Stocks were mixed Tuesday and bond yields rose after a report on U.S. retail sales in September was stronger than expected. Meanwhile, President Joe Biden is scheduled to visit Israel Wednesday, and third-quarter earnings season picked up momentum.

These stocks made moves Tuesday:

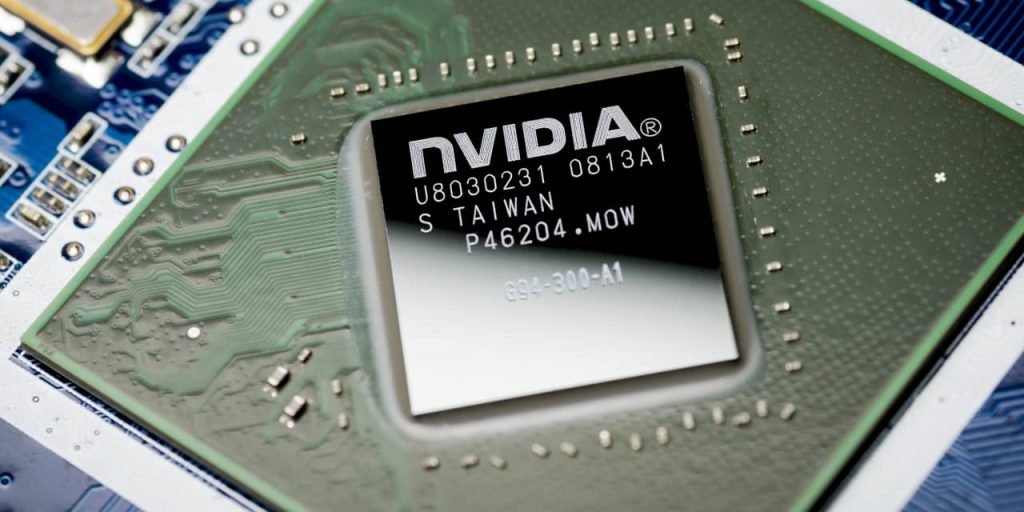

Nvidia

(NVDA) fell 4.7% after the Biden administration said it would be tightening its restrictions on exports of artificial intelligence chips to China. A spokesperson at the chip maker told Barron’s that given the worldwide demand for its products, the company doesn’t expect a meaningful impact on its near-term financial results.

VMware

(VMW) declined 7.7% on concerns that intensifying trade tensions between the U.S. and China could spur regulators in Beijing to block

Broadcom

‘s (AVGO) pending acquisition of the infrastructure software company.

VF Corp.

(VFC) rose 14% following a report from The Wall Street Journal that said investment firm Engaged Capital has “built a big stake” in the parent company of The North Face and Vans and has cost-cutting plans in mind.

Bank of America

(BAC) reported third-quarter earnings of 90 cents a share, topping Wall Street forecasts of 83 cents. Net interest income rose 4% to $14.4 billion because of higher interest rates and loan growth. The stock closed up 2.3%.

Lockheed Martin

(LMT), the defense contractor, reported third-quarter earnings of $6.73 a share on sales of $16.9 billion. Wall Street was looking for profit of $6.67 a share on sales of $16.7 billion. Lockheed closed up 0.2%.

Johnson & Johnson

(JNJ) reported third-quarter adjusted earnings of $2.66 a share, beating analysts’ estimates of $2.52. Sales of $21.4 billion also topped estimates of $21 billion and the healthcare giant lifted full-year guidance. The report marked the company’s first that doesn’t include the results of its consumer health division that separated from J&J over the summer. The stock was down 0.9%.

Third-quarter profit of $5.47 a share at investment bank

Goldman Sachs

(GS) beat expectations of $5.42. Third-quarter revenue of $11.82 billion declined from almost $12 billion a year earlier. The stock fell 1.6%.

Lucid

(LCID) was down 5.3% after the electric-vehicle maker produced 1,550 vehicles in the third quarter, down 32.1% from a year earlier.

U.S.-listed shares of

Ericsson

(ERIC) fell 2.9% after the Sweden-based maker of telecommunications equipment withdrew margin guidance for 2024, saying it expects current macroeconomic uncertainty to prevail into next year.

Choice Hotels International

(CHH) launched a hostile bid for

Wyndham Hotels & Resorts

(WH) of $90 a share in cash and stock. Wyndham’s board rejected the unsolicited proposal. Wyndham shares jumped 9% to $75.29. Choice shares fell 6.8%.

NetScout Systems

(NTCT) fell 17% after the cybersecurity company said it was reducing guidance for fiscal 2024 “to reflect a recent slowing in order conversion.”

Dollar Tree

(DLTR) was upgraded to Buy from Neutral at

Goldman Sachs

and the stock rose 4.8%.

Write to Joe Woelfel at [email protected]

Read the full article here