The financial alliance between Apple

AAPL,

and Goldman Sachs Group

GS,

launched in 2019 with the intent of tapping into the consumer finance marketplace, has hit a rough patch.

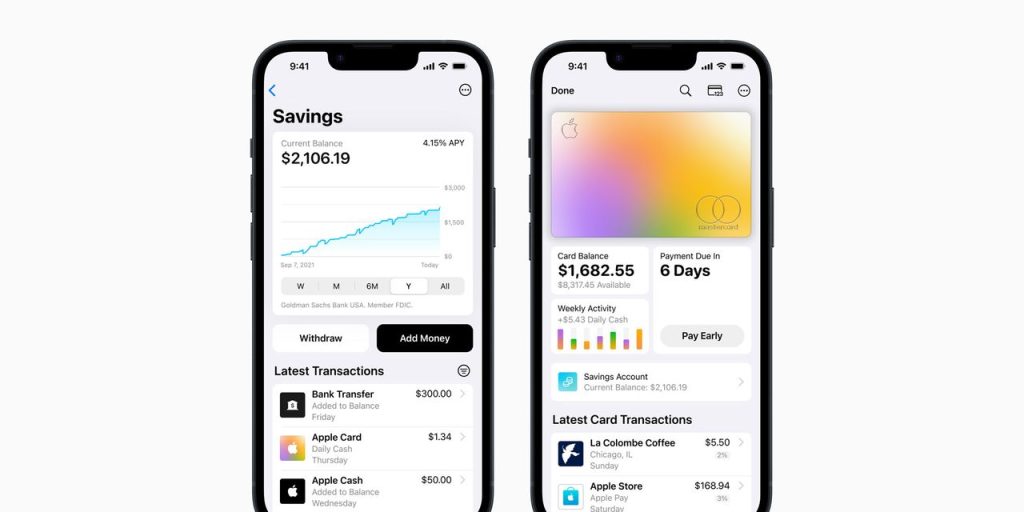

The partnership that birthed Apple Card and its high-yield savings account was reportedly deemed a “mistake” by a Goldman Sachs executive, encapsulating the bank’s burgeoning discontent with the venture. By the start of 2023, Goldman Sachs had lost more than $1 billion over three years due to its Apple Card partnership. The consumer lending foray, a detour from Goldman’s traditional clientele of corporations and governments, has proven to be a financial albatross.

Announced with much fanfare, Apple-Goldman Sachs savings account is a particular bone of contention. The venture has not only been financially draining but has also trapped Goldman Sachs, as the Wall Street giant can’t offload the Apple Card business due to the millions of dollars invested in the savings accounts.

Rising tensions between Apple and Goldman Sachs illuminate a different narrative — one showcasing Apple’s ambitious drive toward financial self-reliance. Between March and April 2022, Apple initiated Project Breakout, the goal of which is development of payment-processing technology and infrastructure to reduce the company’s reliance on external financial partners.

The project, once it solves the remaining engineering hurdles, would encompass a wide array of financial services including risk assessment, fraud analysis, credit checks, and potentially, a new “buy now, pay later” program, all aimed at creating a self-sufficient financial ecosystem for Apple.

Pushing boundaries

Could brewing discontent between Apple and Goldman Sachs be a telling precursor of a broader shift?

As Apple and other tech behemoths delve into the financial realm, traditional boundaries of finance are being pushed, paving the way for a new era of tech-driven financial innovation. The drive is simple but profound, leveraging technology to forge a more consumer-centric approach to financial services.

Apple’s Project Breakout is not just a quest for financial autonomy, but also a vision of more integrated, convenient, and user-friendly financial landscape. Apple’s global user base adds another layer to this evolving narrative, challenging the geographic constraints of traditional financial entities and proposing a global expansion of financial services, bound not by borders but by the reach of technology.

“ A major challenge for traditional models. ”

On the flip side, traditional financial stalwarts have found themselves at a crossroad. High costs of the Goldman Sachs-Apple partnership underscore financial strain that could be emblematic of a major challenge for traditional models in this new landscape. The rapid pace of digital transformation led by tech giants necessitates agility and willingness to adapt, traits that could be detrimental for survival of slow-adapting dinosaurs of finance.

The regulatory environment too is poised for a re-evaluation as tech companies manage an increasing share of financial services. This foray also heightens the competitive pressure on traditional institutions, nudging them toward a digital transformation to retain market share in an increasingly tech-dominated financial market.

Moreover, the unfolding scenario could lead to a re-evaluation of strategic partnerships and alliances. As tech companies aim to reduce reliance on traditional financial institutions, new partnerships might emerge, each aligned with the evolving market dynamics and the digital rhythm of Silicon Valley.

Goldman Sachs’ dissatisfaction with its partnership with Apple could be a harbinger of the broader shift awaiting the financial sector. Yet this transition won’t be smooth, and if past events are any indication, we can expect the traditional finance sector to put up a fight.

The stories of Meta Platforms’s

META,

Libra (aka Diem) and Alphabet’s

GOOGL,

Plex underline the tension between rapid innovation driven by tech behemoths and the cautious, if not territiorial regulatory stance of traditional financial systems.

These ventures show how tech giants are vying for a slice of financial pie, leveraging their massive user bases, data analytics prowess, and digital platforms to offer modernized financial services. Yet, they also highlight the regulatory hurdles that such ventures often stumble upon.

Libra, spearheaded by Facebook (now Meta), aimed to establish a new global digital currency. It faced strong regulatory pushback, with concerns ranging from potential risks to financial stability to money laundering and consumer protection. As of 2023, Meta’s ambitious project Diem (formerly Libra) has confirmed its shutdown, selling its assets for $200 million following regulatory hurdles.

Meanwhile, Plex, a digital banking initiative from Alphabet’s Google, should’ve provided a new banking experience integrated within Google Pay. While the accepted narrative was that Plex was scrapped due to delays of technical nature, it’s worth noting that before it even ran into those hurdles, Plex faced a significant backlash from Bank of America, JPMorgan Chase, Wells Fargo, and a handful of other large U.S. banks.

Traditional finance’s resistance to tech-driven financial initiatives isn’t new. A similar hard stance toward cryptocurrencies was taken when they first emerged. Skepticism, regulatory scrutiny and attempts to stifle new forms of currency were rampant. Yet crypto’s acceptance has continued to grow, showcasing that while the road may be bumpy, the march toward a tech-driven financial sector seems inevitable, redefining how we manage, spend and think about money.

More: Goldman Sachs sheds GreenSky lending platform but still faces lack of low-cost deposits, analyst says

Also read: This bargain-hunting fund manager is finding value in PayPal and other fintech stocks

Read the full article here