TotalEnergies (NYSE:TTE), like other majors, benefited from the exceptional price environment in 2022. In spite of oil and gas prices softening the company will return substantial cash to its shareholders in FY23 and will be able to continue growing the dividend in FY2024. This holds for a dividend which is already rather high at 5.3%.

Priorities continued

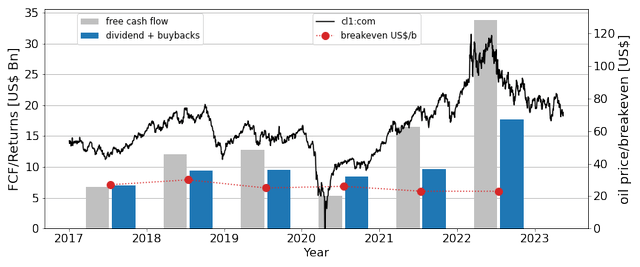

In 2022 TotalEnergies posted record earnings on the back of elevated energy prices, this is clearly shown in figure 1.

Figure 1 – Cash flow, shareholder returns and oil price (totalenergies.com, seekingalpha.com; chart by author)

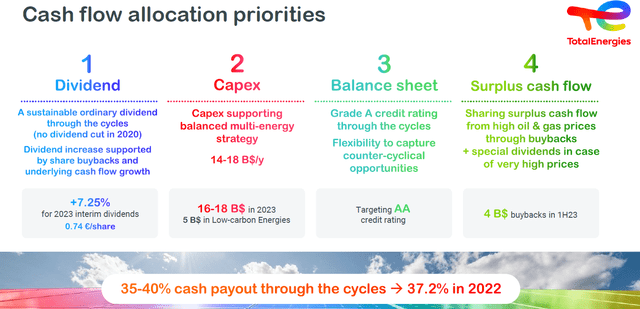

Even as income was exceptional, management continued the focus ‘through the cycle’. This means the company continued to follow its cash allocation framework, see figure 2, and did not substantially increase ‘fixed costs’ such as dividend. Instead, share buybacks were boosted and net debt was reduced by US$12.2Bn, significantly lowering the gearing.

Figure 2 – Cash flow allocation priorities; Strategy, Sustainability and Climate presentation, March 2023 (totalenergies.com)

As the oil and gas price environment is softening, returns will likely reduce, but the company remains a solid investment. This will be explained based on the expected dividend growth, potential buybacks and the perceived undervaluation.

Dividends

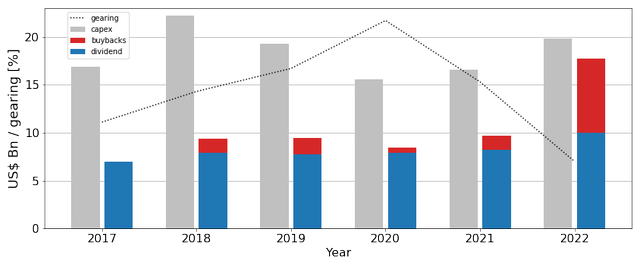

2022 has seen exceptional shareholder returns on the back of elevated energy prices. The dividend per share was increased by 7.25% and on top of that a special dividend of €1 per share was distributed. The deal was further sweetened by a US$7.8Bn buyback, meaning shareholder returns totaled US$17.8Bn, see figure 3.

Figure 3 – Six year history of cash allocation priorities (totalenergies.com; chart by author)

As noted during my previous coverage of TTE, the dividend growth is “fixed” but the level of buybacks is not, as it actually depends on cash flow. Apart from 2020, the company appears to stay true to its long term commitment as laid out in the 2019 Annual Report:

… in view to accelerate the dividend growth for the years to come with the orientation a dividend increase of 5 to 6% per year so as to reflect the anticipated growth of cash flows in an environment at 60$/b.

Even in a softening oil and gas price environment, my base case is the company will maintain the forecasted dividend growth. With inflation coming down, an annual 5% increase in dividend means the dividend growth will outpace inflation. Even if a recession materializes, the question is how far the oil price will fall and if dividend growth needs to be reduced. Then again, the company is looking ‘through the cycles’ and the current low gearing and amount of buybacks done mean there is ample room to grow the dividend in the future.

The current quarterly dividend of €0.74/share (US$3.21) results in a dividend yield of 5.3%. This is a decent dividend, especially considering the expected dividend growth and potential for buybacks.

Buybacks

The dividend growth is further supported by the fact management is still executing substantial share buybacks. Only in 1H23 it already committed to US$4Bn in buybacks, but likely this number will increase.

In March news hit the wire TotalEnergies would sell part of its European gas stations to Alimentation Couche-Tard in a US$3.3Bn deal. Tellingly, the company would remain in control of electric vehicle charging and hydrogen retail.

Late April, the divestment of oil sands assets to Suncor was announced for a price of US$4.1Bn. The most notable merits of this divestment are that it will help the company to reduce its emissions and simultaneously return value to shareholders. On the latter, analysts probed the CEO during the 1Q23 conference call. More specifically, concerning the oil sands divestment, it was explained the Board of Directors felt a commitment towards shareholders to return part of the proceeds. Regarding the returns CEO Pouyanne noted the following:

“It will be then discussed either buyback or dividends. You have noticed but for the time being, we have maintained the buybacks at $2 billion per quarter for the first 2 quarters, despite the fact that the environment has softened, we did not decrease it. There might be a chance that we could maintain the $2 billion along the year.”

