Thesis

Given the rise in the yield curve and expectations for a Fed cut later in 2023 or in early 2024, we are going to explore further the fixed income universe, especially the one tilted towards investment grade bonds. Why? Because highly rated bonds are driven by rates primarily, and with rates at decades high it is a good time to consider buying IG fixed income:

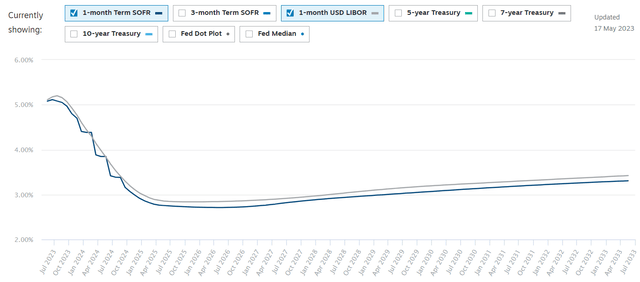

Forward Curve (Chatham)

The forward SOFR and Libor curves are telling us market participants expect much lower rates starting with 2024. We have not witnessed risk free rates this high in over a decade, which will make 2023 the year of bonds in our opinion.

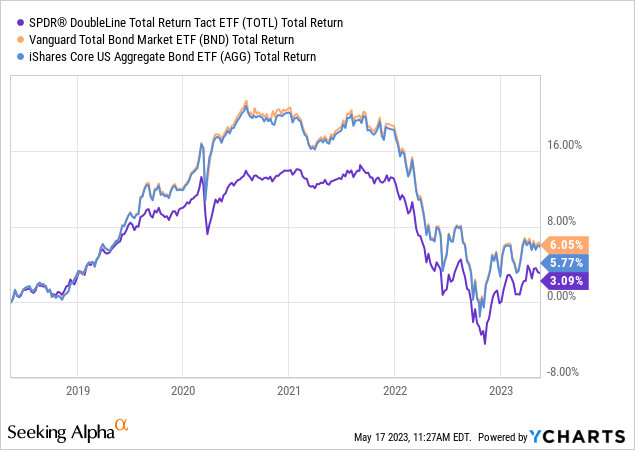

The SPDR DoubleLine Total Return Tactical ETF (NYSEARCA:TOTL) is an exchange traded fund that tries to replicate or outperform the Bloomberg US Aggregate Bond Index. Unfortunately for TOTL, it fails to do both. On a long term basis the ETF underperforms both the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG):

This underperformance is also done with a much higher management fee (0.55% for TOTL versus only 0.04% for AGG).

A retail investor needs to understand that funds outside the generic ones need to prove themselves in order to be bought. Simple portfolios often prove to be the best choice. Some investors that layer in complexity via funds that fail to produce historically better risk adjusted returns when compared to simple indices end up shooting themselves in the foot.

Another trend we are witnessing in the ETF world is the significant contraction of charged fees. Most generic funds these days charge less than 10 bps in fees, which is a substantial change from a number of years ago. TOTL charges 5x in fees, yet it fails to produce better risk adjusted returns. In the investment grade / treasuries world 40 bps in added returns matter. An investor should not forget that only a year ago this very same fund was yielding around 2%.

In our mind TOTL does not bring anything new to the market, and furthermore it charges much more than its generic peers. While we expect the fund to have a positive performance on the 12 and 18 months timeframe, there is no reason to sit in TOTL because it is neither here, nor there in terms of returns or fees. A retail investor would do well to Sell here and swap into AGG.

Analytics

- AUM: $2.9 billion

- Sharpe Ratio: -0.61 (3Y)

- Std. Deviation: 5.4 (3Y)

- Yield: 5.16%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income – US Agg

- Duration: 6.4 yrs

- Expense Ratio: 0.55%

Holdings

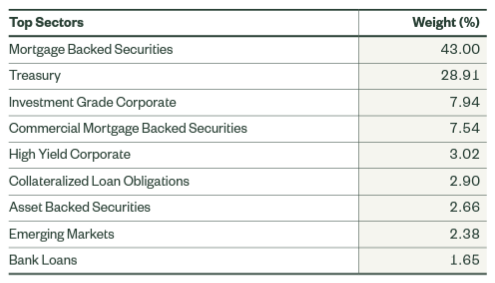

The fund holds an array of mostly investment grade bonds:

Composition (Fund Fact Sheet)

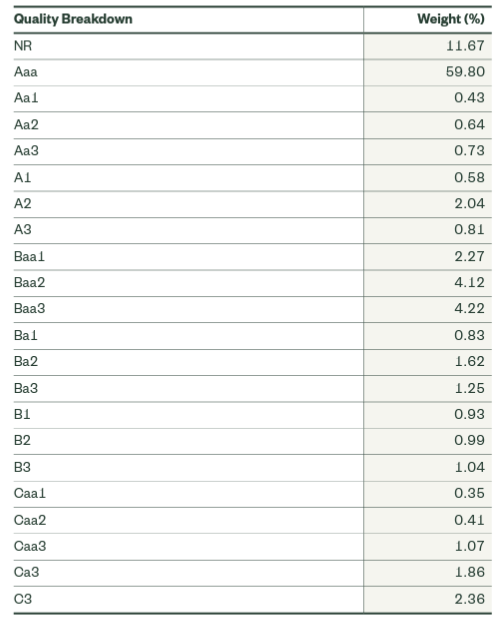

Treasuries and Mortgage Backed Securities are AAA assets, while the rest are bucketed as follows:

Ratings (Fund Website)

We can observe from the above table that below investment grade bonds are very limited in this fund (ratings of Ba1 and below). This translates into a collateral pool that is driven mostly by rates.

The fund is extremely granular and has an intermediate duration:

Holdings (Fund Fact Sheet)

We can observe the collateral pool contains more than 1,000 names, and the duration bucket is an intermediate one, with a 6.46 years adjusted duration figure.

Conclusion

TOTL is a fixed income exchange traded fund. The vehicle does not have any leverage, and tries to replicate and outperform the Bloomberg US Aggregate Bond Index. The fund has a predominantly investment grade build, with large Treasury and Agency MBS buckets. TOTL’s build is very similar to the ones exhibited by much better known funds such as AGG and BND. Despite its active management and mandate to outperform, TOTL lags both its peers on longer time frames. Furthermore TOTL charges 55 bps in management fees versus just 4 bps for AGG. We believe we are witnessing peak rates as we speak in 2023, and next year will bring lower treasury yields. In this environment buying fixed income is a good idea if held long term, however TOTL is neither here nor there in term of returns or fees. A retail investor would do well to Sell TOTL and swap into AGG.

Read the full article here