That the California BanCorp (NASDAQ:CALB) stock is down by 40% year-to-date and has fallen by almost 21% in the last month alone should come as no surprise. The banking industry has seen significant challenges earlier this year resulting in the dissolution of some banks, resulting in investor diffidence towards the sector’s stocks. This is evident from the fact that the S&P 500 bank index is down by 23% in 2023 so far, which compares poorly to the S&P 500 (SP500) which is actually up by almost 10% as I write this article.

But a challenging time in the stock market does not mean that there is something fundamentally wrong with the bank, irrespective of what is going on in the industry. Here I take it to look at the company and see how its financials are placed, touching specifically upon some of the aspects related to recent bank failures to assess what could be next for it.

The bank

Established in 2007 to serve the Northern California market, California BanCorp is quite small by market capitalization. At $118 million, the fact that its market cap is a fraction of JPMorgan Chase & Co. (JPM) at $405 billion, which is the biggest bank by this metric, provides a context for its size.

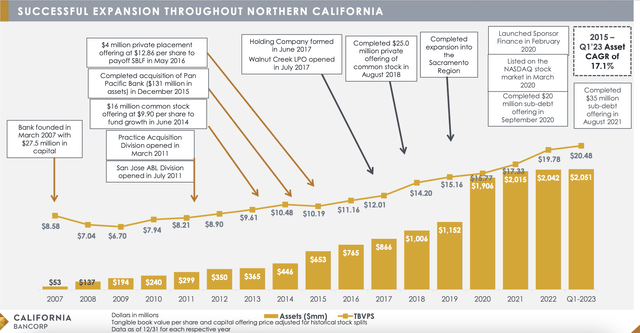

But small does not necessarily mean underperforming. The bank has seen good growth between 2015 and the first quarter of 2023 (Q1 2023) with a compounded annual growth rate (CAGR) of 17% in gross loans and 17.2% in deposits. Its assets have increased by 40x since inception, and it has also provided a good return to shareholders (see chart below). To its credit is the fact that despite the plunge in its share price to the lowest levels since 2020, over the last decade price returns on it are still at 48%.

California BanCorp

The positives

No matter how they have performed in the past, however, there are big questions around small, regional banks’ sustainability based on specific criteria these days. Fortunately for CALB, it does have positives going for it in this regard.

First, consider the nature of its deposits. Unlike Silicon Valley Bank, which had a large concentration of industry-specific, high-value deposits, CALB has a diversified portfolio base, which is not concentrated in any industry. The bank also clarifies that it has no “venture capital or crypto-related deposits”. Its mention of cryptos is important here, considering that Silvergate Bank (OTC:SICP) suffered on account of this exposure. Further, it also assures that there is almost no exposure to segments most likely to be impacted by a recession like consumer loans or those to small businesses, which too is significant considering the current state of the economy.

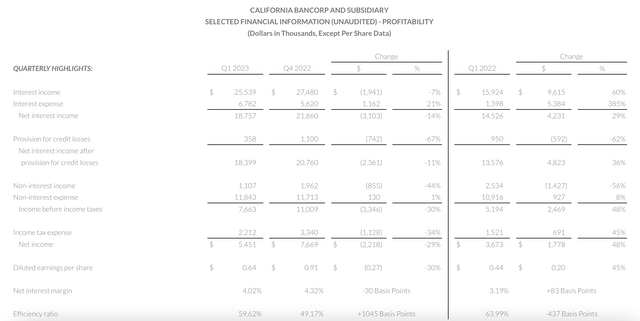

It also saw a 29% year-on-year (YoY) increase in net interest income (NII) in Q1 2023. At the same time, NII has fallen by 14% quarter-on-quarter (QoQ) as interest expenses rose it had “lower balances of average earning assets”. This shows up in net interest margin (NIM) too. The bank reported a decline in net interest margin to 4.02% in Q1 2023 compared to 4.32% in Q4 2022. But it has actually expanded over Q1 2022, when it was at 3.19%, which gives a healthier ring to it. Further, the NIM saw expansion in Q4 2022, which is very different from what was experienced by the likes of SVB and First Republic, which actually saw a decline.

California BanCorp

The risks

The bank’s loans-to-deposit ratio at 94.2% is also significantly higher and very different from that for SVB, which was at 43%, which led to investments in bonds that eventually resulted in lost money for the bank. Now it is debatable on the other hand if CALB’s figure is not too high a ratio for a bank. If there is a run on its deposits, it has a very limited amount to pay back to its depositors. That the number has risen from both the previous quarter and the same quarter last year is also worth noting.

The bank has also seen a 4% quarter-on-quarter (QoQ) decline in deposits in Q1 2023, which would be a concern at any other point in time, but the bank does ascribe it to a seasonal outflow. This is acceptable considering that it saw the same trend last year too. Also, deposits are still up by 7% YoY.

However, getting into the details of the decline in deposits during the latest quarter from Q4 2022 reveals, that there was a $71 million decrease in non-interest bearing deposits. These are more likely to take flight if there are better alternatives available to park funds, which is probably already happening, and something to note at this point when interest rates are rising.

The proportion of non-interest bearing deposits to total deposits has not declined dramatically, which is some relief. But at 43.1% compared to 45.3% in Q4 2022 and 45.6% in Q1 2022, this number is one to watch. This is particularly so as the trend for this year is the opposite of what was seen last year. In Q1 2022, the percentage had risen sequentially to 46.6% from 45.9% in Q4 2021 and 45.6% in Q1 2021.

Or look at it another way. Last year, only $24.5 million of the decline in deposits was contributed to by non-interest bearing deposits. The decline was far more evenly distributed among these, money market and saving deposits and time deposits. This time around, the decline is more heavily skewed toward non-interest deposits.

What next?

This is by no means an exhaustive analysis, but clearly, some potential risks are visible. These of course are tempered by the bank’s positives, especially as compared to some of the recently failed banks. But the big question is are they enough? I reckon it is a wait-and-watch.

It could be tempting to buy the stock when it is down. Its trailing twelve months price-to-earnings (P/E) ratio does look attractive at 5.2x compared to the financials sector at 8.8x. But I would resist that for now. The US economy is sluggish, and interest rates are still rising, indicating that vulnerabilities could surface going forward. In particular, I would watch for the trends in its non-interest bearing deposits, especially considering its high loan-to-deposit ratio. I am going with a Hold rating on CALB.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here