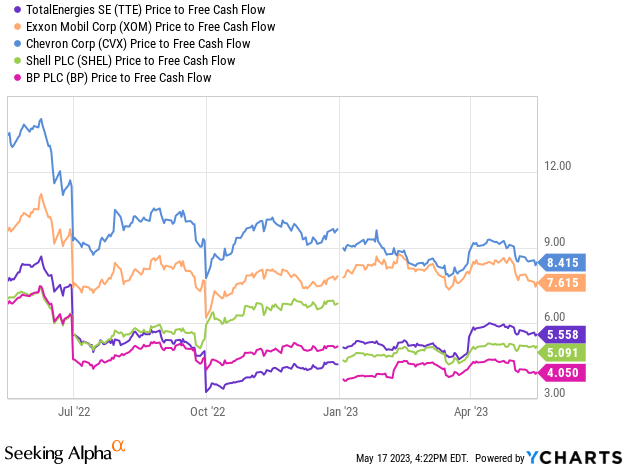

Essentially, the company is divesting US$7.4Bn and subsequently the CEO hints at potential FY23 buybacks in the order of US$8Bn. This remark is important as the CEO has complained TotalEnergies trades at a discount compared to its US peers. Considering the price-to-cashflow metrics, the man does have a point, see figure 4.

Figure 4 – Price-to-cashflow of the five oil majors (seekingalpha.com, Ycharts)

Undervaluation

Essentially, the perceived undervaluation is simply risk being discounted into the share price. In this section three reasons, or risks, leading to this undervaluation will be highlighted.

Rhineland model

At least in Europe, the relation between society and corporations is changing, or evolving if you will. Nowadays, virtually every major corporation has attention for Corporate Social Responsibility [CSR] and Environmental, Social and Governance [ESG] aspects. I’ve touched on this subject before, and will continue to do so as the implication for investors is paramount. It will shape the strategy of multinationals for years to come.

The risk being discounted into the share price is essentially driven by cultural differences. From a corporate perspective this difference translates itself into the business model. European companies typically operate according to the Rhineland business model as opposed to the better known Anglo-Saxon model. For those unaware of the former model, the following quote summarizes it best:

A Rhineland firm views itself as an interdependent part of a wider community that offers a lasting place for each of its members rather than simply as a moneymaking machine for investors

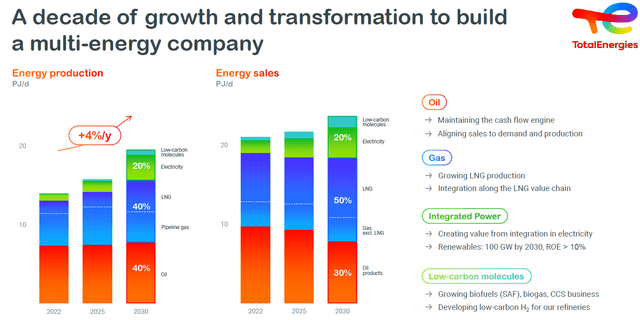

Clearly, the attention for climate change, whether or not driven by court rulings or shareholders, is exemplary of the Rhineland model. In the case of TotalEnergies this translates into attention for scope 1,2 and 3 emissions, resulting in aforementioned divestment of the carbon intensive oil sands operations amongst others. This is just one reason why the company is changing into a ‘multi-energy company’, see figure 5.

Figure 5 – Transformation from oil major to multi-energy company, from Strategy, Sustainability and Climate presentation, March 2023 (totalenergies.com)

Carbon pricing

Another reason the company has to work on its carbon intensity is the carbon pricing mechanism being enacted by the European Union. The European Commission has set clear directives, to wit:

To achieve the EU’s overall greenhouse gas emissions reduction target for 2030, the sectors covered by the EU Emissions Trading System (EU ETS) must reduce their emissions by 43% compared to 2005 levels.

As argued before, this legislation, aimed at reducing carbon emissions, could be considered protectionism disguised under the banner of climate change. Yet, whatever way the mechanism is being framed, at the end of the day a price will be put on carbon and this will affect TotalEnergies. As refineries for example fall within the framework of the emission trading system, TTE already shared the intend to convert its European refineries into biorefineries. Of course, the European carbon pricing mechanism and the consequential investments weigh on the valuation.

Windfall tax

Similar to Europe, the levy of windfall taxes was discussed in the United States. The big difference however is that this tax has not materialized in the U.S. so far. Or as Bloomberg aptly noted; the windfall tax on big oil is more politics than a real threat.

On the contrary, in Europe the tax has been levied already. In its FY22 annual report TotalEnergies recorded a US$1.7Bn outflow related to the European Solidarity Contribution and Energy Profits Levy in the UK. This number does not yet account for the ‘voluntary’ discount the company offered at its French fuel stations. This stands in stark contrast to Exxon (XOM) suing the EU over the windfall tax.

Conclusion

At the end of the day all this weighs on the valuation, and rightfully so. In other words, the undervaluation compared to U.S. peers is here to stay. But when push comes to shove, the French government will not allow TTE, considered to be its national oil company, to be pushed around too much. How this works was recently demonstrated by the Germans when the new emission reduction plans appeared to be affecting the German car industry too much. And, in my experience, the French tend to be more pig-headed than the Germans. Analogous to the Fed put, let’s call this the French put.

What remains is a management team ‘looking through the cycle’, growing the 5.3% dividend by an estimated 5% annually and return excess cash in the form of buybacks. To top it off, the balance sheet is pristine as the gearing has been brought down significantly meaning the company has the ability to successfully weather a potential recession.

As the overall market appears to be fully valued and has moved sideways for several weeks, this is not the time to back up the truck and load up on TTE stock. Yet, even at the current price of US$60 investors can gradually expand their long position with confidence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here