According to a new study, cryptocurrency adoption grows in Latin America as users leverage digital assets to offset currency devaluations and inflation.

A new Chainalysis report shows a growing adoption rate in Latin America following a surge of new use cases on a country-country basis and an increased demand for centralized exchanges.

The region has become the seventh largest in terms of its crypto economy accounting for 7.3% of crypto values received between July 2022 and June 2023 behind Sub-Saharan Africa but statistics show it does not trail Eastern Europe, Asia, and the Middle East by a wide margin.

Although institutional investment remains low compared to Asia, the United States, and Europe, Latin America gets its numbers from individual uses showing high rates of grassroots acceptance with Argentina, Mexico, and Brazil in the top 20 globally.

Economies in the region leverage cryptocurrencies for remittances, and global payments with many using Bitcoin and stablecoins as a hedge against inflation.

“Industry participants will likely be interested to see if that share rises in the coming years, both for Mexico and other Latin American countries with large remittance markets.”

In Brazil, while general institutional investment declined last year, there has been a growing rate in the last six months with March and June being the highest.

Centralized exchange services attract users

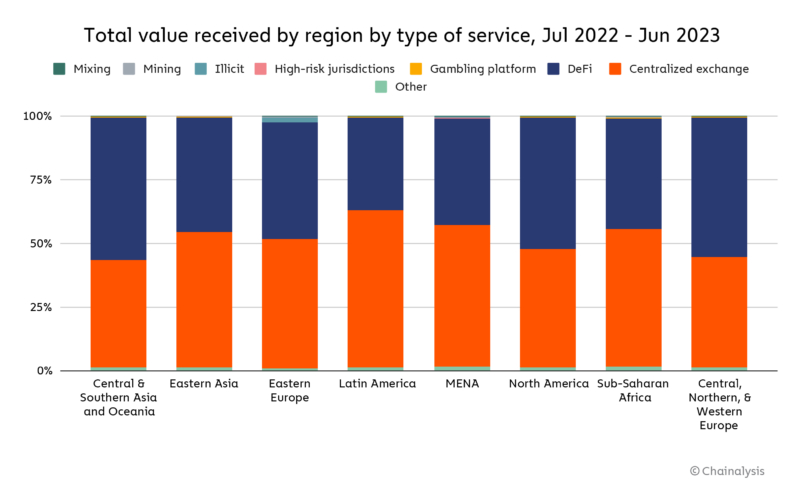

Aside from increasing use, another peculiar characteristic is the growing rate of centralized exchange (CEX) numbers compared to other jurisdictions.

“Latin America shows the highest preference for centralized exchanges of any region we study, and tilts slightly away from institutional activity compared to other regions,” the report reads.

In Venezuela, CEXs make up 92.5% of trades while decentralized exchanges (DEX) show a mere 5.6% placing it far below the global DEX usage of 44%.

In Venezuela, CEXs make up 92.5% of trades while decentralized exchanges (DEX) show a mere 5.6% placing it far below the global DEX usage of 44%.

Columbia’s figures are also above the global CEX figures of 48.1% as its citizens carry out 74% of transactions through centralized exchanges while performing 21% through DEXs.

Argentina and Venezuela’s growing numbers

This year, Argentina has recorded high crypto numbers following its economic woes in recent times making the industry an issue in the forthcoming elections.

As the country posts triple-digit inflation, Presidential candidates have revealed plans to use digital assets to revive its economy.

Pro-Bitcoin Javier Milei calls for radical measures like the abolition of the central bank and fiat while Economic Minister, Sergio Massa pushes for a CBDC hammering against the dollarization of the economy.

Argentina received the highest number of crypto worth $85 billion over the last year compared to any other country in the region. However, as expected, institutional investment and DeFi projects remain low.

Venezuelan digital asset adoption surged after the Covid 19 pandemic with the government’s refusal to accept foreign aid spurring donors and medical services turning to virtual assets.

This month, The Inter-American Development Bank (IDB) and the Cambridge Centre for Alternative Finance (CCAF) released a report signaling significant growth in the crypto sectors around Latin American countries since 2016.

Read the full article here