Overview

While MicroStrategy (NASDAQ:MSTR) often gets press for the $4.2 Billion (aggregate purchase price, worth $3.77B at current prices) in Bitcoin that it holds, it is ultimately a business intelligence software company. The firm has recently completed work on a new cloud-native BI software called MicroStrategy One:

Next, I would like you to introduce you to MicroStrategy One. Eight years and over 2.5 million hours of engineering have resulted in MicroStrategy One, a modern, open cloud-native BI platform that can serve all the analytics needs of large enterprises. MicroStrategy One is highlighted by a modern product suite, including dossier, library, workstation and Hyperintelligence. It is fully open, built on restful APIs and Python. And because we are an independent analytics company, work seamlessly with any data sources and clients.

Similarly, our cloud platform works on AWS, Microsoft Azure and soon the Google Cloud platform, supporting multi-cloud deployments through a container-based architecture. Finally, MicroStrategy One serves all major categories of analytics, self-service, business reporting, advanced applications and embedded analytics.

The product sounds modern in its architecture and also acts as the foundation for MicroStrategy’s further product development:

With the completion of the MicroStrategy One platform and the focus on rebuilding much of our platform in the last eight years, we’re now able to increasingly focus on MicroStrategy’s hallmark product innovation. Our innovation is focused on four areas: one, core analytics; two, augmented analytics; three, artificial intelligence; and four, Lightning network.

As a data company, I think MicroStrategy is well-positioned to potentially innovate across these areas, and it has certainly done so to date. While new product performance will play out over the course of this year and the next, I want to focus on MicroStrategy’s core fundamental metrics and its valuation to see if it’s a good investment in the here and now.

Financials

Since MicroStrategy has been in business for some time, and public since Q2 1998, we have a decade’s worth of financial statements to compare and review.

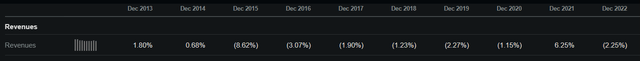

The revenue picture has unfortunately been one of decline; MicroStrategy’s revenue peaked in 2014 and has declined every year but one since.

Seeking Alpha

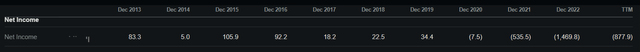

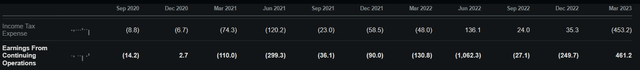

Along with this, the firm became unprofitable as of 2020 and increasingly less so for the two years after that.

Seeking Alpha

MicroStrategy did generate a profit in its most recent quarter, although this was driven by a tax benefit from Bitcoin value adjustments that amounted to 98.3% of the firm’s income for the quarter.

Seeking Alpha

Seeking Alpha

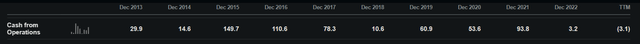

As to cash flow, MicroStrategy has had a generally sound showing – until recent times. Last year’s cash from operations was its lowest in a decade. In its most recent quarter, the firm generated a solid 30.7% cash operating margin, but had negative cash from operations for the 3 quarters prior to that.

Seeking Alpha

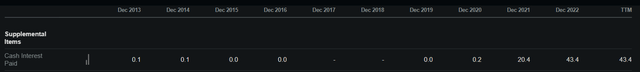

Cash operating margin will be an important metric to watch going forward, as MicroStrategy has a lot of debt: $2.241 Billion, to be exact. The company still maintains assets in excess of this, providing a margin of safety if things were to get dire, but it has also been paying increasing levels of cash interest. The company will need to return to historical levels of operating cash flow in order to keep this from becoming a problem.

Seeking Alpha

Overall, there isn’t too much to like here. MicroStrategy has declining revenues, a persistent lack of profits, and an uncertain ability to maintain historical levels of operating cash flow.

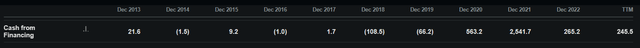

I believe that cash is the thing to focus on here. MicroStrategy has high levels of debt and has continued to get more of its cash from financing rather than from operations. If it keeps assuming more debt, it will have to pay more in cash interest, acting to eat up operating cash flow before it becomes free cash flow. Since the business is already on shaky ground as to generating cash from operations, this feedback loop could very well act against it.

Seeking Alpha

Nonetheless, the company has an extensive track record of generating positive cash from operations, and I think that it is possible for it to return to doing so. This will also have to be followed by a return to profitability.

The problem here is that the company is at the end of an extended product development cycle – 8 years ostensibly spent building MicroStrategy One. It now has to get its new product into the market and attempt to return to growth. This requires investment rather than cost-cutting, however, and acts as a contradicting force to improving unit economics for profitability and cash flow generation – which is its other top priority.

