Recent price action across precious metals, stocks, and bonds, suggests there is a tactical opportunity in the iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK). With US Treasury yields resuming their rise and the recent decline in breakeven inflation expectations stabilizing, industrial metal prices and their producers are highly likely to outperform both precious metals and the broader global stock market.

The PICK ETF

PICK seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver. Iron ore prices are a key driver of PICK, as the three largest companies on the index are BHP (BHP), Rio Tinto (OTCPK:RTPPF), and Vale (VALE). The ETF tracks the performance of the S&P GSCI Industrial Metals Index extremely closely, while paying a high dividend yield of 7.1%. While this is set to fall in line with the underlying ACWI Metals and Mining ex- Gold and Silver index, the yield here is still an attractive 5.3%. The ETF charges a management fee of 0.39% per year.

In my last article on the PICK ETF on March 23 (‘Forget Gold, Industrial Metals Are The Real Inflation Hedge’), I noted that rising industrial metal miners were are far better hedge against rising inflation than gold. The reason being that rising inflation expectations push up interest rate expectations to the detriment of gold. PICK also tends to outperform the broader US equity market when bond yields rise, particularly if the rise is being driven by higher inflation expectations. Over the past two months the ETF remained flat, but the conditions that have typically benefitted PICK have become more intense.

Rising Bond Yields And Breakevens Suggest Outperformance Versus Gold And Stocks

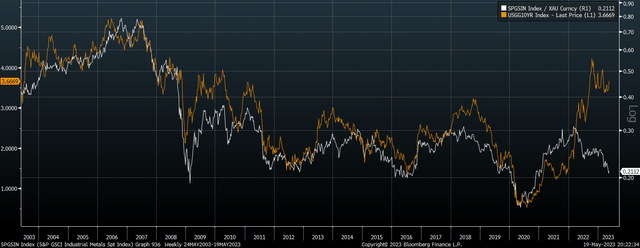

There is a strong historical correlation between US bond yields and the ratio of industrial metals prices over gold prices. The recent push higher in Treasury yields strongly suggests that industrial metals prices should outperform gold.

10-Year Bond Yield Vs Ratio Of Industrial Metals Index Over Gold Price (Bloomberg)

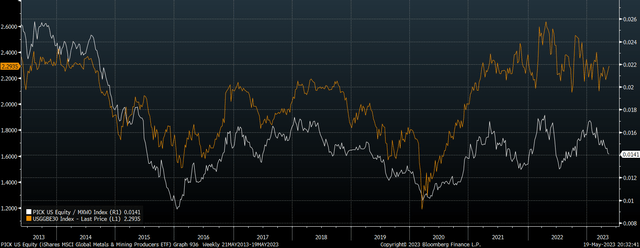

The key to whether this outperformance will result from gold price weakness of rising industrial metals prices will be inflation expectations. Industrial metal miners perform well during periods or rising inflation expectations, and the fact that 10-year breakevens have stabilized even as near-term rates have continued to rise suggests there could be more to come. The following chart shows the correlation between 10-year breakeven inflation expectations and the ratio of PICK over the MSCI World.

US 10 Year Breakevens Vs Ratio Of PICK Over MSCI World (Bloomberg)

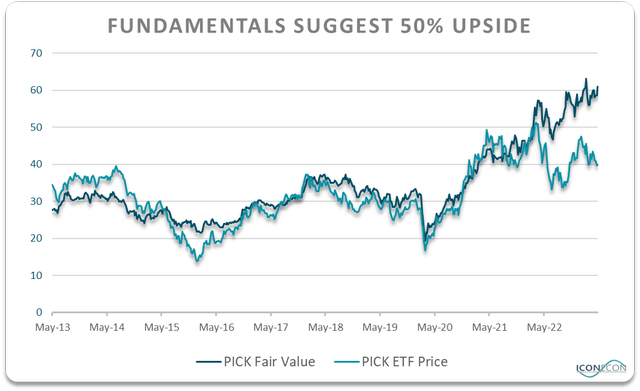

We can combine the above factors to arrive at a fair value for PICK based on its historical correlation with bond yields, gold prices, and global equity prices. The results are shown below and suggest that PICK should be around 50% higher than current levels.

Bloomberg, Author’s calculations

Underperformance Versus Fundamentals Leaves PICK Undervalued

The breakdown between PICK and its fair value based on its historical drivers begun in early-2022 and has widened since. This underperformance relative to its fundamentals explain why the underlying ACWI Metals and Mining Index ex Gold and Silver Miners has seen its valuations improve significantly since then. Even accounting for the expected decline in earnings over the next 12 months following the recent decline in industrial metals prices, the forward P/E ratio is just 8.9x, while the forward dividend yield is 5.0%. These figures compare with 17.8x and 2.2% for the MSCI World.

Deflationary Pressures A Concern, But Outperformance Highly Likely

Based on current conditions, industrial metals miners look incredibly undervalued. However, the main drivers of this underperformance have been the strength of global equities and gold prices in the face of rising bond yields, and I believe that both are at risk of a downside reversal. I also believe that the rise in bond yields poses a deflationary threat, which could cause inflation expectations to head lower, and bond yields to top out. These factors would undoubtedly be bearish for PICK, but we should still expect to see outperformance relative to gold and global stocks due to its undervalued starting position.

Read the full article here