As student loan payments resume this month, more than 43 million Americans carrying that debt saw the end of more than three years of relief from monthly payments. But the financial landscape in which they resume payments has shifted.

Researchers are still working to understand the impact that the pause had on borrowers’ finances, said Jonathan Glater, a professor at Berkeley Law and co-founder of the Student Loan Law Initiative.

“People who are precarious at the outset…will also be financially more precarious when the payment obligations resume,” Glater said.

“We’re worried about what the effects of this resumption of the obligation to repay will be,” he said. “Of course, it’s also the case that now there are repayment plans that are more generous so hopefully those will mitigate the resumption of the obligation to pay down this debt burden.”

In particular, the Biden administration’s SAVE plan, which launched this summer, is expected to lower payments for millions of borrowers. Borrowers enrolled in SAVE with incomes below $32,800 annually will not be required to make monthly payments. Additionally, it ensures that balances do not grow for borrowers enrolled in the plan who make their required monthly payments.

Since 2003, student debt has been the fastest-growing form of household debt, increasing more than 500% over the two decades, far more than increases in mortgage and auto debt that occurred over the same period, according to data from the New York Federal Reserve Bank.

During the pause, student loan debt growth slowed: from the second quarter in 2020 to the second quarter of 2023, the burden of mortgage and auto loan debt increased by close to 20%, while student loan debt grew by only 2% in the same period.

The slower growth doesn’t reflect more people paying off their educational debt. In the first quarter of 2020, more than 16 million borrowers were current in their student loan payments, according to Department of Education data. By the third quarter, just over 300,000 were continuing to make on-time payments.

But interest rates were set to zero, so most outstanding debt remained stagnant. In the meantime, car and home prices were increasing, making them a larger part of overall household debt, said Constantine Yannelis, an associate professor of finance at the University of Chicago’s Booth School of Business.

As the pandemic pause comes to an end, it’s possible the growth of outstanding student debt could still be slow, especially for those enrolled in the SAVE plan, which will limit accumulation of interest for many borrowers.

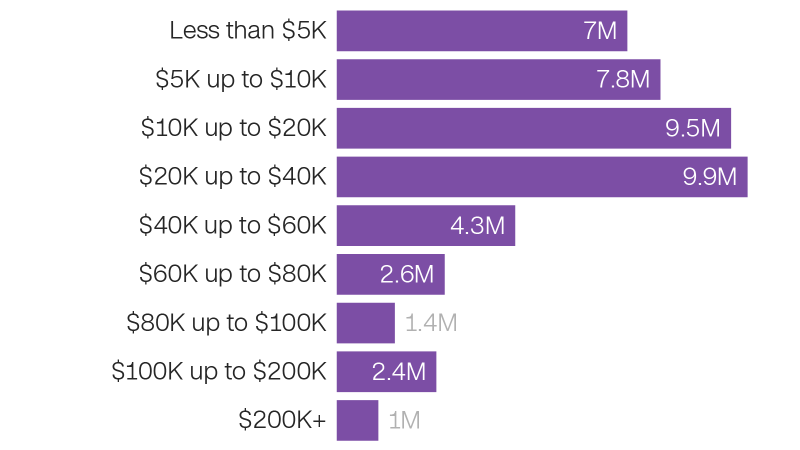

The vast majority of student debt holders owe less than $40,000, with nearly one-third owing less than $10,000. The largest loan balances are among those who took on debt to attend medical school or law school. Preliminary College Board data from the 2021-2022 school year shows that the average amount of subsidized and unsubsidized federal loans per undergraduate borrower was over $6,000 while for graduate students, the average was nearly three times that amount.

The concentration of student loan debt also remains uneven among demographic lines. Black borrowers have seen their debt grow the fastest in recent years. They’re more likely to take out loans and their outstanding debt is larger on average, Yannelis said.

“When they enter a payment, Black and White borrowers have similar balances,” Yannelis said. “But Black borrowers pay down their loans at a slower pace.”

This is likely explained by differences in the labor market, Yannelis added. In 2021, median earnings for White bachelor’s degree-holders were $65,000, while they were just under $50,000 for Black bachelor’s degree-holders, according to data from the Department of Education.

The number of people delinquent or in default was steady before the pandemic

The college-age population has reached a peak in recent years, according to Yannelis. As more new borrowers enter repayment and the existing debt-holders struggle to pay off their loans, the number of Americans with outstanding student debt has grown.

After the Great Recession and the most-recent federal increase in student borrowing limits in 2008, there was a corresponding spike in the percent of borrowers in default or delinquency, starting in 2012. Since then, the percent of borrowers in default has hovered above 10%, sharply declining during the pause, when payments and balances were frozen.

“That post-Great-Recession student loan bubble I think is still pretty much in the rearview mirror at this point,” said Jason Delisle, a nonresident senior fellow in the Center on Education Data and Policy at the Urban Institute.

It’s difficult to predict how these figures will change with the ending of the payment pause, Glater said. His team found that, among borrowers in California, measures of financial distress declined at the start of the pandemic. While the Biden administration’s new repayment plan may improve conditions for borrowers who enroll, others may have taken a financial hit during the pandemic, he added. In the meantime, the Biden administration has provided a temporary “on-ramp” period: Until Sept. 30, 2024, borrowers who miss payments during this time will not be considered in default, although their interest may still grow.

Read the full article here