Investment Summary

Centrus Energy Corp (NYSE:LEU) supplies nuclear fuel and services to both commercial and government clients worldwide. The company is divided into two segments: the Low-Enriched Uranium [LEU] segment, which provides LEU to government and commercial clients, and the Contract Services segment, which delivers engineering, technical, and other services to support the national security objectives of the United States government.

Emission Goals (Investor Presentation)

The company had a very good start to the year with net income reaching $7.2 million representing a net margin of around 10%. A solid move upward compared to the year prior when the company had a net loss instead of $0.4 million. Overall the margins took a big step upwards with the gross profits almost increasing by 4x to $23 million. The trend of going for more clean energy will be a major tailwind for LEU as the demand for their nuclear fuel will be in high demand. Nuclear power plants are a long-term investment for governments and they need to be able to secure solid contracts with companies to keep them running. A market I have faith LEU will be able to make an impact in. The future seems certain, clean energy solutions are needed and with LEU trading at quite a low valuation, I think they deserve a hold rating for now until there is a bit more clarity with the business model and margins.

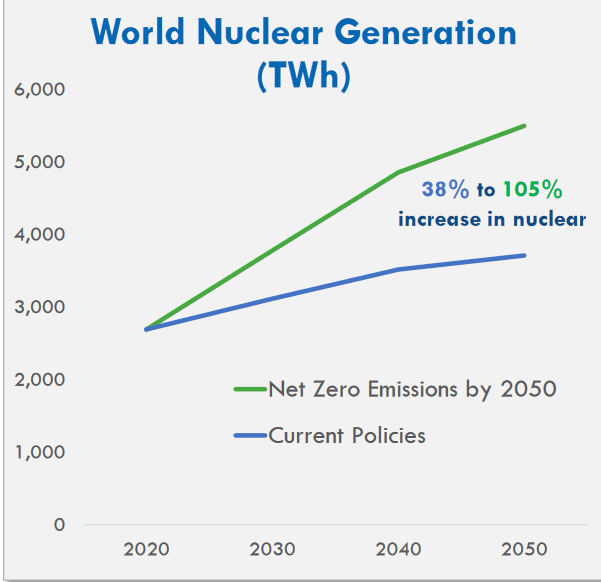

Nuclear Market Outlook

Experts have varying views on the future of nuclear power. While some argue that nuclear power is a dependable and eco-friendly energy source that can assist in mitigating climate change, others express apprehension regarding nuclear accidents, the disposal of radioactive waste, and the potential for nuclear weapons proliferation. This divide has led to opposition to nuclear power in some countries, despite its potential benefits. Where I see this going is that nuclear power proves that there is a possibility of going completely emission-free for generating energy. But it comes with the cost of having to make solid long-term investments and dedicate a lot of resources to it.

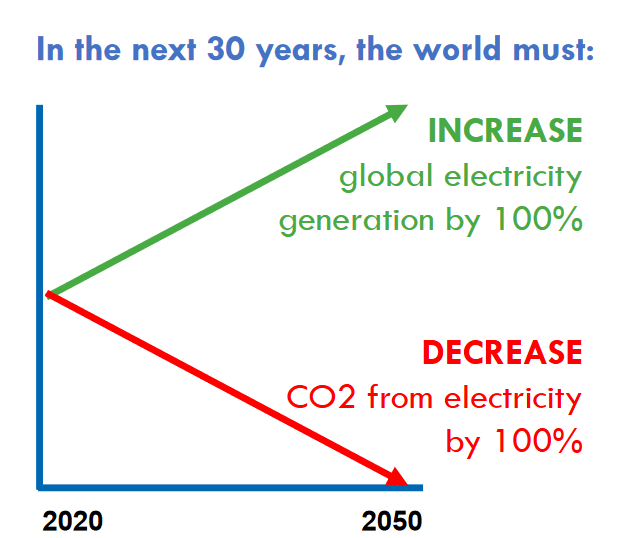

Market Outlook (Investor Presentation)

Going on what LEU themselves say the need for nuclear solutions is immediate if we want to achieve our climate goals. Some countries are phasing out nuclear power, others are investing in new nuclear technologies and exploring the potential for nuclear fusion as a source of energy.

Company Goals (Investor Presentation)

Where LEU presents a strong opportunity to investors seeking exposure to the trends of nuclear power, they have already established an order book worth $1 billion all the way until 2030. That is 3x as much as they generated in 2022, so over the coming years it would on average be less than the generated in 2022, but on the other hand, they still have the possibility of taking on more orders to drive higher top-line growth. With that said there are also projections of a shortage in nuclear fuels in the coming decades, which should have a positive impact on the price, driving higher revenues for a company like LEU.

Risks

Perhaps the most prominent risk with investing in LEU right now is the inconsistencies in margins over the last few years, it’s not long ago they had negative net margins, and it was just in 2021 they reached -10% in one quarter. They had negative net income just 12 months ago but have made big steps upwards. Despite that, though I still see the possibility of more pain ahead as volatile prices most likely will affect the revenue of the company. But the long-term picture remains solid and as mentioned, LEU has secured an order book valued at $1 billion already, running up to 2030.