As such, MicroStrategy has a fine line to walk, and it will be very challenging to both return to growth and return to profitability at the same time. Since this is a software business, however, the economics are more workable than most; there is very little variable cost/cost of goods sold for software businesses. Still, it is less than likely that MicroStrategy achieves both a return to growth and a return to profitability at the same time. Trying to do both at the same time may end up with the firm achieving neither.

The strategic juncture that MicroStrategy is at right now isn’t a good one, and this certainly goes for shareholders as well.

Valuation

MicroStrategy stock is cheap on a forward P/E basis relative to the rest of the IT sector. This isn’t too surprising.

Seeking Alpha

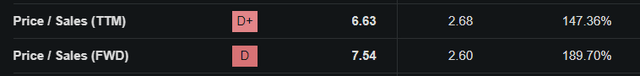

What is more unexpected is that it trades expensively on a price/sales basis, indicating that it could still be overvalued.

Seeking Alpha

As to capital structure, MicroStrategy at its current market cap of $3.77B has debt of $2.24B, 59.52% of its market cap in debt outstanding. Factoring in the Bitcoin, however, the company can exchange it for $3.77B at current prices. Bitcoin is liquid enough for it to get that cash fairly readily, although probably with a material transaction cost. Nonetheless, this $3.77B would pay off all of its debt while also leaving it with $1.53B in cash. Its market cap would then be 40.6% cash.

The valuation scenario here is distinct because the company’s core business is declining, while it has immense exposure to an asset that fluctuates beyond its control. This creates significant uncertainty in its core metrics and erodes the utility of forward relative value calculations. Here, I believe the best thing to do is to look at the stock chart and try to make sense of it there.

Seeking Alpha

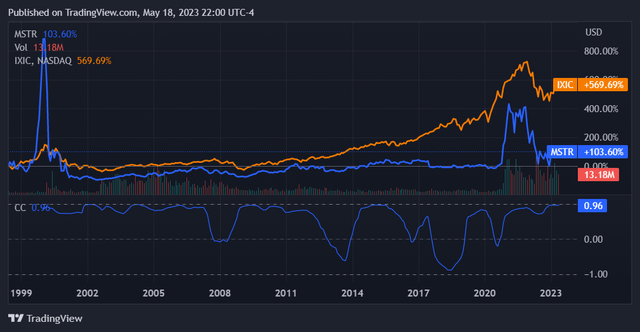

MicroStrategy has seen periods of significant volatility since its IPO, but it has never returned what the NASDAQ Composite has since 2000. This was a stock that got trounced by the dotcom bust and survived to tell the tale. It certainly did not thrive thereafter, however.

Looking at the stock’s 1-month rolling correlation coefficient as compared to the NASDAQ Composite, we see that it has had a high correlation with the index during its recent peak. This makes me skeptical that the stock saw ‘differentiated buying’ (demand for its shares in particular) during that time. As such, I don’t see it getting back to those previous price levels without a material change in its business conditions, which are at a difficult juncture.

MicroStrategy looks to be cheap relative to historical levels, but it is also facing uncertain prospects.

Conclusion

This one is a real coin flip.

The bull case here is that MicroStrategy succeeds with its new product offering while also establishing profitability and positive cash flow generation. As an added bonus, Bitcoin will go up.

The bear case is that MicroStrategy does not see a return to growth and makes only marginal progress on improving profitability. Bitcoin will also go down.

In both these cases, Bitcoin can end up acting for or against the prospects of the business. Given the outsize exposure that the company has relative to its market cap, this is just the way it is. This creates another layer of uncertainty for MicroStrategy’s prospects.

Overall, I think it is the bear case that will win out here. If the company was that good at new product development, I expect that it would have made progress in that regard by now and reversed revenue declines years ago. I am skeptical that a flashy new system is going to turn everything around all of a sudden, particularly so as B2B tech spend has been under pressure economy-wide.

Additionally, I think the company’s contradictory needs for increasing revenue growth while also increasing profitability are not particularly realistic. Given the company’s debt position and poor recent unit economics, it will face difficult decisions no matter which way it pivots. Finally, I am not expecting Bitcoin to save the day.

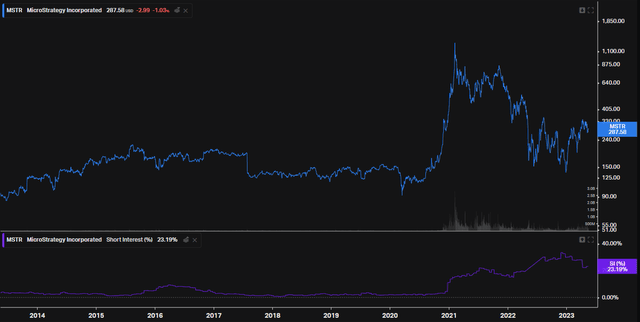

We can see that others hold this view and are actively shorting the stock. While not as high as it was during the start of 2023, short interest on these shares is a significant 23.19% as of this article.

Koyfin

Overall, I would rate MicroStrategy a sell.

Read the full article here