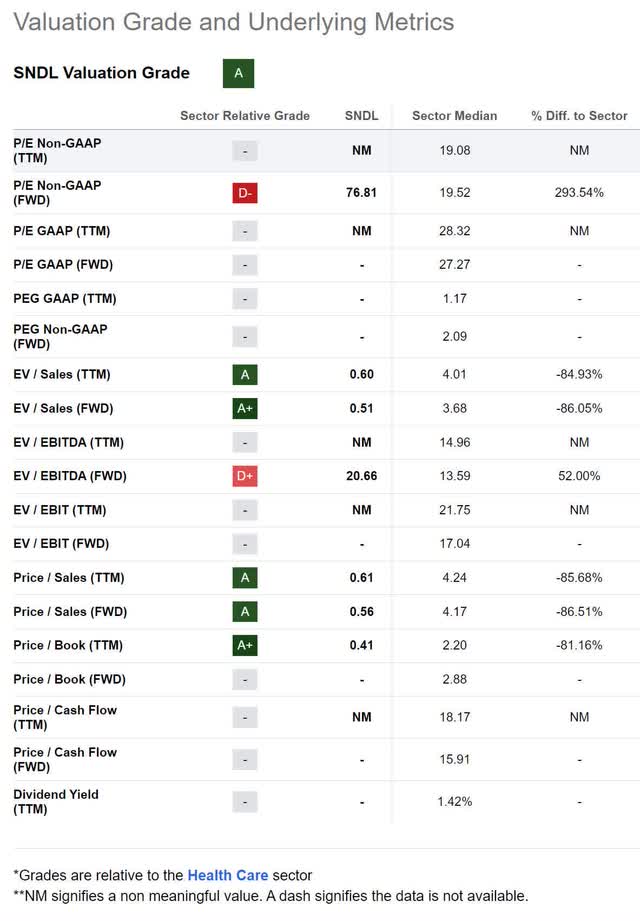

As of May 16th, 2023, SNDL had a market capitalization of $439.57M and was trading for $1.63 per share. With a forward Price/Sales of 0.56x, forward P/E of 76.81x, and a forward EV/EBITDA of 20.66x, I view the company as overvalued from an earnings and cash flow perspective. The company also has a Price/Book of 0.41x, so if earnings stay diminished for long enough, it may eventually attract a corporate raider or become a buyout target.

SNDL Valuation (By Author)

Catalysts

The company faces continued pressure from competitors. Predictions from a couple of years ago that most of the sector would be out of business already have proven to be overly optimistic. The price of wholesale cannabis continues to stay depressed, and is likely to stay low until most of the producers are driven out of operations. The longer this situation continues, the more Canada’s producers will suffer.

The company has improved its ROIC and ROE this most recent quarter, but this may be an outlier. The trend of steadily increasing losses may still be in progress.

Cannabis prices may fall even further. If this happens, SNDL’s margins will deteriorate. The pace of failure across the entire sector will increase. SNDL has a larger pool of cash reserves than most of its competition, but even that will not last indefinitely.

Risks

On October 6th, 2022, Biden set in motion a process, which is expected to result in rescheduling. When the news of rescheduling arrives, the entire sector will experience inflows. Along with all of its competition, SNDL should rally.

As the sector is currently consolidating, and their competitors are dropping out of the race one by one, an increase in the pace of bankruptcies may alleviate financial woes earlier than expected. Most of the sector expects that prices will begin rising once the oversupply is mitigated.

Red Flags

When I first began studying the cannabis sector two years ago, I considered buying into SNDL because they initially seemed like they were going to end up as one of the dominant players. Unfortunately, once I began reading their earnings call transcripts, multiple red flags presented themselves. Most companies will highlight their best numbers, while still mentioning their less attractive numbers. SNDL seems to present investor information that risks investors coming away with an incomplete view, in my opinion.

Every quarter, their gross, operating, and net margins are expressed in dollar values instead of percentages. Revenue growth is always compared to the correlating quarter in the previous year instead of the previous quarter. The fact that they keep diluting shareholders with stock-based compensation is never mentioned in the earnings calls; instead, buybacks are mentioned regularly.

The company regularly touts its portfolio of cannabis-related investments as being worth several hundred million dollars, while also conveniently not mentioning that most of the money was loaned out to financially distressed competitors. With most of the sector facing bankruptcy, it is possible SNDL is going to be forced to absorb the assets of these borrowers after they fail.

Whenever revenue drops are mentioned, they are almost always blamed on seasonality. This wouldn’t normally be a red flag, except that the company seems to be affected by ‘seasonality’ every single quarter.

Conclusions

SNDL is currently trying to build an empire out of everyone else’s broken toys. Although the tone of this article is extremely bearish, and I believe the company has chosen a sub-optimal strategy, it is possible they eventually manage to build a sports car out of a jalopy. By patiently waiting for others to fail around them, they have been collecting low quality revenue for pennies on the dollar. These assets already drove their original owners into bankruptcy, so after acquiring them, profitability improvement measures are always required. The specific measures will be unique to each asset, but if they manage to improve overall gross margins to the point that it carries operating margins up into positive territory, I would consider it a sign that the company had shifted to a more positive path.

After looking over their financials, I believe SNDL is still in an unsustainable situation. However, the company has been on a cost-cutting campaign which is showing up in the trend changes of their ROIC, ROCE, and ROE values. This alone was enough for me to change my rating from a Strong Sell to a Sell. If they manage to improve their margins enough, I will again change my rating.

Read the full article here