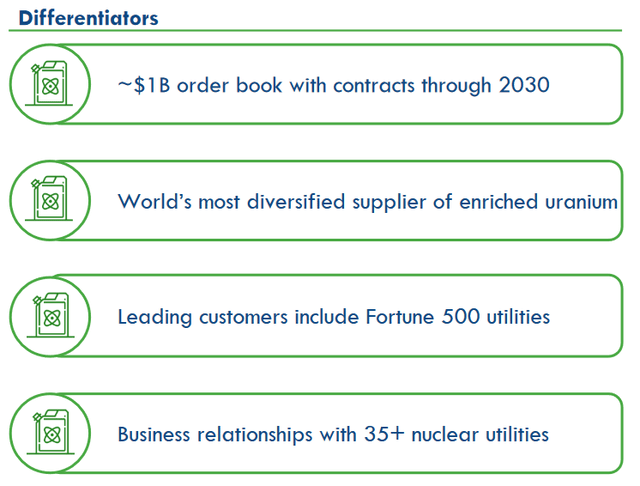

Shares Outstanding (Macrotrends)

Seeing as the company is still growing and hasn’t been profitable for that long, share dilution is quite common. This does hurt a long-term position in the company, and as long as this is prevalent I don’t think there is a strong argument to invest in the company right now. Instead, waiting for margins to settle and dilution to stop or at least heavily slow down might present a much safer investment scenario in my opinion. Seeing as levered FCF was negative in 2022 as well I think the company will continue to dilute to help drive further investments and gain valuable contracts too.

Financials

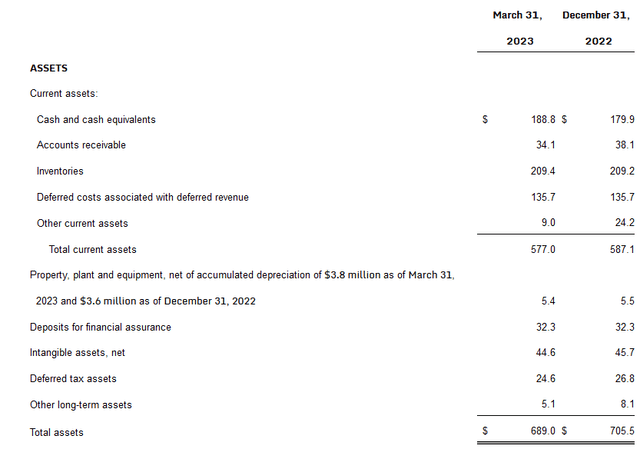

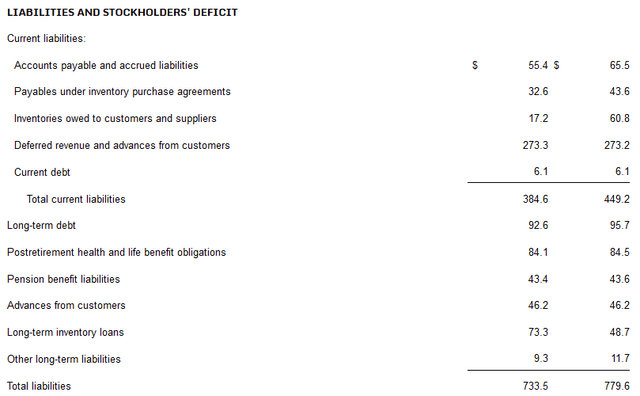

Looking at the balance sheet of the company I think there are some healthy improvements happening. The cash position seeing a slight increase is at least a move in the right direction. It is still sufficient enough to cover all the long-term debts just about 2 times over. A very strong position to be in and this makes me a little more optimistic about the dilution potentially stopping as mentioned before. The necessity to dilute to pay liabilities isn’t really there. Instead, it was a necessary move to have capital freed up as the levered FCF margin is negative 13.7% right now.

Company Assets (Earnings Report) Company Liabilities (Earnings Report)

Comparing the assets to liabilities it is worrisome that the liabilities outweigh the assets, with a ratio of 0.93. This is primarily due to a $273 million note of “deferred revenue” which otherwise would make the balance sheet look a lot better in my opinion. To get rid of any uncertainty though, the net debts are even negative right now at $-16.8 million, which does mean the company is in a fantastic position to cover its liabilities efficiently. All in all, I think LEU is set up great to help further investments and continue to hopefully drive growth. The margins trending upward is a great sign and I hope this will mean LEU is eventually able to start having positive cash flows gain.

Valuation & Wrap Up

As mentioned before, the valuation is quite low for LEU, with the forward p/e just around the 14x multiple for earnings. Looking ahead, the estimates suggest around a 10% EPS growth annually, which I think is plausible as the net margins as mentioned previously are moving upwards too and should help with this growth.

Where there is a lot of uncertainty and probably the reason for the lower multiple given to the company is the free cash flows. These will be vital to increase to reduce the dependence on diluting shares to raise capital. It should mean the company introduces a repurchase program in the future. The share price for the company is quite volatile and I wouldn’t be surprised if there is a move downward if the coming earnings reports don’t show an improvement in the cash flows.

Stock Chart (Seeking Alpha)

Where LEU does provide some certainty though is the contacts it has within the US government. The company came out of the Manhattan Project and has maintained strong ties with officials. This gives them a much easier time to secure contracts like they have done in the past, which has helped them build up their order book to $1 billion. The company for me now though is a hold. I want better cash flows and a stop or at least a large decrease in the dilution before I dip my toes in the company.

Read the full article here