Investment Thesis

Farfetch’s (NYSE:FTCH) Q1 2023 results positively surprised investors with its improving EBITDA profile.

Q1 2023 marked the first quarter in 5 quarters where Farfetch’s EBITDA profile improved. For a stock that was pricing in so much negativity as it headed into this earnings result, investors positively welcomed some positive news.

Farfetch makes the case that 2023 will end with positive free cash flow, as Q4 2023 is expected to be highly free cash flow positive.

And while I’m able to highlight some positive considerations, I also note some pesky negative considerations. Overall I’m neutral on this name.

Why Farfetch? Why Now?

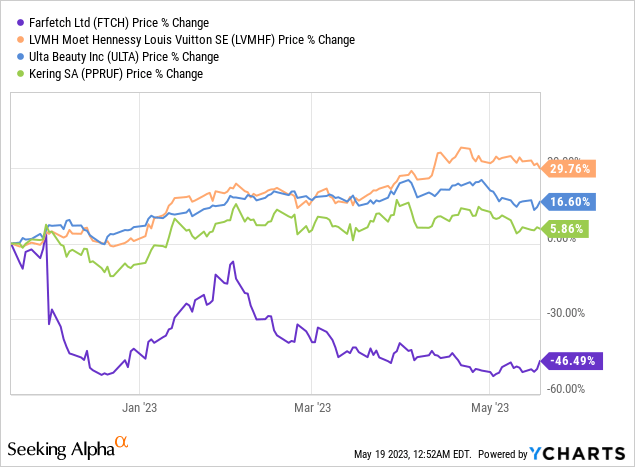

Farfetch is an online luxury fashion retail platform. As a digital marketplace for luxury merchandise, given the overall strength in the luxury market, one would have assumed the stock would be performing better.

And yet, Farfetch’s stock headed into this earnings report down more than 90% from its all-time highs.

For investors, this was always going to be a charged earnings result. On the one hand, the momentum headed into this earnings report was exceeding negative, as Farfetch was down more than 40% in the past 6 months alone.

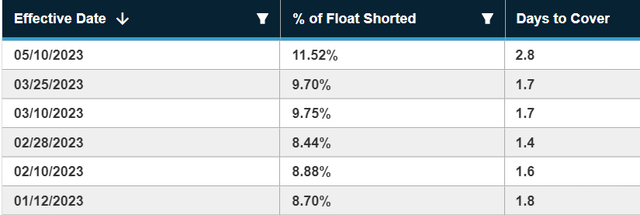

But on the other hand, Farfetch became too crowded a short.

Benzinga

As you can see above, Farfetch’s days to cover were up substantially relative to any point in 2023. When everyone moved to the same side of the boat, the boat tipped over.

Revenue Growth Rates Impress

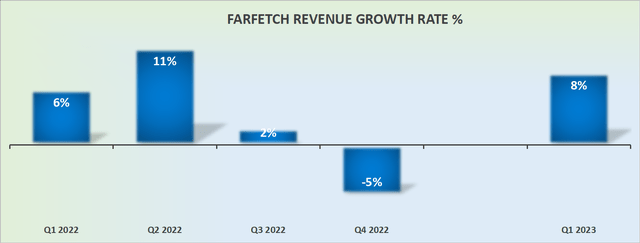

FTCH revenue growth rates

As we headed into this earnings report analysts had expected no y/y revenue growth. So, when Farfetch reported 8% GAAP revenue growth rates y/y, the market was taken by surprise. In fact, in constant currency Farfetch was up 12% y/y.

Suddenly this means two things. First, Farfetch is back in growth mode. Secondly, if Farfetch is able to keep this momentum into Q2 2023, the rest of the year Farfetch will have much easier comparables.

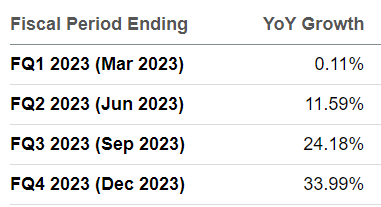

SA Premium

But can Farfetch truly exit 2023 growing at more than 30% y/y? Even if we allow for the easier comparable with Q4 2023, see above, I remain unsure.

