Several Covid-19 pandemic-era benefits have recently expired, leaving millions of people without the economic assistance they’ve come to rely on.

Congress passed a number of sweeping spending packages during 2020 and 2021, authorizing trillions of dollars in aid meant to provide economic relief to struggling households. Many of those programs, like direct stimulus payments, the enhanced child tax credit and expanded unemployment benefits, expired long ago.

But there are some pandemic relief benefits that are just now coming to an end. Nearly 30% of Americans with some college education are resuming monthly federal student debt payments this month after a three-year plus hiatus. One in three children enrolled in child care programs supported by American Rescue Plan Act, or ARPA, grants are projected to lose their spots since the federal funding expired at the end of September. And one in five Medicaid enrollees could be kicked off the program by the end of May.

CNN analyzed the data to see how many US households could be impacted.

Overall household debt grew in the pandemic, even though student loan debt remained steady

After a yearslong pause on student loan payments provided temporary relief to federal loan borrowers, interest on student loans resumed in September and payments resumed in October.

As payments on federal student loans were paused during the past three years, Americans continued to take on different kinds of debt. Credit card debt grew from $820 billion at the start of the pandemic to over $1 trillion three years later, according to data from the Federal Reserve Bank of New York. Mortgage debt increased from $9.8 trillion to $12 trillion. Student loan debt remained steady at the $1.5 trillion marker.

Some economists are concerned that borrowers may have difficulty affording their student loan payments if they have taken on additional debt of other kinds. More student loan borrowers are currently behind on other types of bills than they were before the Covid-19 pandemic, according to a study by the Consumer Financial Protection Bureau.

An estimated 70,000 programs could be shuttered, and 3.2 million children could lose their spots now that a federal pandemic stabilization grant program expired at the end of September, according to The Century Foundation. As a result, parents could be forced to quit their jobs or cut back hours and are expected to lose billions in earnings in total.

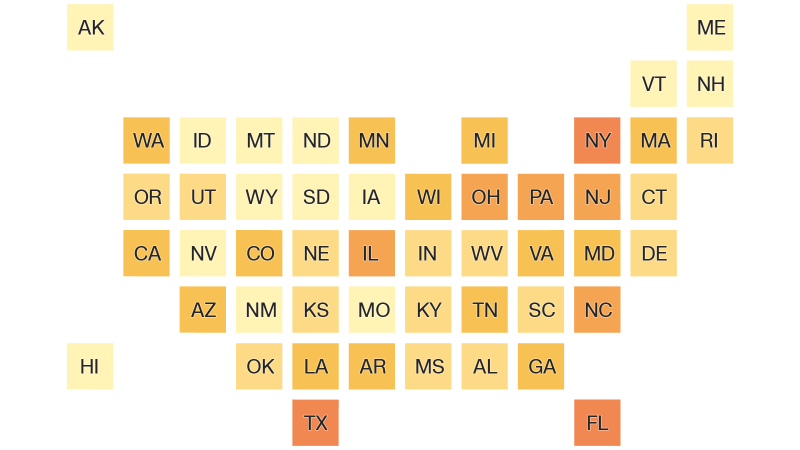

Medicaid enrollment steadily increased for both adults and children during the pandemic. In March, there were nearly 45% more adults and nearly 24% more children with Medicaid coverage than there were in February 2020. But millions of Americans will be kicked off their health care plans in coming months as states terminate coverage for residents deemed no longer eligible. Disenrollments began in April, and nearly 8.7 million enrollees have lost their coverage as of October 11, according to KFF.

So far, Texas reports the highest disenrollment rate of any state with 66%, followed by Idaho with 64%, according to KFF.

With the declaration of the Covid-19 public health emergency in 2020, the work requirement for certain adults to receive food stamps was put on hold. That mandate, however, returned in October now that the public health emergency is over.

Able-bodied adults between ages 18 and 49 without dependents are only eligible for food stamps for three months out of every three years unless they work — or participate in an approved training or education program — for at least 20 hours a week. An estimated 500,000 people could lose access to food stamps as a result, according to the Center on Budget and Policy Priorities.

This requirement now also temporarily extends to Americans between ages 50 and 52, as stipulated in the debt ceiling package that lawmakers agreed to in June. That’s about 450,000 more adults who could lose out on food stamp benefits, according to CBPP. Those ages 53 and 54 will be subject to the work requirement next fall.

Read the full article here