That being said, for now, I suspect that investors are more than willing to ignore all future considerations and simply cheer for this very positive quarterly performance.

Profitability Profile Could Improve Further

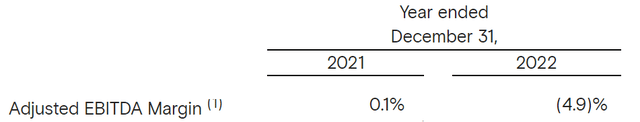

Before we go further, let’s get some context. What you see below is Farfetch’s EBITDA margin progress from 2021 into 2022.

FTCH Q4 2022

You can see that Farfetch’s EBITDA turned meaningfully negative in 2022, which truly disappointed investors. However, now, Farfetch’s EBITDA margins started to move in a more positive direction, see below.

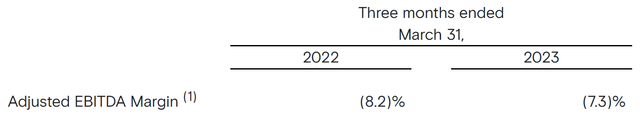

FTCH Q1 2023

As you can see above Farfetch’s EBITDA margins improved by 900 basis points y/y.

Also, Farfetch now believes that it can reach 1% to 3% of EBITDA this year.

And while this EBITDA margin is unchanged from what Farfetch had previously guided for back in February, when Farfetch reported its Q4 2022 results, given the progress in its EBITDA margin, investors are willing to give more credibility to Farfetch’s full-year guidance.

FTCH Stock Valuation — Difficult to Value

Personally, I continue to struggle in my attempts to value Farfetch.

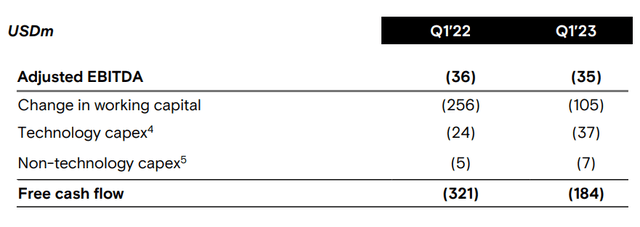

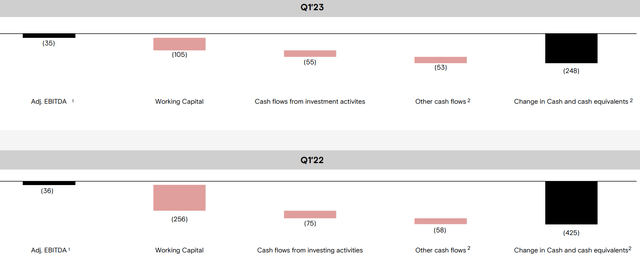

FTCH Q1 2023

We can see above that Farfetch has meaningfully improved its usage of free cash flow. In last year’s Q1 Farfetch used $321 million of free cash flow, while in Q1 of this year, its usage of free cash flow improved to $184 million.

But when we consider that the bulk of cash flow improvement came from a reduction in capex and unlocking of working capital, I’m not fully sure that’s really so impressive.

FTCH Q1 2023

After all, if Farfetch is using less cash to invest in its business, surely in the medium term this will impact its growth prospects, won’t it?

On the other hand, Farfetch can’t really afford to burn through more than $200 million of free cash flow each quarter. After all, Farfetch’s balance sheet holds less than $500 million in cash. And Farfetch’s borrowings are already more than $900 million, plus there are plenty of pesky liabilities such as convertibles notes, and other derivatives.

The Bottom Line

Farfetch has made one very large move in the right direction.

While I remain unsure of Farfetch’s long-term viability, the fact remains that this quarter was the first quarter in a long time where Farfetch’s profitability was able to report positive progress.

Read the full article here